Bruker Leads 3 Growth Stocks With Strong Insider Ownership

As the U.S. stock market continues its upward trajectory, buoyed by positive economic indicators and easing trade tensions between the U.S. and China, investors are increasingly focused on growth stocks that demonstrate strong insider ownership. In this context, companies like Bruker stand out as they align with current market optimism by potentially offering stability and confidence through significant insider investment.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 120.2% |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Prairie Operating (PROP) | 34.2% | 71.1% |

| FTC Solar (FTCI) | 27.9% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Duolingo (DUOL) | 14.3% | 40% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.7% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 60.6% |

We're going to check out a few of the best picks from our screener tool.

Bruker (BRKR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bruker Corporation develops, manufactures, and distributes scientific instruments and analytical and diagnostic solutions globally, with a market cap of approximately $5.80 billion.

Operations: Bruker's revenue segments include BSI CALID at $1.15 billion, BSI Nano at $1.11 billion, BSI BioSpin at $930.70 million, and BEST at $269.20 million.

Insider Ownership: 28.4%

Earnings Growth Forecast: 45.5% p.a.

Bruker Corporation's insider ownership aligns with its growth trajectory, highlighted by a forecasted 45.5% annual earnings increase, outpacing the US market. Recent innovations in mass spectrometry and proteomics underscore Bruker's commitment to expanding its applied markets, despite revenue growth projections trailing the broader market at 4.7% annually. With insiders buying more shares than selling recently and strategic investments like RECIPE, Bruker is poised for continued development in therapeutic drug monitoring and environmental analysis sectors.

- Get an in-depth perspective on Bruker's performance by reading our analyst estimates report here.

- Our valuation report here indicates Bruker may be overvalued.

Daqo New Energy (DQ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Daqo New Energy Corp. manufactures and sells polysilicon to photovoltaic product manufacturers in China, with a market cap of $963.60 million.

Operations: The company generates revenue primarily through the sale of polysilicon, amounting to $737.68 million.

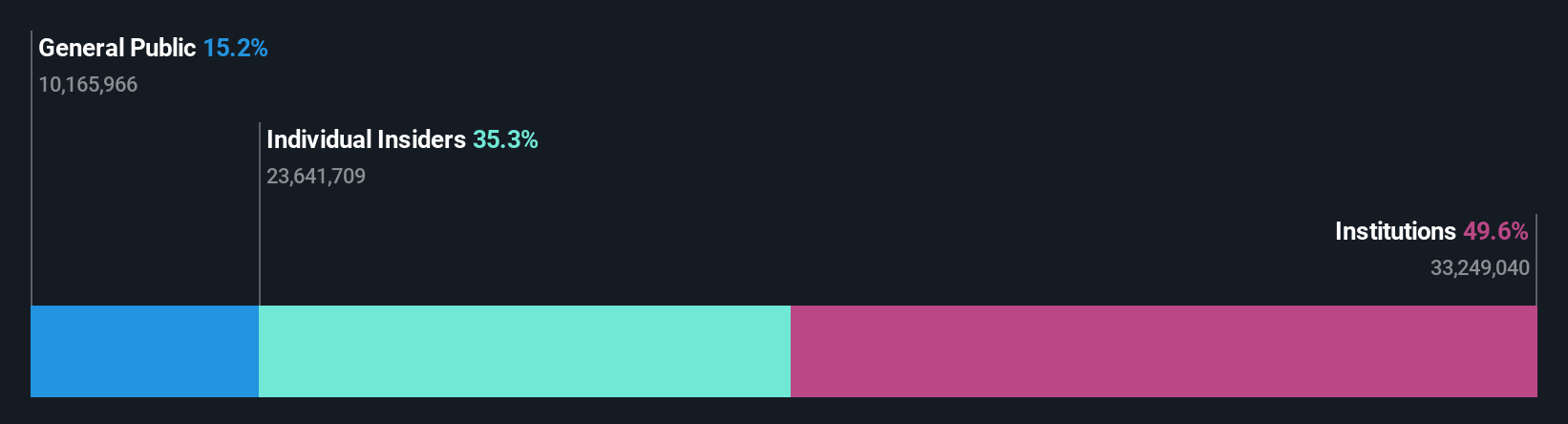

Insider Ownership: 35.3%

Earnings Growth Forecast: 79.7% p.a.

Daqo New Energy is set for substantial growth with revenue expected to rise 28.5% annually, outpacing the US market. Despite a current net loss of US$71.84 million and decreased sales in Q1 2025, earnings are projected to grow significantly at 79.67% per year, and the company is forecasted to become profitable within three years. Production guidance suggests robust output levels for polysilicon, indicating potential recovery and expansion opportunities ahead despite recent challenges.

- Click here to discover the nuances of Daqo New Energy with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Daqo New Energy shares in the market.

Loar Holdings (LOAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loar Holdings Inc. designs, manufactures, and markets aerospace and defense components for aircraft and systems both in the United States and internationally, with a market cap of $8.41 billion.

Operations: The company generates revenue of $425.63 million from its aerospace and defense segment.

Insider Ownership: 19.2%

Earnings Growth Forecast: 28.6% p.a.

Loar Holdings demonstrates strong growth potential, with earnings forecasted to increase 28.6% annually, surpassing the US market's average. Despite significant insider selling recently, the company has shown impressive financial performance, reporting Q1 2025 net income of US$15.32 million compared to US$2.25 million a year ago. The recent completion of a US$750.69 million follow-on equity offering highlights strategic capital raising efforts to support its expansion initiatives and align with upwardly revised guidance for 2025 earnings and sales targets.

- Click to explore a detailed breakdown of our findings in Loar Holdings' earnings growth report.

- Our expertly prepared valuation report Loar Holdings implies its share price may be too high.

Make It Happen

- Embark on your investment journey to our 190 Fast Growing US Companies With High Insider Ownership selection here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English