June 2025's Leading Growth Stocks With Strong Insider Confidence

As the U.S. stock market navigates ongoing trade talks between the U.S. and China, with indices like the S&P 500 and Nasdaq Composite reaching their highest levels since February, investors are keenly observing growth stocks that display strong insider confidence. In such an environment, companies with high insider ownership may be particularly appealing as they often signal management's belief in their long-term potential amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Prairie Operating (PROP) | 34.5% | 71.1% |

| OS Therapies (OSTX) | 23.2% | 13.4% |

| FTC Solar (FTCI) | 27.9% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Eagle Financial Services (EFSI) | 15.9% | 82.8% |

| Duolingo (DUOL) | 14.3% | 40% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.7% | 44.4% |

Here we highlight a subset of our preferred stocks from the screener.

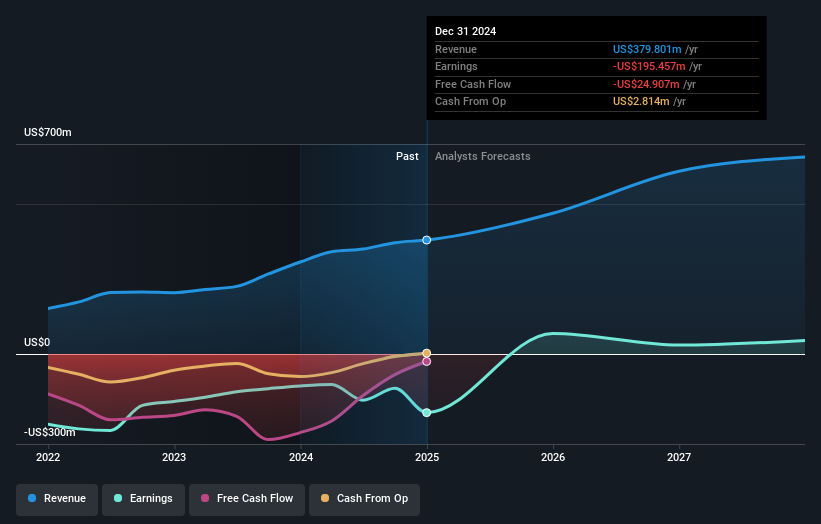

Microvast Holdings (MVST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Microvast Holdings, Inc. specializes in battery technologies for electric vehicles and energy storage solutions, with a market cap of approximately $1.32 billion.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, which amounts to $414.94 million.

Insider Ownership: 27.7%

Microvast Holdings, despite its volatile share price and less than one year of cash runway, is forecasted to achieve profitability within three years with a significant earnings growth rate of 45.33% annually. Recent developments include showcasing advanced battery solutions at CIBF 2025 and expanding production capacity in response to strong demand. However, the company faces financial challenges as highlighted by an auditor's going concern doubts, but maintains its revenue guidance for 2025 between US$450 million and US$475 million.

- Get an in-depth perspective on Microvast Holdings' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Microvast Holdings' shares may be trading at a premium.

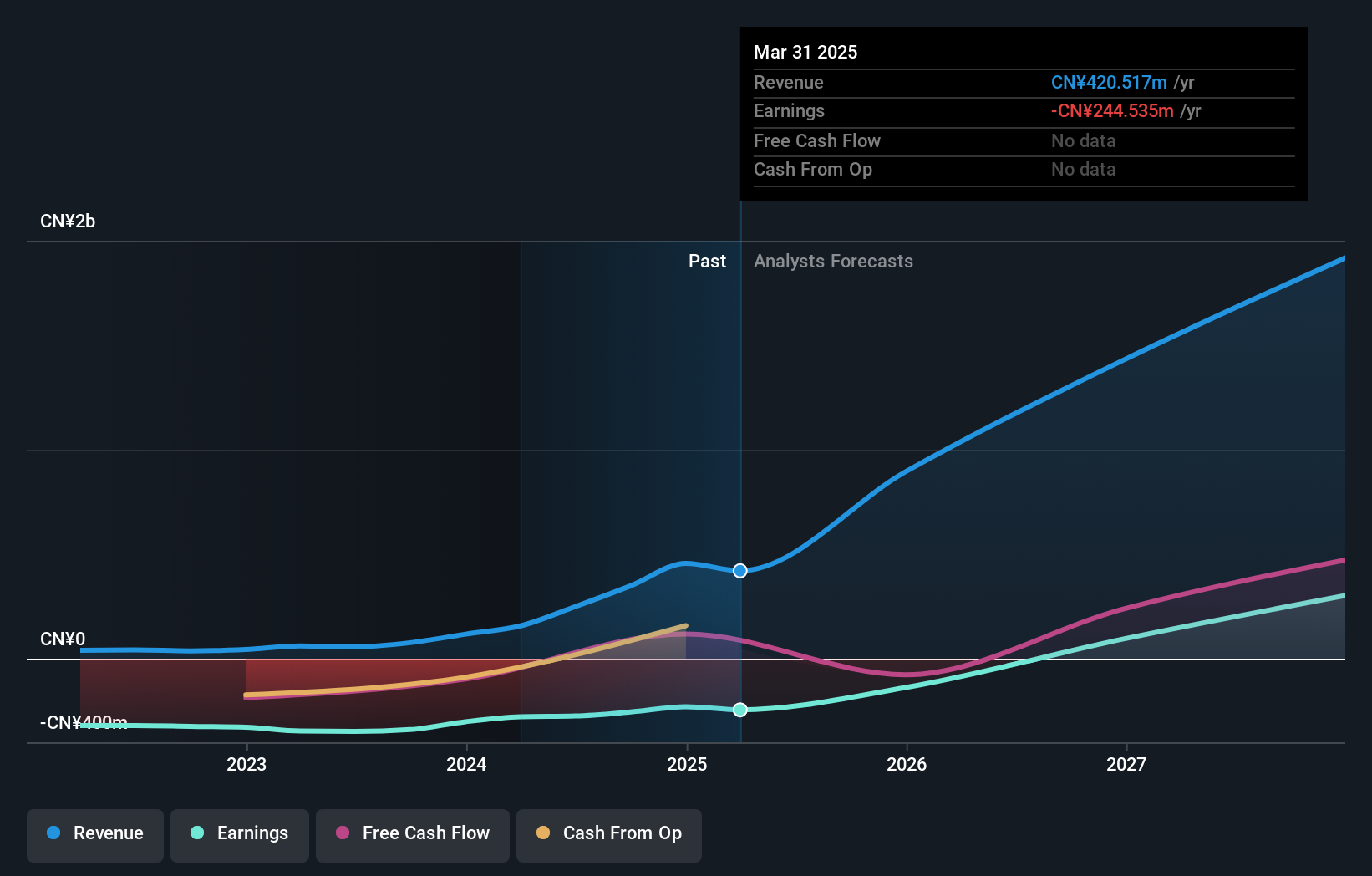

EHang Holdings (EH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EHang Holdings Limited is an urban air mobility technology platform company operating across multiple regions including China, East Asia, and Europe, with a market cap of approximately $1.17 billion.

Operations: The company's revenue is primarily generated from its Aerospace & Defense segment, which accounts for CN¥420.52 million.

Insider Ownership: 27.8%

EHang Holdings, with high insider ownership, is forecasted to grow revenue by 32.4% annually, outpacing the US market. Despite a net loss of CNY 78.08 million in Q1 2025 and reduced sales compared to last year, the company maintains its annual revenue guidance of RMB 900 million for fiscal year 2025. Analysts expect profitability within three years and project a significant stock price increase while noting that EHang trades below estimated fair value.

- Dive into the specifics of EHang Holdings here with our thorough growth forecast report.

- The valuation report we've compiled suggests that EHang Holdings' current price could be quite moderate.

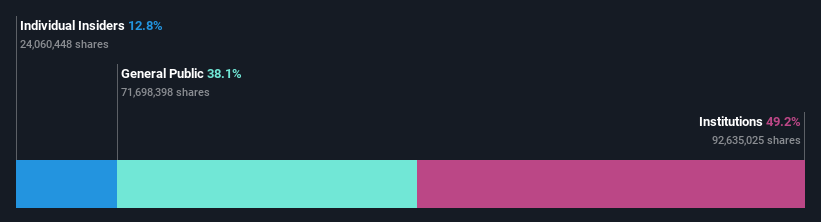

Enovix (ENVX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Enovix Corporation designs, develops, and manufactures lithium-ion battery cells both in the United States and internationally, with a market cap of approximately $1.60 billion.

Operations: The company generates revenue primarily through its Batteries / Battery Systems segment, which reported $22.90 million.

Insider Ownership: 12.1%

Enovix is forecast to achieve substantial revenue growth of 46.4% annually, surpassing the US market average. Despite a Q1 2025 net loss of US$23.51 million, the company reduced its losses from the previous year and provided Q2 guidance with revenue expectations between US$4.5 million and US$6.5 million. While insider buying hasn't been substantial recently, more shares were bought than sold in the past three months, indicating some insider confidence amidst high share price volatility.

- Delve into the full analysis future growth report here for a deeper understanding of Enovix.

- The valuation report we've compiled suggests that Enovix's current price could be inflated.

Next Steps

- Gain an insight into the universe of 192 Fast Growing US Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English