Albemarle (NYSE:ALB) Surges 13% In A Week As Broader Market Sees Modest Gains

Albemarle (NYSE:ALB) experienced a significant price move of 13% over the last week. This rise follows a series of market events where stocks, including indices like the S&P 500, saw modest gains, partly fueled by positive sentiments surrounding US-China trade talks. While the broader market rose by 1.5%, Albemarle's surge was more pronounced. Although specific news events concerning the company were not highlighted in this period, the general market optimism and tech sector activities may have lent some support to Albemarle’s robust movement, outpacing the prevailing market trend.

Albemarle has 1 risk we think you should know about.

The recent 13% price increase for Albemarle (NYSE:ALB) amid modest market gains highlights how broader economic optimism can influence short-term stock movements. However, over a longer period, the company's total return, including share price and dividends, showed a 14.21% decline over five years as of June 10, 2025. In the past year, Albemarle underperformed both the US market and the US Chemicals industry, which experienced a positive shift at 12.4% and a decline of 3.7%, respectively.

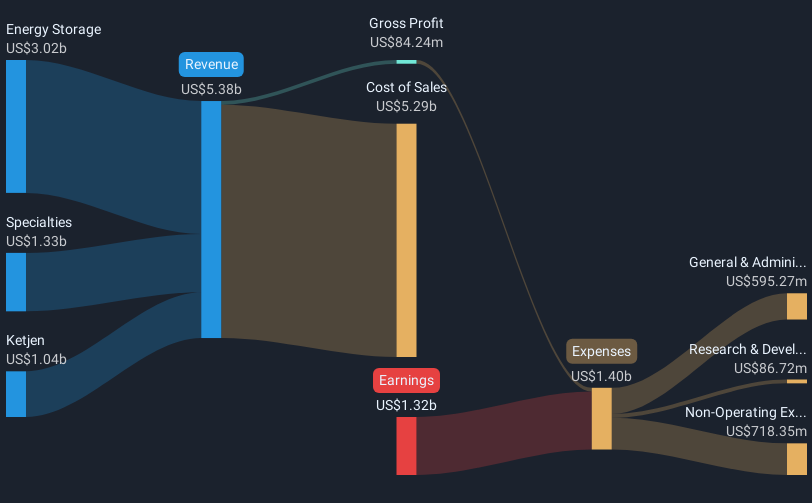

This recent surge, though noteworthy, may only have a limited effect on Albemarle's revenue and earnings forecasts. The company's ongoing efforts in optimizing its conversion network and reducing capital expenditures aim to improve EBITDA margins, but it remains vulnerable to volatility in lithium prices. Analysts expect revenue growth due to capacity expansions and strategic contracting. Still, the influence of lithium price fluctuations remains a wildcard in their forecasts.

Albemarle's current share price of US$59.46 leaves it trading at a significant discount to the consensus analyst price target of US$88.42, suggesting a potential upside of 32.7%. This gap may reflect a cautious market view of the company’s ability to stabilize earnings against ongoing sector challenges. Investors might weigh this price disparity with consideration of existing risks from economic factors and lithium market dynamics.

Examine Albemarle's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English