Mersana Therapeutics, Inc. (NASDAQ:MRSN) Surges 28% Yet Its Low P/S Is No Reason For Excitement

Mersana Therapeutics, Inc. (NASDAQ:MRSN) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 82% share price drop in the last twelve months.

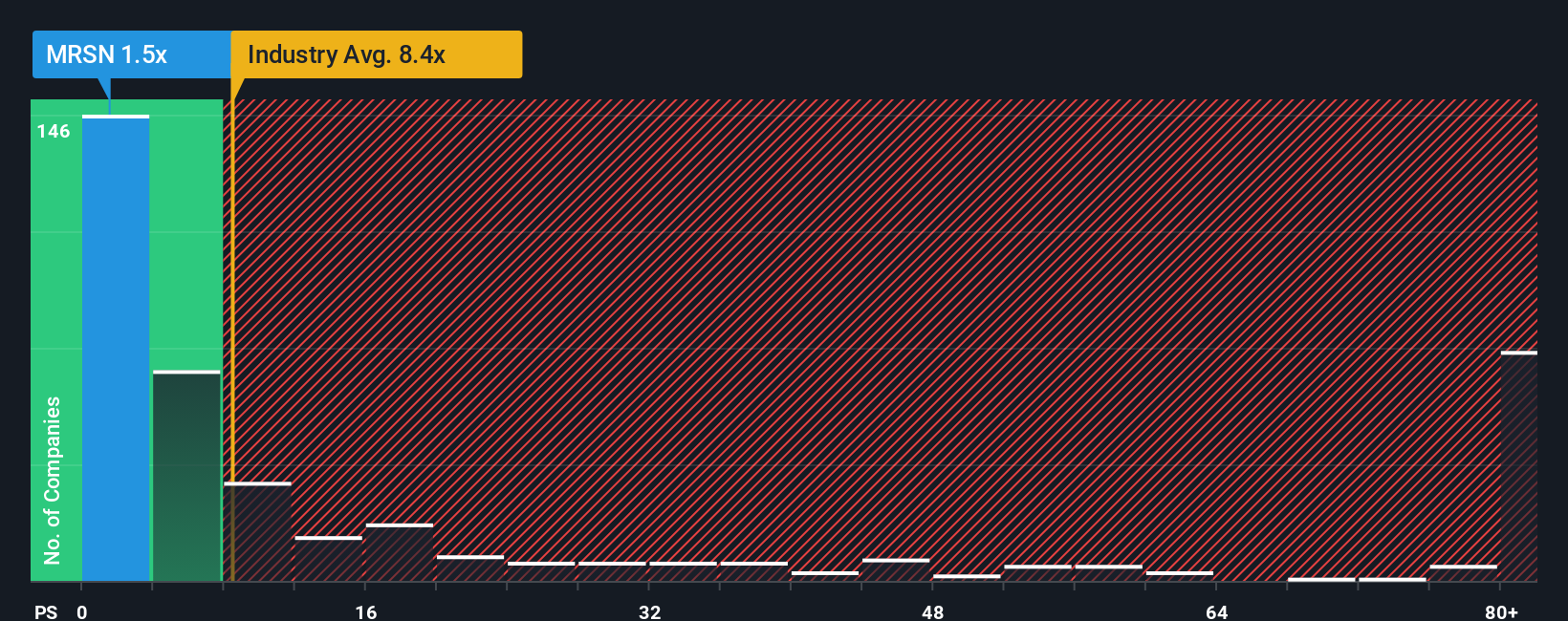

In spite of the firm bounce in price, Mersana Therapeutics may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.4x and even P/S higher than 53x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Mersana Therapeutics

What Does Mersana Therapeutics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Mersana Therapeutics' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mersana Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Mersana Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next three years should generate growth of 8.6% each year as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 109% per annum growth forecast for the broader industry.

In light of this, it's understandable that Mersana Therapeutics' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Mersana Therapeutics' P/S Mean For Investors?

Even after such a strong price move, Mersana Therapeutics' P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Mersana Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for Mersana Therapeutics (1 is significant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English