Applied Materials (NasdaqGS:AMAT) Declares US$0.46 Per Share Quarterly Dividend

Applied Materials (NasdaqGS:AMAT) recently announced a dividend increase, which coincided with its 16.6% share price rise over the last quarter. The dividend boost, coupled with robust Q2 earnings that reported higher sales and net income, likely bolstered investor confidence. These outcomes align with broader market trends, as the S&P 500 and Nasdaq Composite also experienced gains driven by easing inflation concerns and progress in U.S.-China trade talks. The company's stock buyback program may have further supported this upward momentum. Overall, Applied Materials' strong performance reflects a favorable response to both its financial results and market conditions.

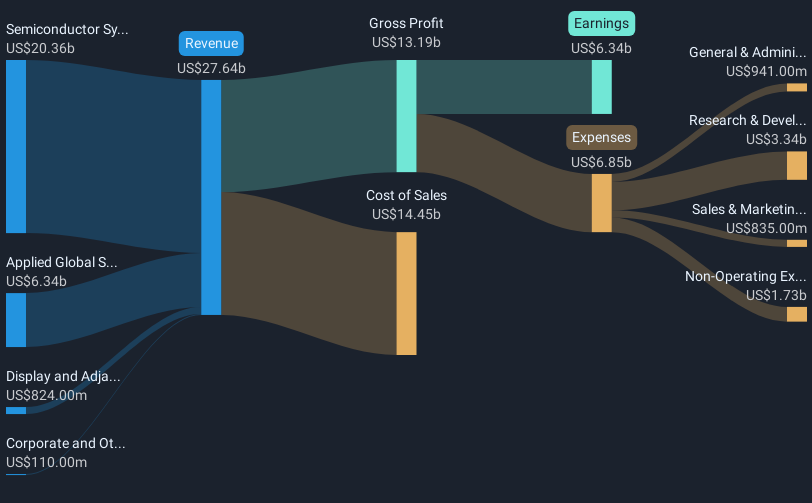

The recent dividend increase and share price rise are pivotal in shaping Applied Materials' narrative. These developments enhance investor sentiment, aligning with the anticipated growth in AI-driven demand and innovations in device architecture. With revenue forecasts reaching over US$33 billion by 2028 and earnings expected to climb to US$8.9 billion, the company's strategic advancements could bolster its market position. The company's recent performance, with a total return of 210.42% over five years, showcases strong long-term growth, although it underperformed the broader US market return of 12.8% over the last year.

Applied Materials' recent share price movement positions it close to the analyst consensus price target of approximately US$201.77. This suggests an upward potential of around 24.2% from the current share price of US$153.03. The company's P/E ratio of 20.6x remains below the US Semiconductor industry average. Such valuation metrics, alongside its strong fundamentals, might imply an attractive investment opportunity relative to its peers. Potential challenges include significant execution risks and reliance on the Chinese market amidst trade tensions, with analysts predicting a possible impact of trade restrictions on revenue growth.

Examine Applied Materials' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English