With EPS Growth And More, Euronet Worldwide (NASDAQ:EEFT) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Euronet Worldwide (NASDAQ:EEFT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Euronet Worldwide with the means to add long-term value to shareholders.

How Fast Is Euronet Worldwide Growing Its Earnings Per Share?

Euronet Worldwide has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Euronet Worldwide's EPS has risen over the last 12 months, growing from US$6.02 to US$7.36. This amounts to a 22% gain; a figure that shareholders will be pleased to see.

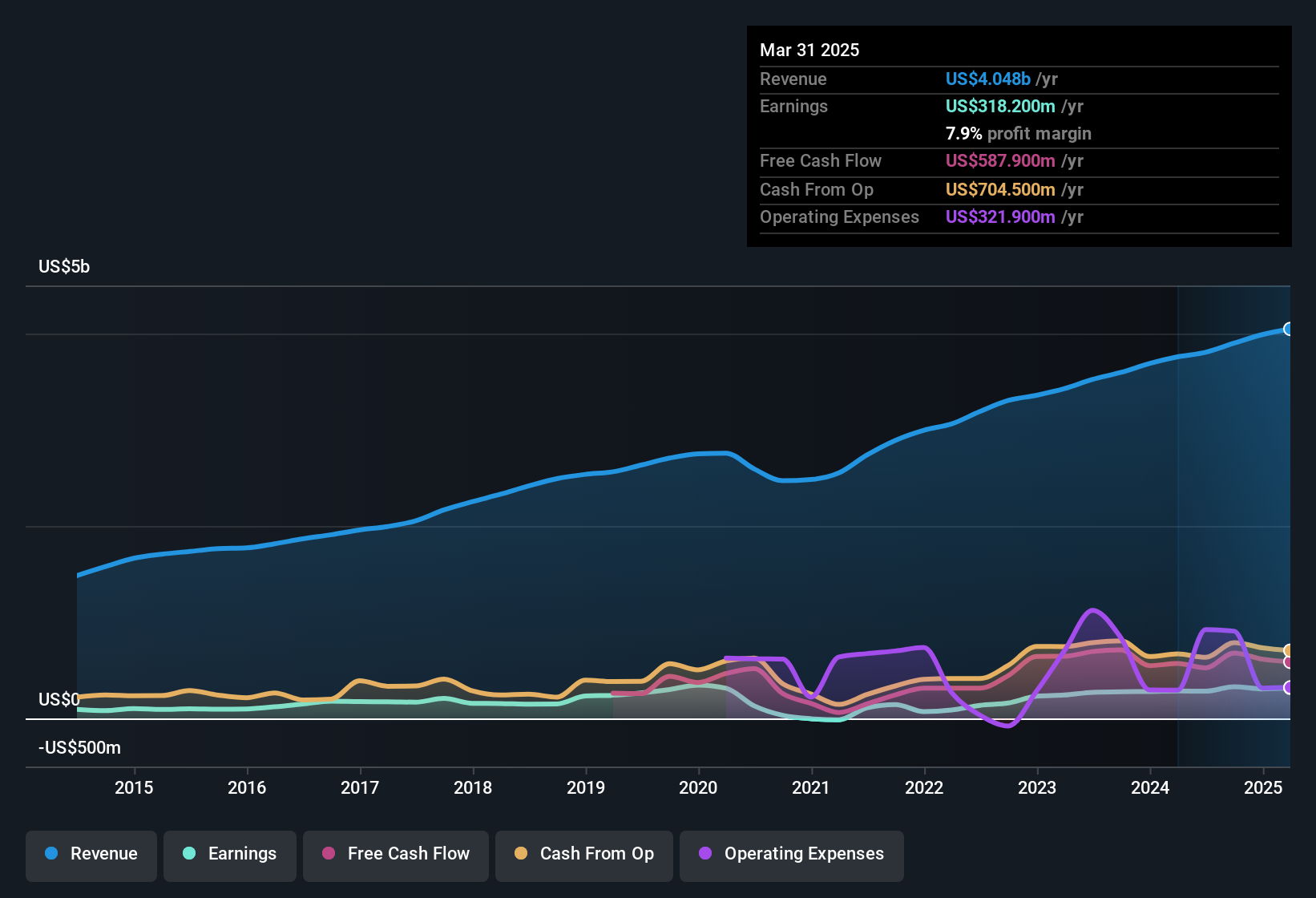

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Euronet Worldwide remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.7% to US$4.0b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

View our latest analysis for Euronet Worldwide

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Euronet Worldwide's forecast profits?

Are Euronet Worldwide Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Euronet Worldwide shares worth a considerable sum. We note that their impressive stake in the company is worth US$314m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Should You Add Euronet Worldwide To Your Watchlist?

One important encouraging feature of Euronet Worldwide is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. However, before you get too excited we've discovered 1 warning sign for Euronet Worldwide that you should be aware of.

Although Euronet Worldwide certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English