Compass Therapeutics And 2 Other Promising Penny Stocks For Your Watchlist

Over the last 7 days, the United States market has risen by 1.2%, and over the past year, it has climbed by 11%, with earnings forecasted to grow annually by 14%. In this context of growth, identifying good stocks often means looking for those with strong financial health and potential for long-term success. Penny stocks, though an outdated term in some respects, remain relevant as they often represent smaller or newer companies that can offer unique growth opportunities when backed by solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.09 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.34 | $35.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.41 | $517.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.165 | $36.81M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.05 | $190.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.84 | $184.35M | ✅ 3 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.60 | $21.9M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.32 | $54.51M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.812 | $6M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.00 | $92.35M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 710 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Compass Therapeutics (CMPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company specializing in the development of antibody-based therapeutics for oncology and other diseases in the United States, with a market cap of approximately $347.09 million.

Operations: Compass Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $347.09M

Compass Therapeutics, Inc., with a market cap of US$347.09 million, is a pre-revenue biopharmaceutical company focused on oncology therapeutics. Recent clinical developments include promising Phase 2/3 trial results for tovecimig in biliary tract cancer, showing significant improvement in objective response rates when combined with paclitaxel. Despite ongoing losses and high volatility, the company maintains a strong cash position of US$124.1 million against minimal liabilities and remains debt-free. Management's relatively short tenure may raise concerns about experience, but the board's seasoned presence offers some stability as Compass advances its pipeline through trials and presentations at key industry conferences.

- Take a closer look at Compass Therapeutics' potential here in our financial health report.

- Gain insights into Compass Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Solid Power (SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid-state battery technologies for electric vehicles and other markets in the United States, with a market cap of $292.36 million.

Operations: The company generates revenue from its Auto Parts & Accessories segment, amounting to $20.20 million.

Market Cap: $292.36M

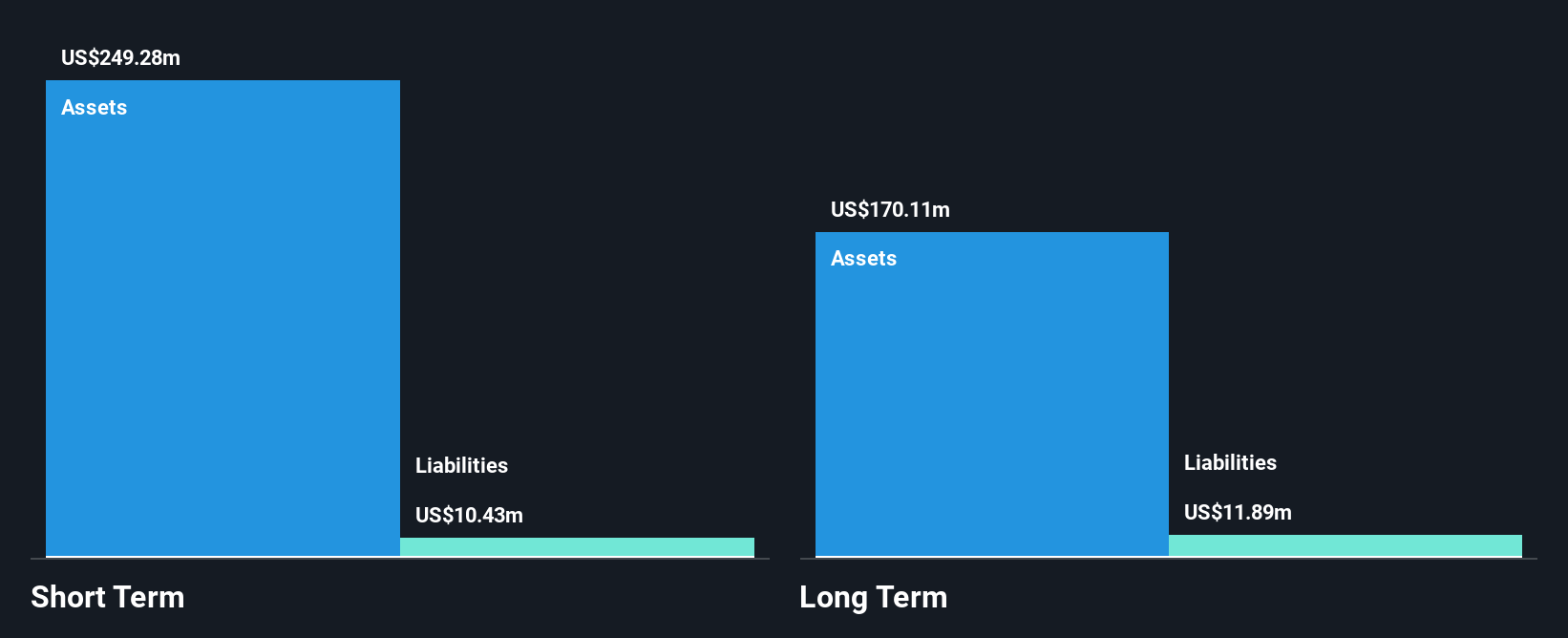

Solid Power, Inc., with a market cap of US$292.36 million, is focused on solid-state battery technologies and reported first-quarter sales of US$6.02 million, slightly up from the previous year. Despite being unprofitable with a net loss of US$15.15 million for Q1 2025, it maintains a strong cash position with short-term assets covering both short- and long-term liabilities. The company is debt-free and has not diluted shareholders recently but faces challenges such as declining earnings forecasts over the next three years and significant insider selling in recent months amidst management changes including appointing Deloitte & Touche LLP as auditors.

- Click here to discover the nuances of Solid Power with our detailed analytical financial health report.

- Learn about Solid Power's future growth trajectory here.

RPC (RES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPC, Inc. provides a variety of oilfield services and equipment to oil and gas companies focused on exploration, production, and development, with a market cap of approximately $1.07 billion.

Operations: RPC's revenue is primarily derived from Technical Services, generating $1.28 billion, with additional income from Support Services totaling $88.59 million.

Market Cap: $1.07B

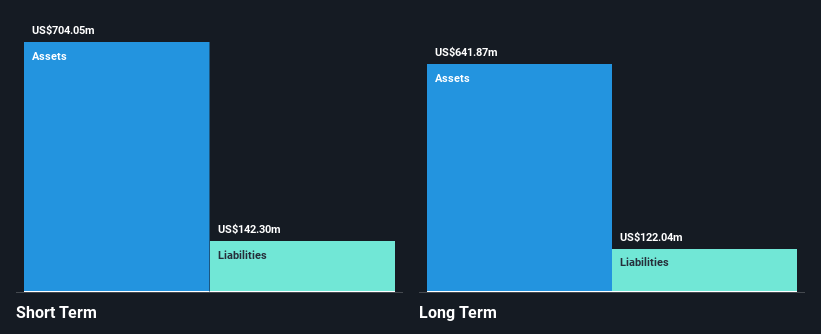

RPC, Inc., with a market cap of US$1.07 billion, generates substantial revenue from its Technical Services segment. The company recently reported Q1 2025 sales of US$332.88 million, though this was a decline from the previous year alongside decreased net income and profit margins. Despite these challenges, RPC remains debt-free with robust short-term assets exceeding liabilities and has not diluted shareholders recently. Management is seasoned, though earnings growth has been negative compared to industry averages. The company is exploring acquisitions while maintaining a stable dividend policy amidst filing for a shelf registration worth $312.72 million to bolster financial flexibility.

- Unlock comprehensive insights into our analysis of RPC stock in this financial health report.

- Understand RPC's earnings outlook by examining our growth report.

Make It Happen

- Explore the 710 names from our US Penny Stocks screener here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English