Top Wall Street Forecasters Revamp Digital Turbine Expectations Ahead Of Q4 Earnings

Digital Turbine, Inc. (NASDAQ:APPS) will release its fourth-quarter financial results after the closing bell on Monday, June 16.

Analysts expect the Austin, Texas-based company to report quarterly earnings at 4 cents per share, down from 12 cents per share in the year-ago period. Digital Turbine projects quarterly revenue of $116.64 million, compared to $112.22 million a year earlier, according to data from Benzinga Pro.

On Feb. 5, Digital Turbine reported quarterly earnings of 13 cents per share, which beat the analyst consensus estimate for a loss of one cent. Quarterly revenue clocked in at $134.64 million, which beat the consensus estimate of $123.68 million.

Digital Turbine shares fell 4.1% to close at $4.98 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

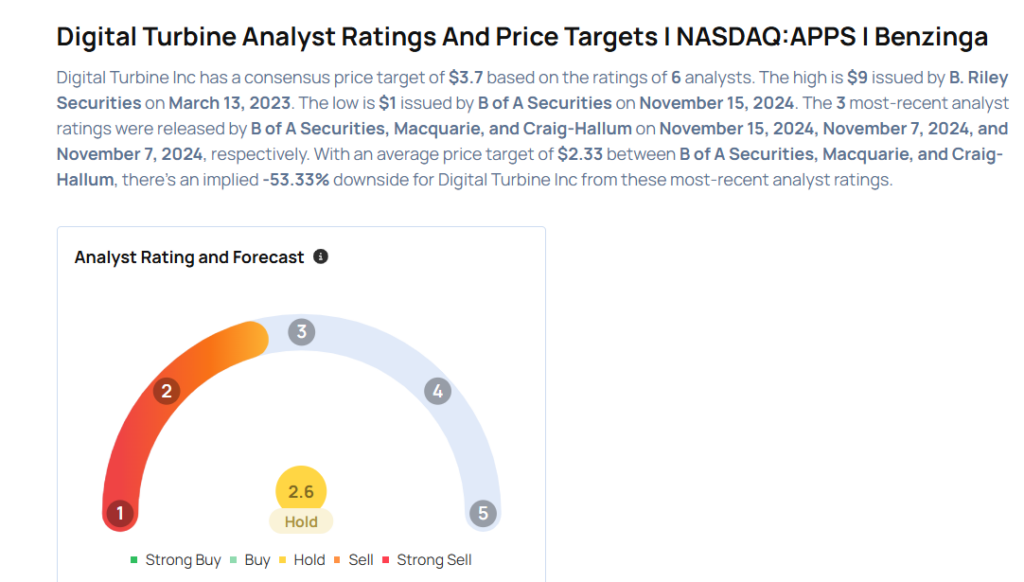

- B of A Securities analyst Omar Dessouky downgraded the stock from Neutral to Underperform and cut the price target from $3.5 to $1 on Nov. 15, 2025. This analyst has an accuracy rate of 66%.

- Macquarie analyst Tim Nollen maintained a Neutral rating and lowered the price target from $3 to $2 on Nov. 7, 2024. This analyst has an accuracy rate of 60%.

- Craig-Hallum analyst Anthony Stoss maintained a Buy rating and cut the price target from $5 to $4 on Nov. 7, 2024. This analyst has an accuracy rate of 61%.

Considering buying APPS stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English