Lennar Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Lennar Corporation (NYSE:LEN) will release earnings results for the second quarter, after the closing bell on Monday, June 16.

Analysts expect the Miami, Florida-based company to report quarterly earnings at $1.94 per share, down from $3.38 per share in the year-ago period. Lennar projects to report quarterly revenue at $8.19 billion, compared to $8.77 billion a year earlier, according to data from Benzinga Pro.

On April 9, the company's board declared a quarterly cash dividend of 50 cents per share for both Class A and Class B common stock.

Lennar shares gained 0.6% to close at $112.15 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

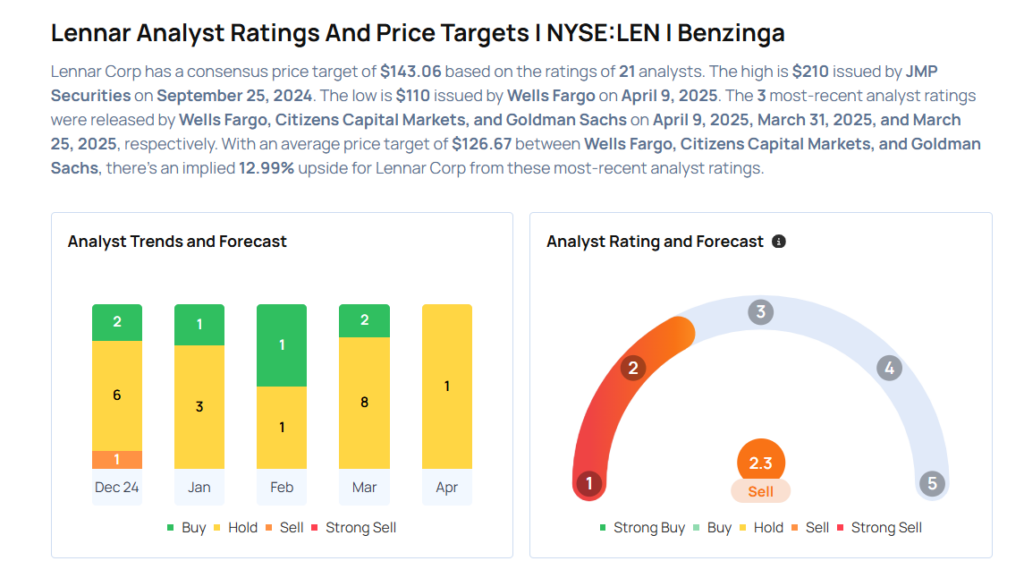

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Deepa Raghavan maintained an Equal-Weight rating and cut the price target from $120 to $110 on April 9, 2025. This analyst has an accuracy rate of 60%.

- Keefe, Bruyette & Woods analyst Jade Rahmani maintained a Market Perform rating and cut the price target from $141 to $128 on March 25, 2025. This analyst has an accuracy rate of 67%.

- UBS analyst John Lovallo maintained a Buy rating and cut the price target from $183 to $164 on March 24, 2025. This analyst has an accuracy rate of 65%.

- RBC Capital analyst Mike Dahl maintained a Sector Perform rating and slashed the price target from $125 to $122 on March 24, 2025. This analyst has an accuracy rate of 73%.

- Barclays analyst Matthew Bouley maintained an Equal-Weight rating and cut the price target from $121 to $110 on March 24, 2025. This analyst has an accuracy rate of 72%.

Considering buying LEN stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English