United Airlines Holdings (NasdaqGS:UAL) Expands San Francisco Operations

United Airlines Holdings (NasdaqGS:UAL) and JetBlue have launched their ambitious collaboration, "Blue Sky," which enhances customer flight options and loyalty benefits. Although the company's share price remained flat over the last quarter, this initiative, alongside other noteworthy developments, including increased San Francisco operations and a significant investment in the Houston hub, may have influenced investor sentiment. These actions could bolster United’s operational capacity and service offerings. In this context, the company's stock movement was in line with the market's broader trends, which remained flat over the past seven days, yet showed a notable rise over the last year.

The collaboration between United Airlines and JetBlue, titled "Blue Sky," could play a substantial role in reinforcing United’s strategic focus on brand loyalty and customer satisfaction, thus potentially influencing revenue and earnings growth positively. By enhancing operational capacity through expanded San Francisco operations and significant investment in the Houston hub, United is positioning itself to capitalize on increased passenger traffic and premium customer acquisition, possibly leading to improved net margins and a strengthened earnings outlook. However, potential risks such as tariffs and reduced flying capacity amid economic uncertainty could offset these benefits, affecting profitability and net margins.

Examining United Airlines' performance over a three-year timeframe, the company's total shareholder return, including share price appreciation and dividends, stands at 104%. This substantial growth highlights strong investor confidence, outperforming both the general U.S. market and the U.S. Airlines industry over the past year, where United recorded higher returns than the market's 11.7% and the industry's 16.9% returns. This longer-term growth offers a solid context for assessing the strategic moves outlined in the "Blue Sky" collaboration.

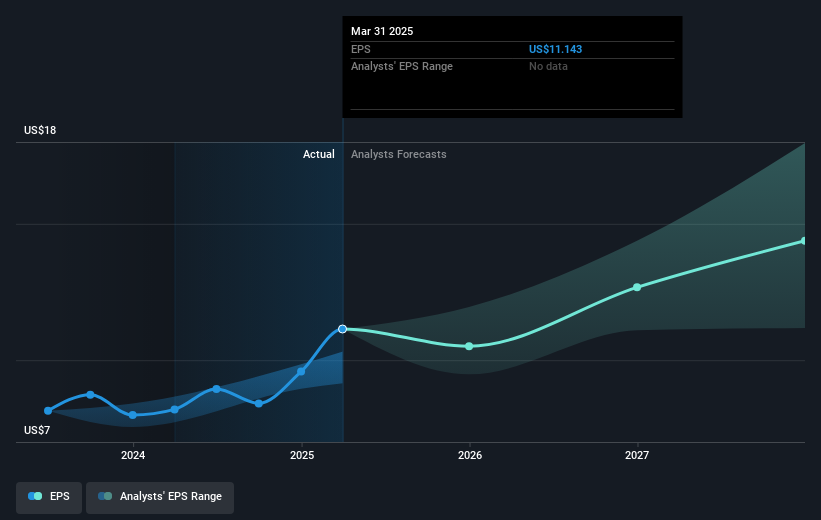

The current share price of approximately US$73.52 is notably below the consensus analyst price target of US$90.84, indicating a 19.1% discount. This suggests potential undervaluation and might reflect market skepticism towards future earnings and revenue forecasts, given the risks previously outlined. Moreover, analysts' expectations for the company’s revenue and earnings are predicated on new initiatives delivering growth, with a forecast to reach US$4.1 billion in earnings by 2028. However, the high level of analyst disagreement underscores the uncertainty surrounding United's capacity to achieve these targets amidst prevailing economic challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English