Tempus AI (NasdaqGS:TEM) Soars 51% In Last Quarter

In an exciting development for Tempus AI (NasdaqGS:TEM), the company experienced a significant 51% increase in its share price over the last quarter. This surge coincides with major events including their collaboration with The Abrams Research Center to advance Alzheimer's research and a partnership with Verastem Oncology for ovarian cancer diagnostics. Additionally, the introduction of innovative products like the liquid biopsy assay for treatment response monitoring reflects Tempus AI's active expansion in AI and precision medicine. With a broad market showing an 11% rise over the past year, Tempus AI's performance is notably robust amidst industry-wide growth projections.

Tempus AI's shares demonstrated impressive resilience, achieving a substantial 77.09% total return over the past year. This outpaced both the broader U.S. market, which returned 10.6%, and the life sciences industry, which saw a decline of 23.1%. The robust share performance aligns with several strategic alliances and innovative product launches over the last year, potentially enhancing Tempus AI's revenue streams in precision medicine and AI-driven diagnostics.

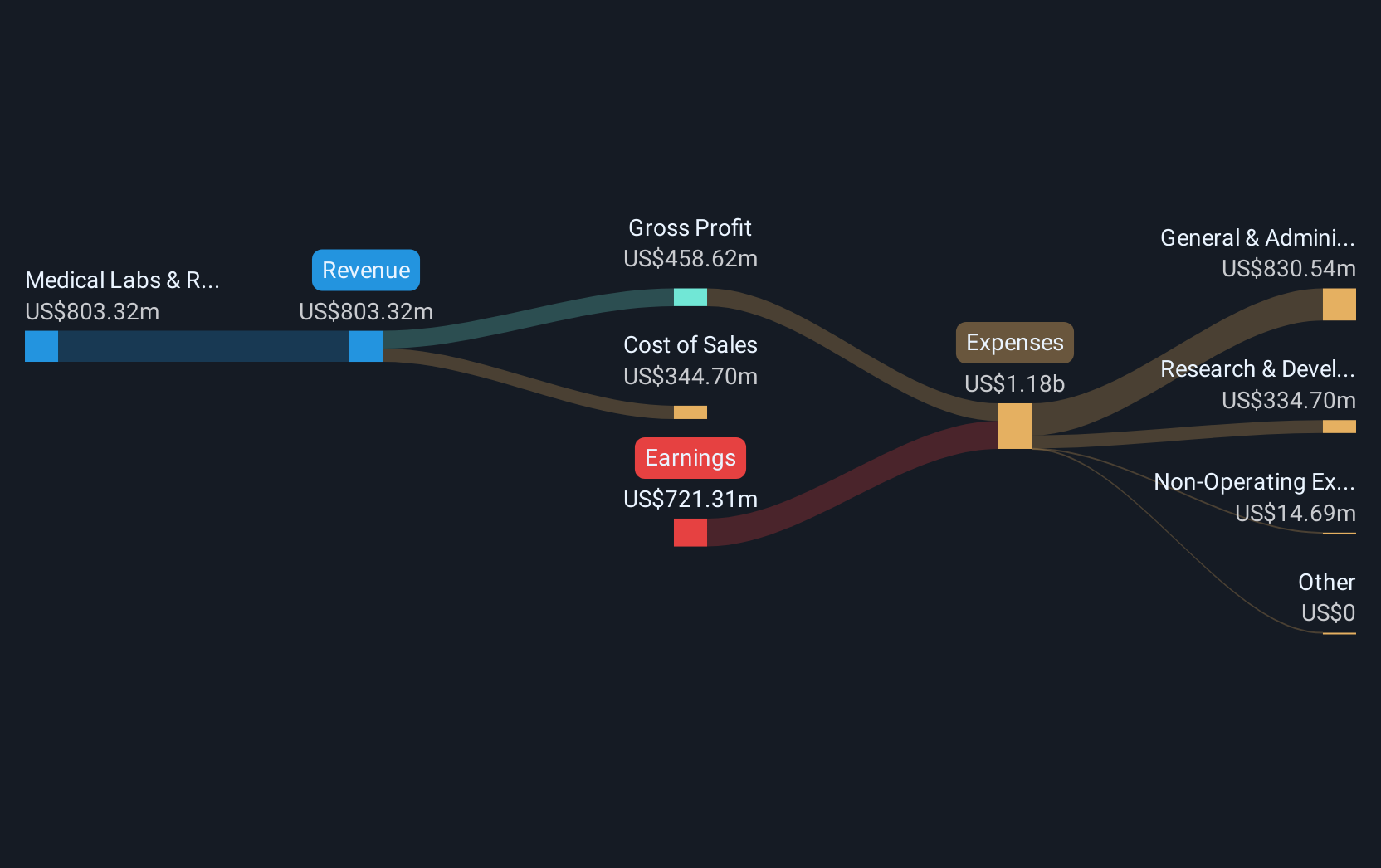

Despite strong revenue forecasts with expected annual growth of 21.71%, Tempus AI faces challenges with its profitability, recording a loss of US$68.04 million in the first quarter of 2025. The significant share price increase, however, positions the company above the consensus analyst price target of US$65.50. While the developments may bolster revenue, the market's valuation of Tempus AI highlights a discrepancy given its current unprofitability and Price-To-Sales Ratio of 15.4x compared to the industry average. The next quarters will be crucial in determining whether the company's strategic initiatives translate into a sustainable financial turnaround.

Examine Tempus AI's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English