Diamondback Energy (NasdaqGS:FANG) Stock Rises 10% Over Last Week

Diamondback Energy (NasdaqGS:FANG) recently experienced a board change with the retirement of David L. Houston. Over the last week, the company's share price rose by 10%, a notable performance given the flat market conditions during the same period. This upward movement in Diamondback's stock might have been bolstered by the executive transition, suggesting enhanced investor confidence or anticipation of a strategic evolution. Despite the lack of broader market momentum, the shareholder return reflects a distinct trajectory that might be influenced by internal corporate adjustments rather than external economic factors.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

The recent board change might signal a shift in investor sentiment, contributing to the recent 10% rise in Diamondback Energy's share price. While this indicates potential investor optimism regarding strategic adjustments, the company has actually achieved a total return of 311.97% over the past five years. This long-term growth underscores the company's strong performance, vastly exceeding the returns over the past year, where it underperformed the US Oil and Gas industry, which achieved a return of only 3.5%.

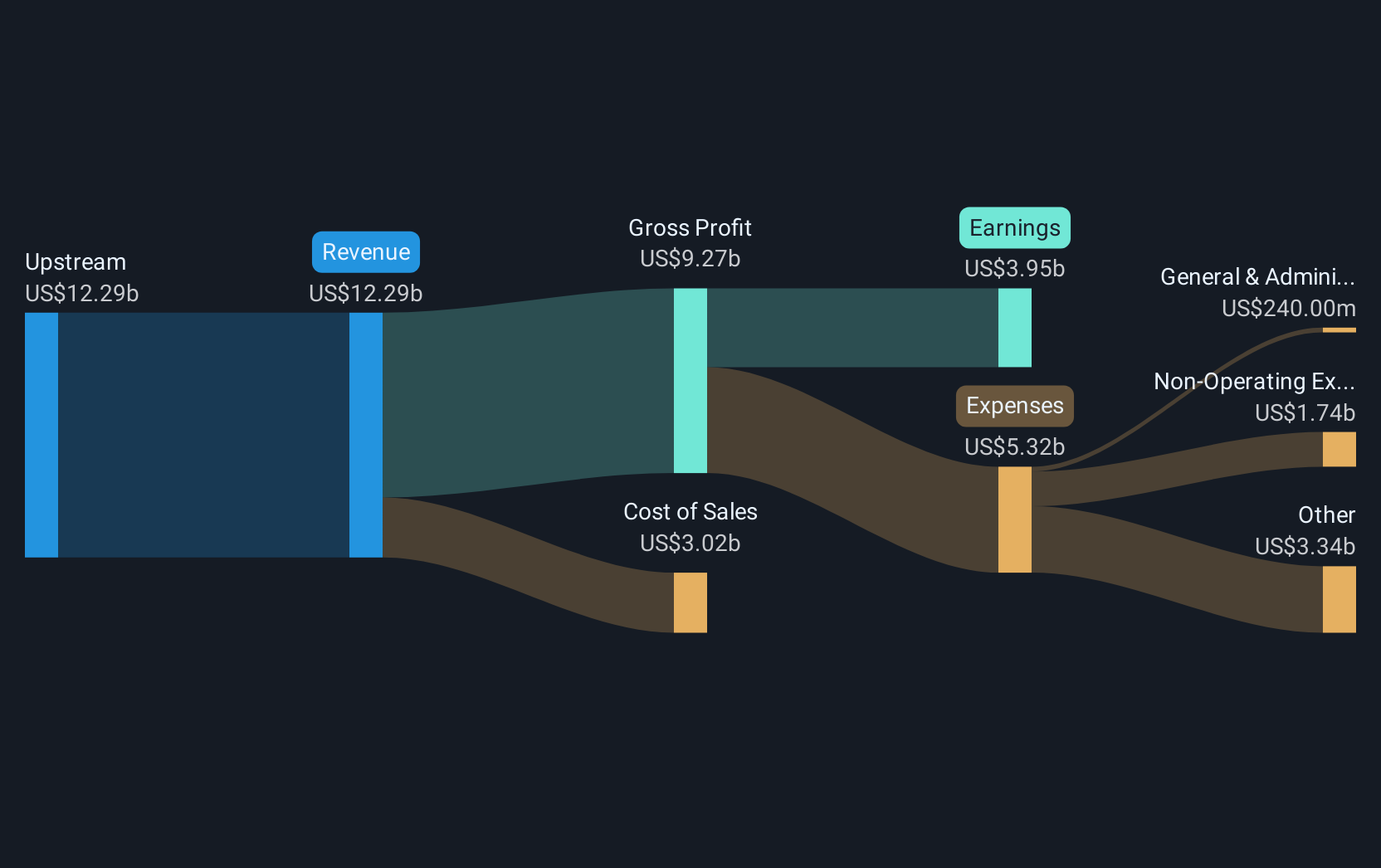

The company's strategic focus on reducing capital expenditure and prioritizing share buybacks suggests that Diamondback Energy is looking to sustain its cash flow and improve net margins. However, these moves must be carefully balanced to ensure continued revenue growth, as forecasted revenue growth of 5% annually is expected to lag behind the broader US market growth of 8.7%. In terms of earnings, maintaining the current level of US$3.95 billion hinges on efficient capital allocation and market conditions, despite a challenging global oil landscape.

The current share price of US$131.98, while appreciating recently, shows a discount when compared to the consensus price target of approximately US$181.84, suggesting potential upside according to analyst forecasts. Investors should weigh the recent executive changes and strategic decisions against these forecasts, considering the potential impact on the company’s future earnings and revenue projections in an evolving market. As always, individuals should analyze these factors based on their interpretations of the company's prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English