Take Care Before Diving Into The Deep End On Weave Communications, Inc. (NYSE:WEAV)

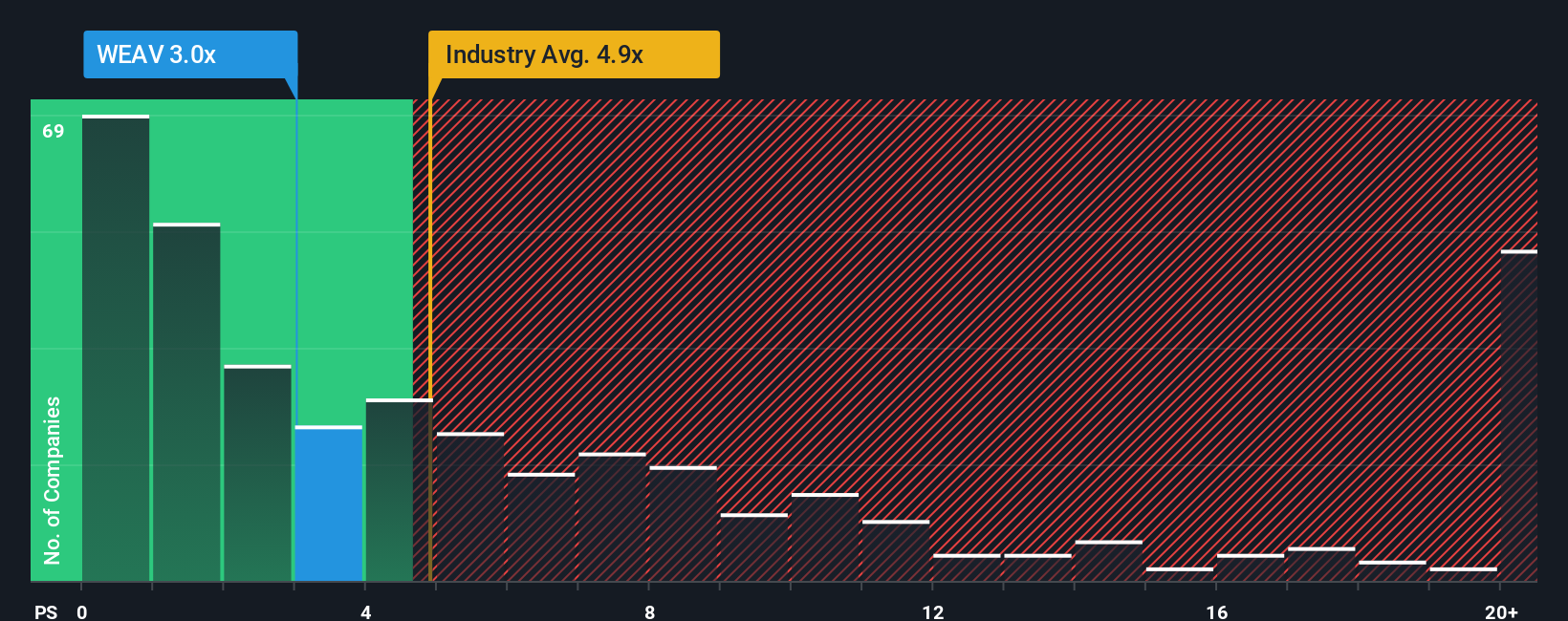

With a price-to-sales (or "P/S") ratio of 3x Weave Communications, Inc. (NYSE:WEAV) may be sending bullish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios greater than 4.9x and even P/S higher than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Weave Communications

What Does Weave Communications' P/S Mean For Shareholders?

Recent times have been advantageous for Weave Communications as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Weave Communications' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Weave Communications?

Weave Communications' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. Pleasingly, revenue has also lifted 72% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 16% over the next year. That's shaping up to be similar to the 16% growth forecast for the broader industry.

With this information, we find it odd that Weave Communications is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Weave Communications' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Weave Communications' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Having said that, be aware Weave Communications is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Weave Communications, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English