How Is Old Dominion Freight Line’s Stock Performance Compared to Other Transportation Stocks?

With a market cap of $33.9 billion, Old Dominion Freight Line, Inc. (ODFL) is a top-tier less-than-truckload (LTL) freight carrier headquartered in Thomasville, NC. It operates over 260 service centers across 48 states, supported by a fleet of approximately 58,000 tractors and trailers and a workforce of around 21,900 employees

Companies worth $10 billion or more are generally described as “large-cap stocks,” Old Dominion fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the trucking industry.

Its nationwide, company-owned network of over 260 service centers ensures tight control over service quality and transit times. The company maintains strong pricing power through disciplined yield management and a premium service model, even during volume downturns.

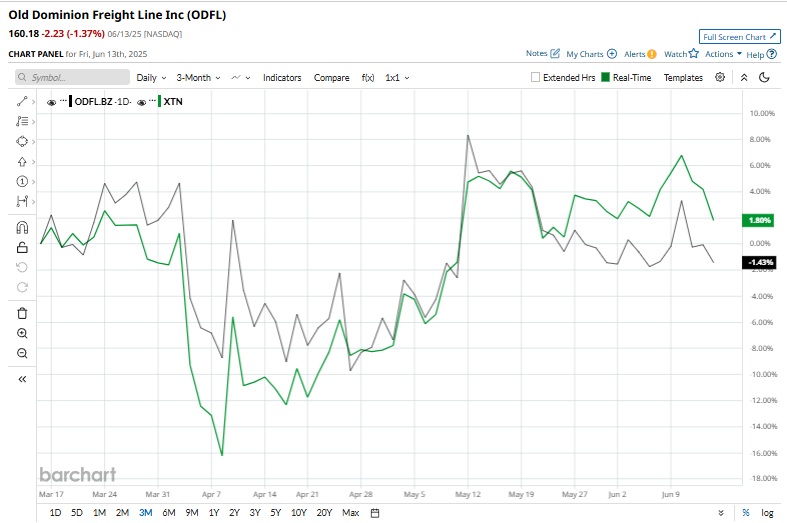

Despite its strengths, ODFL stock has retreated 31.3% from its 52-week high of $233.26 touched on Nov. 11, 2024. Meanwhile, ODFL has dropped 1.7% over the past three months, outperforming the SPDR S&P Transportation ETF’s (XTN) 4.1% rise over the same time frame.

ODFL stock has dipped 9.2% in 2025 and 7.4% over the past 52 weeks, compared to XTN’s 12% fall in this year and marginal plunge over the past year.

While ODFL has traded mostly below its 200-day moving average since early late February, it has climbed above its 50-day moving average since mid-May.

Following the release of its better-than-expected Q1 results on April 23, Old Dominion Freight Line’s stock recorded a marginal rise. Although the company continued to face volume declines amid a persistently soft macroeconomic environment, revenue fell 5.8% year-over-year to $1.4 billion, still exceeding Street estimates. Margin pressures were evident, with net income declining 12.9% to $254.7 million.

However, earnings per share came in at $1.19, surpassing consensus expectations by 3.5%, underscoring the company’s strong cost discipline and operational resilience despite ongoing industry headwinds.

Meanwhile, Old Dominion has also underperformed its peer XPO, Inc.’s (XPO) 8.2% drop on a YTD basis and a 17% rise over the past year.

Among the 22 analysts covering the ODFL stock, the consensus rating is a “Moderate Buy.” Its mean price target of $169.82 suggests a 6% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English