We're Hopeful That Ascletis Pharma (HKG:1672) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. By way of example, Ascletis Pharma (HKG:1672) has seen its share price rise 995% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Ascletis Pharma's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

When Might Ascletis Pharma Run Out Of Money?

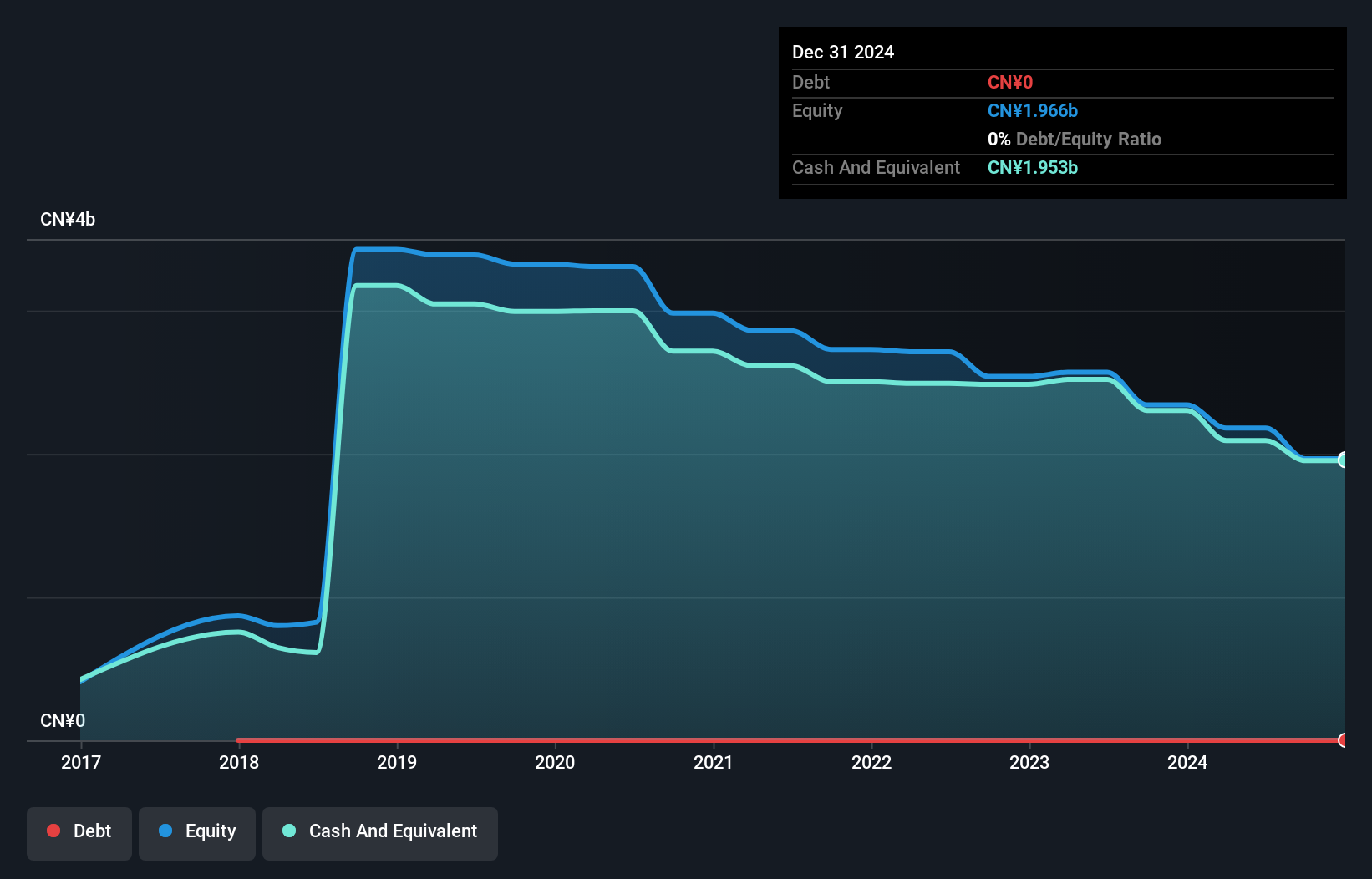

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2024, Ascletis Pharma had CN¥2.0b in cash, and was debt-free. Importantly, its cash burn was CN¥344m over the trailing twelve months. Therefore, from December 2024 it had 5.7 years of cash runway. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

View our latest analysis for Ascletis Pharma

How Is Ascletis Pharma's Cash Burn Changing Over Time?

Whilst it's great to see that Ascletis Pharma has already begun generating revenue from operations, last year it only produced CN¥1.3m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. Over the last year its cash burn actually increased by 41%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Ascletis Pharma Raise More Cash Easily?

Given its cash burn trajectory, Ascletis Pharma shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of CN¥9.4b, Ascletis Pharma's CN¥344m in cash burn equates to about 3.7% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Ascletis Pharma's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Ascletis Pharma is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Ascletis Pharma has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English