3 Promising Penny Stocks With Market Caps Under $500M

In the last week, the United States market has stayed flat, though it's up 11% over the past year with earnings expected to grow by 14% per annum over the next few years. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (SDCH) | $0.0433 | $10.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (IMPP) | $3.40 | $115.98M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.84 | $58.69M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.31 | $484.63M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.10 | $34.79M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.05 | $171.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (FSI) | $4.35 | $53.75M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84505 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.05 | $83.16M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.55 | $463.09M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 715 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Zedge (ZDGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zedge, Inc. operates digital marketplaces and competitive games focused on self-expression content, with a market cap of $37.90 million.

Operations: The company's revenue is derived from two main segments: Gurushots, contributing $2.48 million, and the Zedge Marketplace, generating $27.03 million.

Market Cap: $37.9M

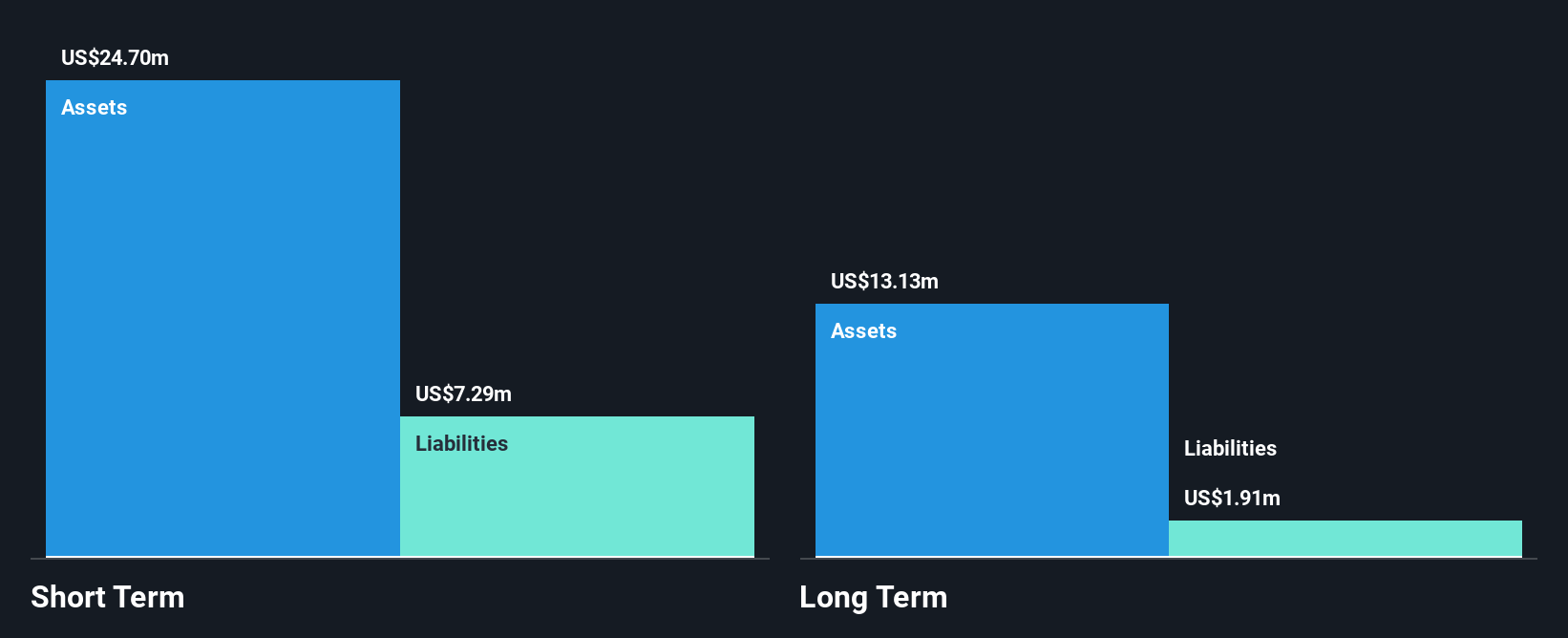

Zedge, Inc., with a market cap of US$37.90 million, operates in digital marketplaces and competitive games. Despite being unprofitable, the company has no debt and maintains a positive cash runway exceeding three years due to growing free cash flow. Zedge's short-term assets significantly cover both its short- and long-term liabilities. Recent earnings indicate stable revenue with slight growth; however, net income remains low at US$0.185 million for Q3 2025. The company completed a share buyback program of 3.3% for US$1.2 million, reflecting strategic financial management amid high stock volatility over recent months.

- Take a closer look at Zedge's potential here in our financial health report.

- Evaluate Zedge's prospects by accessing our earnings growth report.

loanDepot (LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of $442.08 million.

Operations: The company generates revenue primarily from the originating, financing, and selling of mortgage loans, amounting to $1.09 billion.

Market Cap: $442.08M

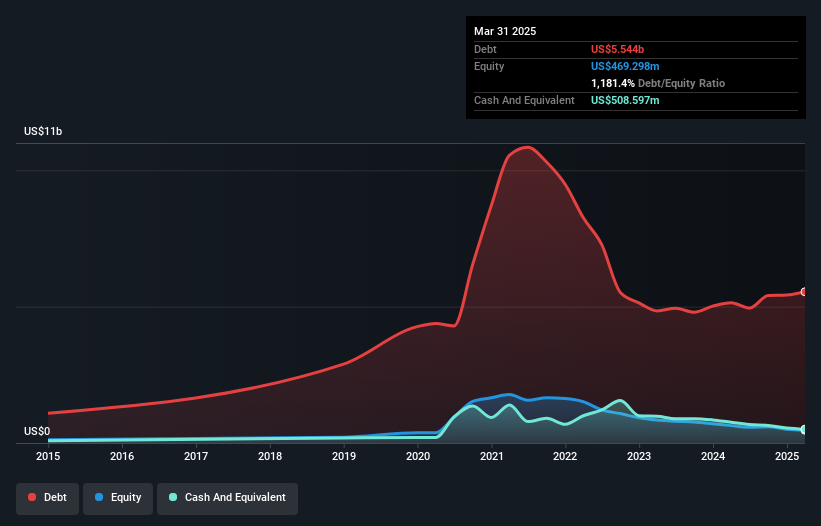

loanDepot, Inc., with a market cap of US$442.08 million, operates in the residential mortgage sector and faces challenges typical of penny stocks. The company remains unprofitable despite generating US$1.09 billion in revenue from mortgage activities and has seen increasing losses over the past five years. Its debt levels are high, with a net debt to equity ratio above 1000%. However, loanDepot's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. Recent earnings show reduced losses compared to last year, while a recent shelf registration filing indicates potential capital raising efforts.

- Navigate through the intricacies of loanDepot with our comprehensive balance sheet health report here.

- Assess loanDepot's future earnings estimates with our detailed growth reports.

Perfect (PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company that offers AI- and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of $185.36 million.

Operations: The company generates $61.93 million in revenue from its Internet Software & Services segment.

Market Cap: $185.36M

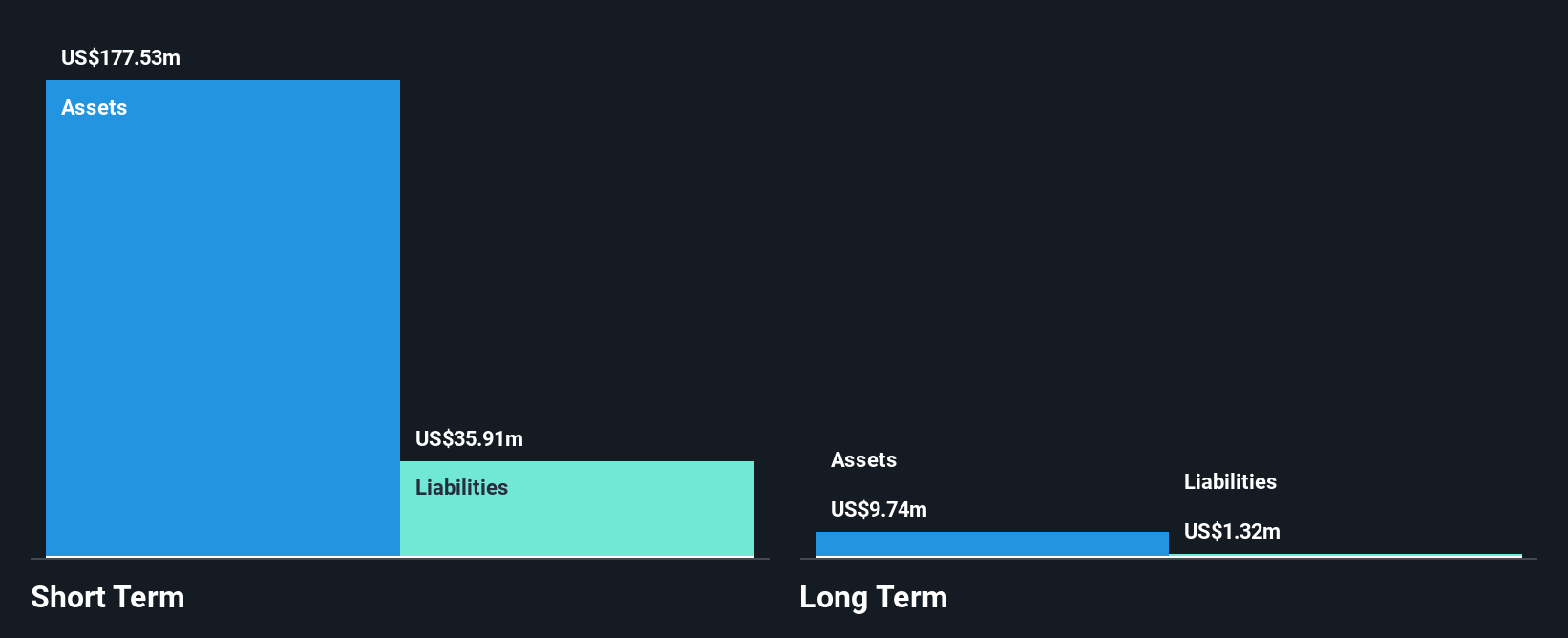

Perfect Corp., with a market cap of US$185.36 million, stands out in the AI software sector by offering innovative solutions for beauty and fashion industries. The company has no debt, which is uncommon for penny stocks, and its short-term assets significantly exceed liabilities. Perfect Corp.'s earnings have grown over 24.9% in the past year, surpassing industry averages, while recent collaborations with NVIDIA enhance its AI capabilities for hyper-personalized consumer experiences. Despite a relatively inexperienced board, Perfect Corp.'s strategic advancements in virtual try-ons and AI-driven recommendations position it well within this competitive landscape.

- Jump into the full analysis health report here for a deeper understanding of Perfect.

- Learn about Perfect's future growth trajectory here.

Next Steps

- Take a closer look at our US Penny Stocks list of 715 companies by clicking here.

- Interested In Other Possibilities? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English