4 Analysts Have This To Say About FrontView REIT

During the last three months, 4 analysts shared their evaluations of FrontView REIT (NYSE:FVR), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 1 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 1 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

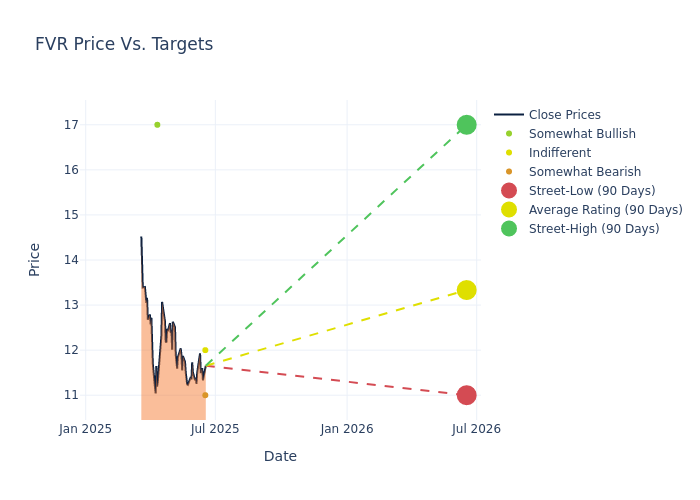

Insights from analysts' 12-month price targets are revealed, presenting an average target of $13.5, a high estimate of $17.00, and a low estimate of $11.00. This current average represents a 14.29% decrease from the previous average price target of $15.75.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of FrontView REIT by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joshua Dennerlein | B of A Securities | Lowers | Underperform | $11.00 | $15.00 |

| Anthony Paolone | JP Morgan | Lowers | Neutral | $12.00 | $14.00 |

| Anthony Paolone | JP Morgan | Lowers | Overweight | $14.00 | $15.00 |

| John Kilichowski | Wells Fargo | Lowers | Overweight | $17.00 | $19.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to FrontView REIT. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of FrontView REIT compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for FrontView REIT's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of FrontView REIT's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on FrontView REIT analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind FrontView REIT

FrontView REIT Inc is an internally managed net-lease REIT that is experienced in acquiring, owning, and managing out parcel properties that are net-leased to a diversified group of tenants. The tenants of the company include service-oriented businesses, such as restaurants, cellular stores, financial institutions, automotive stores and dealers, medical and dental providers, pharmacies, convenience and gas stores, car washes, home improvement stores, grocery stores, professional services as well as general retail tenants.

Unraveling the Financial Story of FrontView REIT

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining FrontView REIT's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.45% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: FrontView REIT's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -6.33%, the company may face hurdles in effective cost management.

Return on Equity (ROE): FrontView REIT's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -0.32%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): FrontView REIT's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.12%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 1.0, FrontView REIT adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English