Optimistic Investors Push United Energy Group Limited (HKG:467) Shares Up 27% But Growth Is Lacking

Despite an already strong run, United Energy Group Limited (HKG:467) shares have been powering on, with a gain of 27% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.4% in the last twelve months.

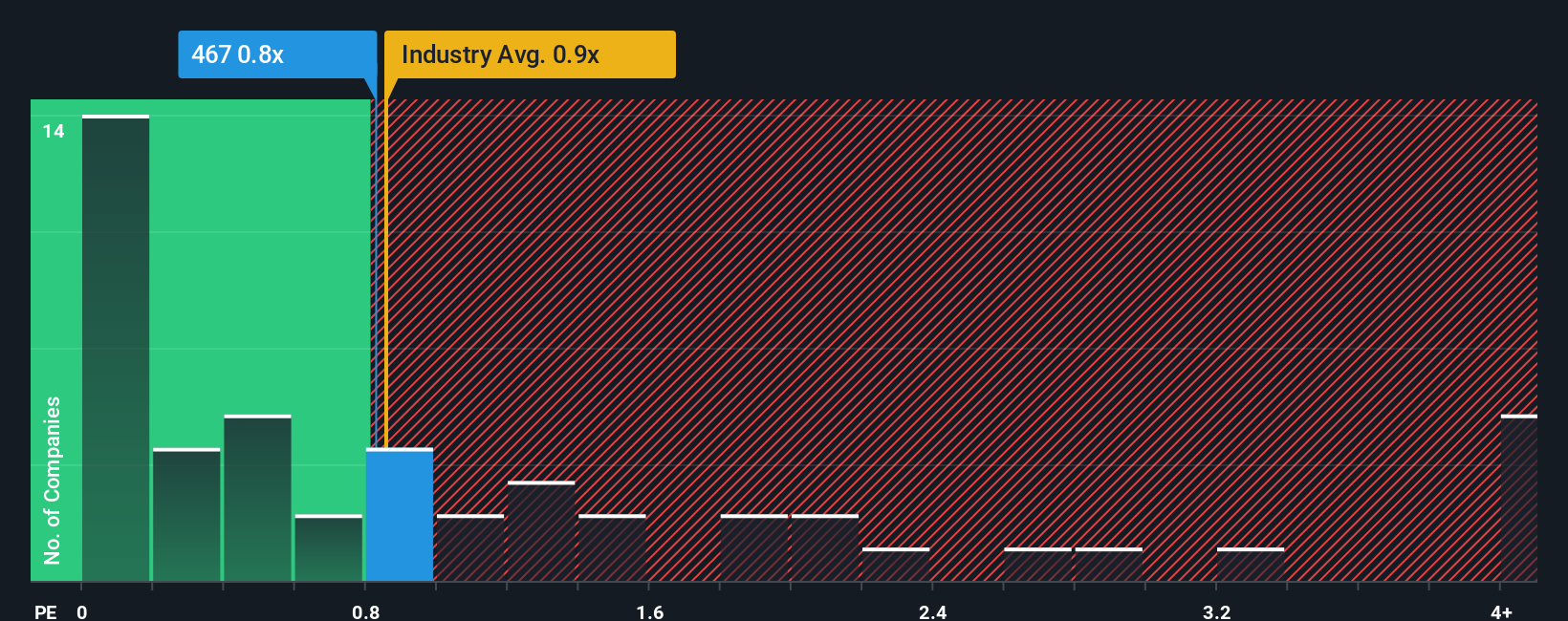

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about United Energy Group's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Oil and Gas industry in Hong Kong is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for United Energy Group

How United Energy Group Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, United Energy Group has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on United Energy Group will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on United Energy Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, United Energy Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. The latest three year period has also seen an excellent 136% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to plummet, contracting by 7.7% during the coming year according to the only analyst following the company. Meanwhile, the broader industry is forecast to moderate by 2.4%, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that United Energy Group's P/S is similar to its industry peers. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From United Energy Group's P/S?

United Energy Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

United Energy Group's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. Even though the company's P/S is on par with the rest of the industry, the fact that it's revenue outlook is poorer than an already struggling industry suggests that the P/S isn't justified. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for United Energy Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English