Ituran Location and Control And 2 Other Top Dividend Stocks To Consider

Over the last 7 days, the United States market has remained flat, yet it is up 9.8% over the past year with earnings forecasted to grow by 15% annually. In this context of steady growth and potential earnings expansion, dividend stocks like Ituran Location and Control can offer investors a reliable income stream while participating in market gains.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 5.23% | ★★★★★☆ |

| Universal (UVV) | 5.54% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.68% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 7.24% | ★★★★★★ |

| Ennis (EBF) | 5.36% | ★★★★★★ |

| Dillard's (DDS) | 6.33% | ★★★★★★ |

| Credicorp (BAP) | 5.06% | ★★★★★☆ |

| CompX International (CIX) | 5.00% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.55% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.13% | ★★★★★☆ |

Click here to see the full list of 151 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Ituran Location and Control (ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products across several countries, including Israel, Brazil, and the United States, with a market cap of $718.36 million.

Operations: Ituran Location and Control Ltd. generates revenue from two main segments: Telematics Products, contributing $93.95 million, and Telematics Services, which account for $243.74 million.

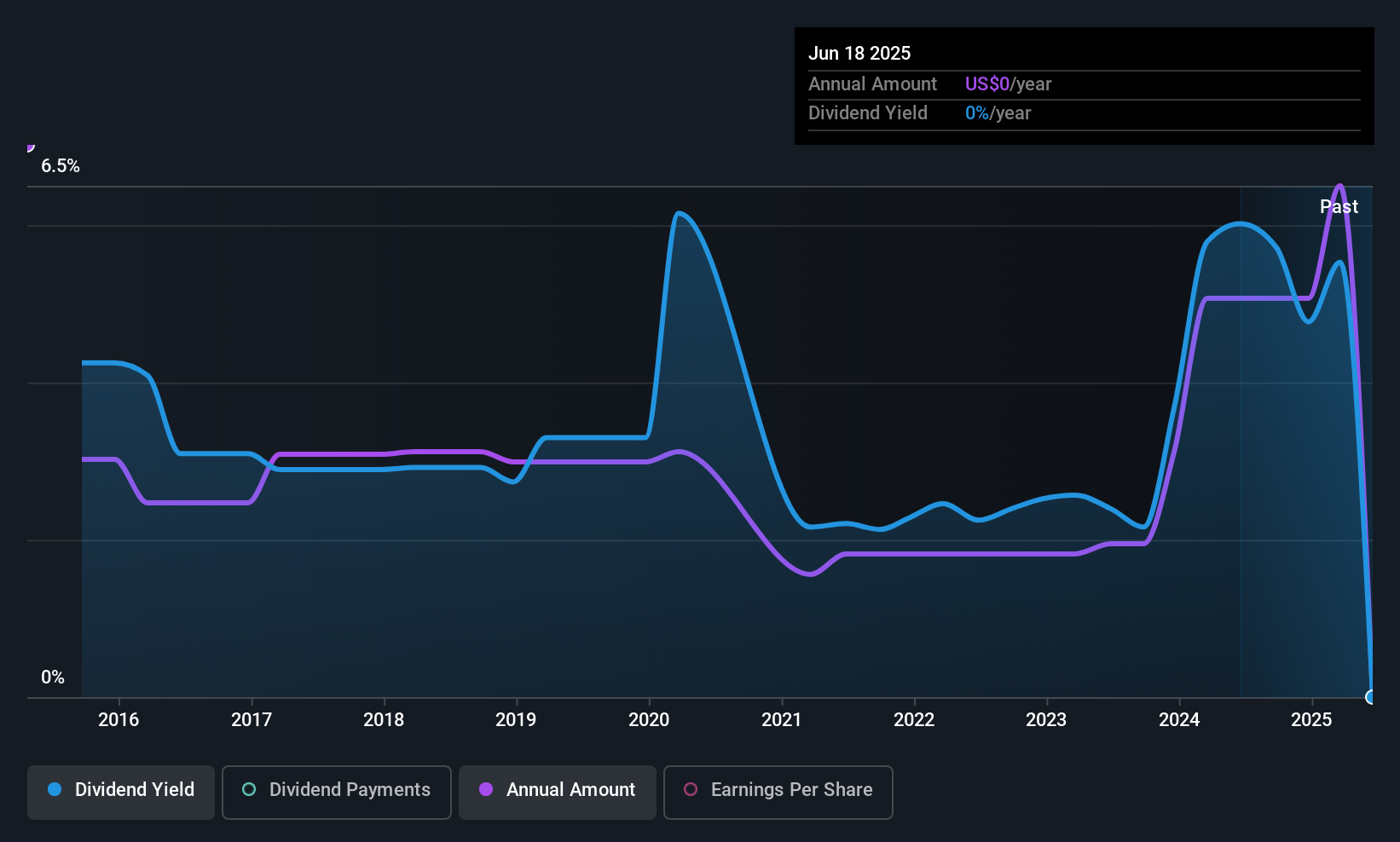

Dividend Yield: 5.6%

Ituran Location and Control Ltd. offers a dividend yield of 5.58%, placing it in the top 25% of US market dividend payers, with recent affirmations of a $0.50 per share cash dividend totaling approximately US$10 million. Despite its reasonable payout ratios—64.1% earnings and 65% cash flow—the company's dividends have been volatile over the past decade, lacking stability despite growth trends. Recent strategic alliances, such as with BMW Motorrad Brazil, may enhance future revenue streams but do not directly impact current dividend reliability or sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Ituran Location and Control.

- The valuation report we've compiled suggests that Ituran Location and Control's current price could be quite moderate.

CareTrust REIT (CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing and leasing seniors housing and healthcare-related properties, with a market cap of $5.39 billion.

Operations: CareTrust REIT generates revenue primarily from its investments in healthcare-related real estate assets, amounting to $329.84 million.

Dividend Yield: 4.6%

CareTrust REIT's dividend yield of 4.6% falls short of the top 25% of US dividend payers, and its high payout ratio (582.6%) indicates dividends are not well covered by earnings, though they are supported by cash flows. Despite recent increases in quarterly dividends to $0.335 per share and stable payments over a decade, shareholder dilution raises concerns. The company is actively pursuing acquisitions with a new $500 million term loan, potentially impacting future cash flow allocations for dividends.

- Click to explore a detailed breakdown of our findings in CareTrust REIT's dividend report.

- According our valuation report, there's an indication that CareTrust REIT's share price might be on the cheaper side.

Fresh Del Monte Produce (FDP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fresh Del Monte Produce Inc. operates globally through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables, with a market cap of approximately $1.56 billion.

Operations: Fresh Del Monte Produce Inc. generates revenue primarily from Fresh and Value-Added Products at $2.61 billion, followed by Bananas at $1.46 billion, and Other Products and Services at $197.20 million.

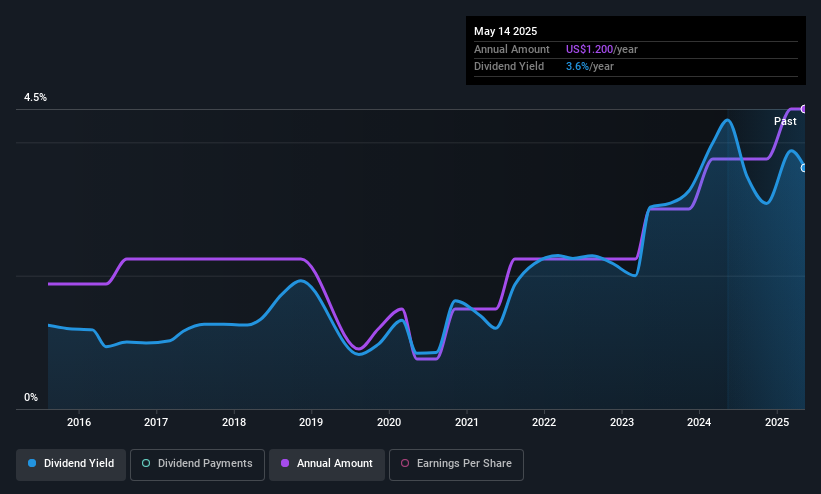

Dividend Yield: 3.6%

Fresh Del Monte Produce's dividend yield of 3.63% is below the top 25% of US dividend payers, but its low payout ratios indicate dividends are well covered by earnings and cash flows. Despite a volatile dividend history, recent payments have increased. The company's strategic expansion in the UAE with Pinkglow® pineapples and a completed share buyback of $7.61 million may influence future financial flexibility and shareholder returns.

- Unlock comprehensive insights into our analysis of Fresh Del Monte Produce stock in this dividend report.

- In light of our recent valuation report, it seems possible that Fresh Del Monte Produce is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Top US Dividend Stocks list of 151 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English