2 Communication Stocks Likely to Tide Over Industry Challenges

Nevertheless, Anterix Inc. ATEX and Bandwidth Inc. BAND are likely to gain from solid demand for scalable infrastructure for seamless connectivity with the wide proliferation of IoT, transition to fiber, cloud and next-gen technologies, and accelerated 5G rollout.

Industry Description

The Zacks Communication - Infrastructure industry players provide various infrastructure solutions for core, access and edge layers of communication networks. Leveraging proprietary modeling and simulation techniques to optimize networks, the firms offer high-speed network access solutions across Internet protocol, asynchronous transfer mode and time-division multiplexed architecture in both wireline and wireless network applications. Their product portfolio encompasses optical fiber and twisted-pair structured cable solutions, infrastructure management hardware and software, network racks and cabinets, fiber-to-home equipment like hardened connector systems, wireless network backhaul planning and optimization products, couplers and splitters, indoor, small cell and distributed wireless antenna systems and hardened optical terminating enclosures.

What's Shaping the Future of the Communication - Infrastructure Industry?

Inflated Raw Material Prices: High raw material prices due to inflation, economic sanctions against the Putin regime and intensifying tensions in the Middle East have affected the operation schedules of various firms. Extended lead times for basic components are also likely to hurt the delivery schedule and escalate production costs. The demand-supply imbalance has crippled operations and largely affected profitability due to inflated equipment prices. The growing tension between the United States and China relating to trade restrictions imposed on the sale of communication equipment to Chinese firms has further affected margins.

Network Convergence: With operators moving toward converged or multi-use network structures, combining voice, video and data communications into a single network, the industry is increasingly developing solutions to support wireline and wireless network convergence. These investments are likely to help minimize service delivery costs to adequately support broadband competition and expand rural coverage and wireless densification in the long run. The industry players have enabled enterprises to rapidly scale communications functionalities to a vast range of applications and devices with easy-to-use software application programming interfaces. The firms support high user volumes without affecting deliverability and cost-effectively eliminate performance degradation.

Short-Term Profitability At Stake: The exponential growth of mobile broadband traffic and home Internet solutions has resulted in massive demand for advanced networking architecture, forcing service providers to spend more to upgrade infrastructure in the core fiber backhaul network. Although higher infrastructure investments will eventually help minimize service delivery costs to support broadband competition and wireless densification, short-term profitability has largely been compromised. High technological obsolescence of most products has escalated operating costs with steady investments in R&D. High customer inventory levels and a conservative approach toward placing orders for high-value items remain other headwinds for the industry. Extended lead times for basic components are expected to adversely impact the delivery schedule and escalate production costs.

Zacks Industry Rank Indicates Bearish Trends

The Zacks Communication - Infrastructure industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #183, which places it in the bottom 25% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bleak prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a couple of communication infrastructure stocks that are well-positioned to outperform the market based on a strong earnings outlook, let’s take a look at the industry’s recent stock market performance and valuation picture.

Industry Outperforms S&P 500 & Sector

The Zacks Communication - Infrastructure industry has outperformed the broader Zacks Computer and Technology sector and the S&P 500 composite over the past year.

The industry has surged 67% over this period compared with the S&P 500 and the sector’s growth of 9.1% and 6.2%, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), which is the most appropriate multiple for valuing telecom stocks, the industry is currently trading at 3.45X compared with the S&P 500’s tally of 16.87X. It is also trading below the sector’s trailing 12-month EV/EBITDA of 16.83X.

Over the past five years, the industry has traded as high as 9.82X, as low as 2.12X and at the median of 6.76X, as the chart below shows.

Trailing 12-Month Enterprise Value-to-EBITDA (EV/EBITDA) Ratio

2 Communication - Infrastructure Stocks to Watch

Anterix: Headquartered in Woodland Park, NJ, Anterix is a premier wireless communications firm. It reportedly holds the largest licensed spectrum in the 900 MHz band, with coverage throughout the United States, Alaska, Hawaii and Puerto Rico. Anterix expects to monetize its spectrum assets to generate long-term value. The company’s transformative broadband solutions for critical infrastructure industries and enterprises help to unlock applications from analytics to automation to edge monitoring and artificial intelligence. Anterix carries a Zacks Rank #3 (Hold).

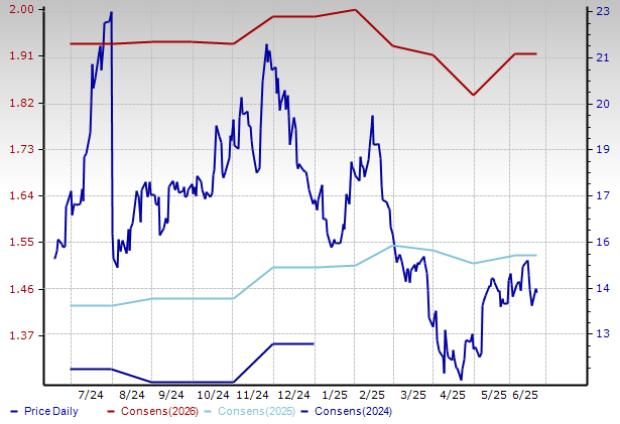

Price and Consensus: ATEX

Bandwidth: Headquartered in Raleigh, NC, Bandwidth operates as a Communications Platform-as-a-Service (CPaaS) provider, offering avant-garde software application programming interfaces for voice and messaging services. It is the only application programming interface (API) platform provider that owns a Tier 1 network with enhanced network capacity, primarily catering to business enterprises. Bandwidth believes that its evolving portfolio and accretive customer base are the cornerstones of long-term growth across a diverse set of markets. It enables enterprises to rapidly scale communications functionalities to various applications and devices with its easy-to-use software APIs. Continuous innovation on CPaaS offerings allows enterprise customers to have direct access to Bandwidth’s comprehensive suite of products and services. This Zacks Rank #3 stock supports high user volumes without affecting deliverability and cost-effectively eliminates performance degradation. It has a VGM Score of A.

Price and Consensus: BAND

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Anterix Inc. (ATEX): Free Stock Analysis Report

Bandwidth Inc. (BAND): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English