Leadership Changes Announced At American Electric Power Company (NasdaqGS:AEP) To Support Long-Term Strategy

American Electric Power Company (NasdaqGS:AEP) recently announced executive leadership changes, including the appointments of Rob Berntsen and Johannes Eckert to key roles. Despite this news, AEP's share price remained flat over the past week amidst a shifting market context influenced by global events and anticipation of the Federal Reserve's interest rate decision. As stock markets experienced slight upticks, with the Dow and S&P 500 posting gains, AEP's market performance was consistent with broader trends, neither contributing significantly to nor deviating from the relative market stability observed during the period.

The recent executive leadership changes at American Electric Power Company could influence the company's strategic plans and potentially refine its focus on regulatory and investment initiatives. While short-term share price movement remained stagnant following the announcement, AEP has achieved a significant total return of 50.81% over the past five years, illustrating the company's potential for consistent shareholder returns over longer periods. Over the past year, AEP matched the US Electric Utilities industry's return of 15.8%, indicating its competitive performance within its sector.

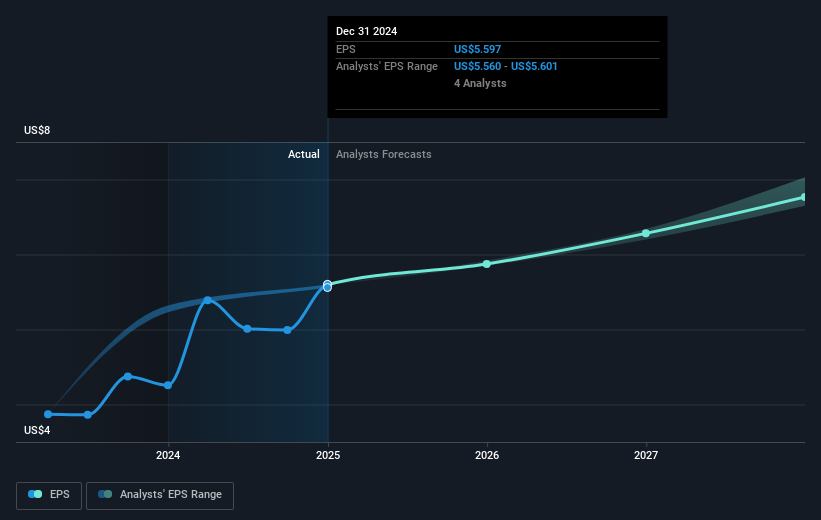

Considering the company's future growth strategies, the leadership changes could play a role in solidifying regulatory activities and capital investment plans, which are vital for the anticipated revenue and earnings growth. Despite recent stability in share price, analysts have set a price target of approximately US$109, slightly above the current share price of US$107.44, suggesting anticipation of modest growth in value. The leadership team's effectiveness in implementing AEP's growth strategies could thus impact both revenue forecasts and the achievement of these targets. As the company maneuvers through regulatory risks and capital requirements, the updated management structure might influence its ability to optimize earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English