The Bunker Buster Showdown: Boeing Built The Bomb, Northrop Built The Bomber—Which Stock Won Over The Past 10 Years?

As tensions flare in the Middle East, Aeronautics giant Boeing Co. (NYSE:BA) and defense contractor Northrop Grumman Corp. (NYSE:NOC) are sharing the headlines for one of the world’s most powerful conventional weapons.

What Happened: With President Donald Trump promising ‘a real end’ to Iran’s nuclear weapons program, and Israel already on the offensive over the past couple of days, defense experts, analysts, and the media are once again focused on Tehran’s fortified nuclear facilities at Fordow and Natanz.

Buried 80 to 110 meters underground, these facilities are impenetrable by conventional munitions, according to the Center for Strategic and International Studies.

The focus is now on the 30,000-pound GBU-57/B MOP (Massive Ordinance Penetrator), a precision-guided bomb made by Boeing, which can penetrate up to 200 feet of hardened concrete before detonation.

There is also only one aircraft that is capable of carrying this massive bomb deep into contested airspace undetected, and that is the B-2 Spirit bomber, made by Northrop Grumman.

Both stocks are benefiting from this renewed attention, but when it comes to shareholder returns, one has significantly outperformed the other over the past 10 years.

Northrop Grumman is up by a phenomenal 211%, significantly outperforming Boeing's 54% gain during the same period, as the latter wrestled with challenges pertaining to its Boeing 737 Max in recent years, followed by the COVID-19 pandemic.

So, if you had invested $1,000 in Northrop Grumman 10 years ago, it would now be worth $3,110, whereas the same with Boeing would now be worth $1,540. If you had invested $1,000 in an S&P 500 index fund, on the other hand, it would now be valued at $3,390, which means both the companies have trailed the market over the past 10 years.

Why It Matters: The crash of a Boeing Dreamliner in Ahmedabad last week brought a fresh set of troubles for Boeing, with the stock witnessing a pullback soon after the news.

The conflict between Iran and Israel, however, could be a likely tailwind for the company, along with several other defense stocks, which have been surging over the past week.

Price Action: Shares of Boeing were down 0.71% on Tuesday, trading at $200.26, with Northrop Grumman up 1.30%, at $503.97, and another 0.60% after hours.

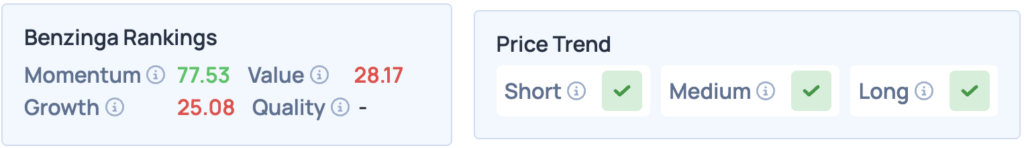

Boeing shares currently see strong momentum in Benzinga’s Edge Stock Rankings, ranked at the 77th percentile, with a favorable price trend in the short, medium, and long term. How does it compare with Northrop Grumman and its other peers and competitors? Click here to find out.

Read More:

Photo courtesy: Mike Mareen / Shutterstock.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English