Hangzhou SF Intra-city Industrial Co., Ltd.'s (HKG:9699) 62% Jump Shows Its Popularity With Investors

Despite an already strong run, Hangzhou SF Intra-city Industrial Co., Ltd. (HKG:9699) shares have been powering on, with a gain of 62% in the last thirty days. The last 30 days bring the annual gain to a very sharp 51%.

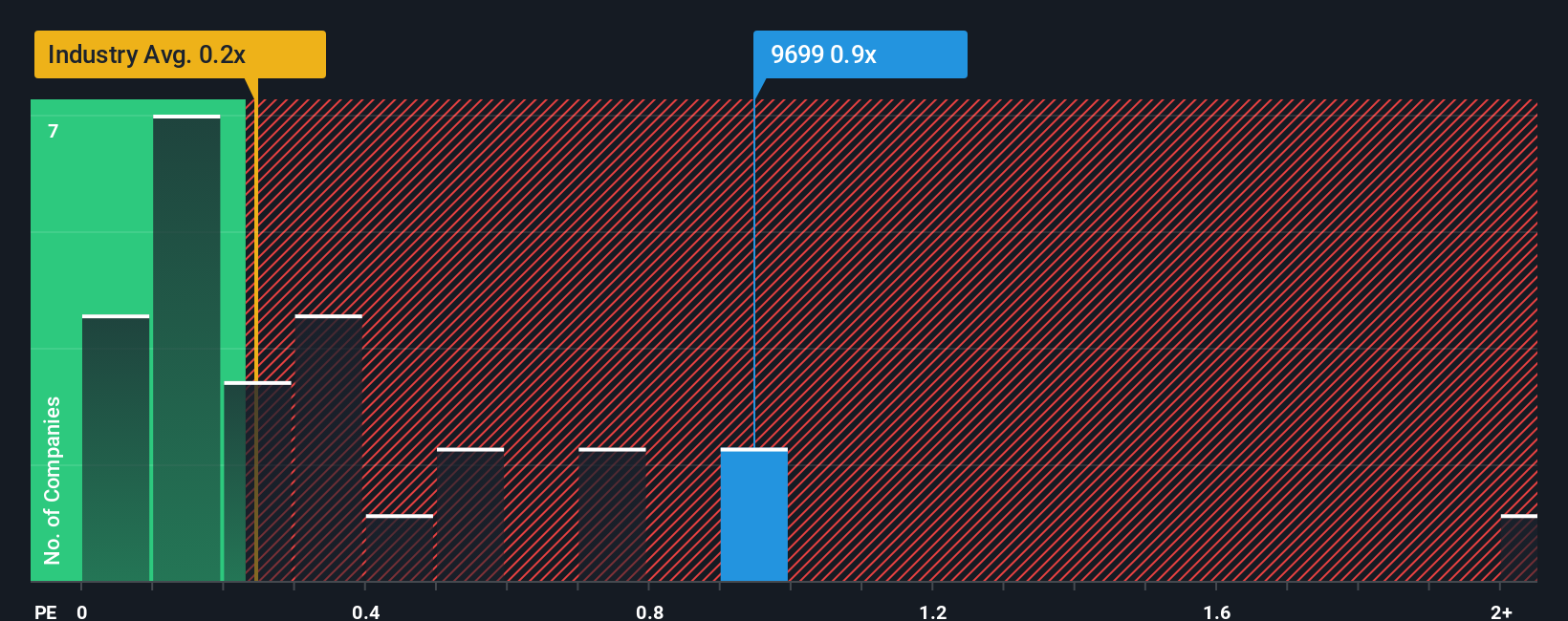

After such a large jump in price, you could be forgiven for thinking Hangzhou SF Intra-city Industrial is a stock not worth researching with a price-to-sales ratios (or "P/S") of 0.9x, considering almost half the companies in Hong Kong's Logistics industry have P/S ratios below 0.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Hangzhou SF Intra-city Industrial

What Does Hangzhou SF Intra-city Industrial's Recent Performance Look Like?

Recent times have been advantageous for Hangzhou SF Intra-city Industrial as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hangzhou SF Intra-city Industrial will help you uncover what's on the horizon.How Is Hangzhou SF Intra-city Industrial's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Hangzhou SF Intra-city Industrial's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. Pleasingly, revenue has also lifted 93% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 25% per annum over the next three years. That's shaping up to be materially higher than the 8.3% per year growth forecast for the broader industry.

With this information, we can see why Hangzhou SF Intra-city Industrial is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Hangzhou SF Intra-city Industrial's P/S

The large bounce in Hangzhou SF Intra-city Industrial's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hangzhou SF Intra-city Industrial maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Logistics industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about this 1 warning sign we've spotted with Hangzhou SF Intra-city Industrial.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English