3 Elite Growth Companies With Strong Insider Ownership

The United States market has remained flat over the past week but has shown a 10% increase over the past year, with earnings projected to grow by 15% annually. In this environment, companies that combine robust growth potential with strong insider ownership can be particularly attractive as insiders' significant stakes often align their interests closely with those of shareholders, potentially driving long-term value.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 120.2% |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| QT Imaging Holdings (QTIH) | 26.7% | 84.5% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

Let's take a closer look at a couple of our picks from the screened companies.

McEwen Mining (MUX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: McEwen Mining Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market cap of $510.72 million.

Operations: The company's revenue segments include $66.36 million from Canada and $102.26 million from the United States.

Insider Ownership: 15.7%

Revenue Growth Forecast: 18.8% p.a.

McEwen Mining, with significant insider ownership, is forecast to become profitable in three years, showcasing above-average market growth. Despite a recent net loss of US$6.27 million for Q1 2025, this marks an improvement from the previous year's loss. The company trades at 78.8% below its estimated fair value and expects revenue growth of 18.8% annually, outpacing the broader US market's growth rate of 8.7%. Recent promising drill results at Grey Fox enhance its exploration prospects.

- Unlock comprehensive insights into our analysis of McEwen Mining stock in this growth report.

- Upon reviewing our latest valuation report, McEwen Mining's share price might be too pessimistic.

Toast (TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry across the United States, Ireland, India, and internationally with a market cap of $24.61 billion.

Operations: The company generates revenue from its data processing segment, which amounts to $5.22 billion.

Insider Ownership: 19%

Revenue Growth Forecast: 15.4% p.a.

Toast demonstrates strong growth potential with high insider ownership, having recently become profitable. Its earnings are forecast to grow significantly at 31.9% annually, surpassing the US market's expected growth rate. Revenue is projected to increase by 15.4% per year, faster than the broader market but below 20%. Recent initiatives like the Menu Price Monitor and partnerships with Topgolf and Applebee's enhance its competitive edge in restaurant technology solutions, while strategic buybacks reflect confidence in future performance.

- Click here to discover the nuances of Toast with our detailed analytical future growth report.

- Our valuation report here indicates Toast may be overvalued.

XPeng (XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. is a company that designs, develops, manufactures, and markets smart electric vehicles in China with a market cap of approximately $17.69 billion.

Operations: The company's revenue primarily comes from its Auto Manufacturers segment, totaling CN¥50.13 billion.

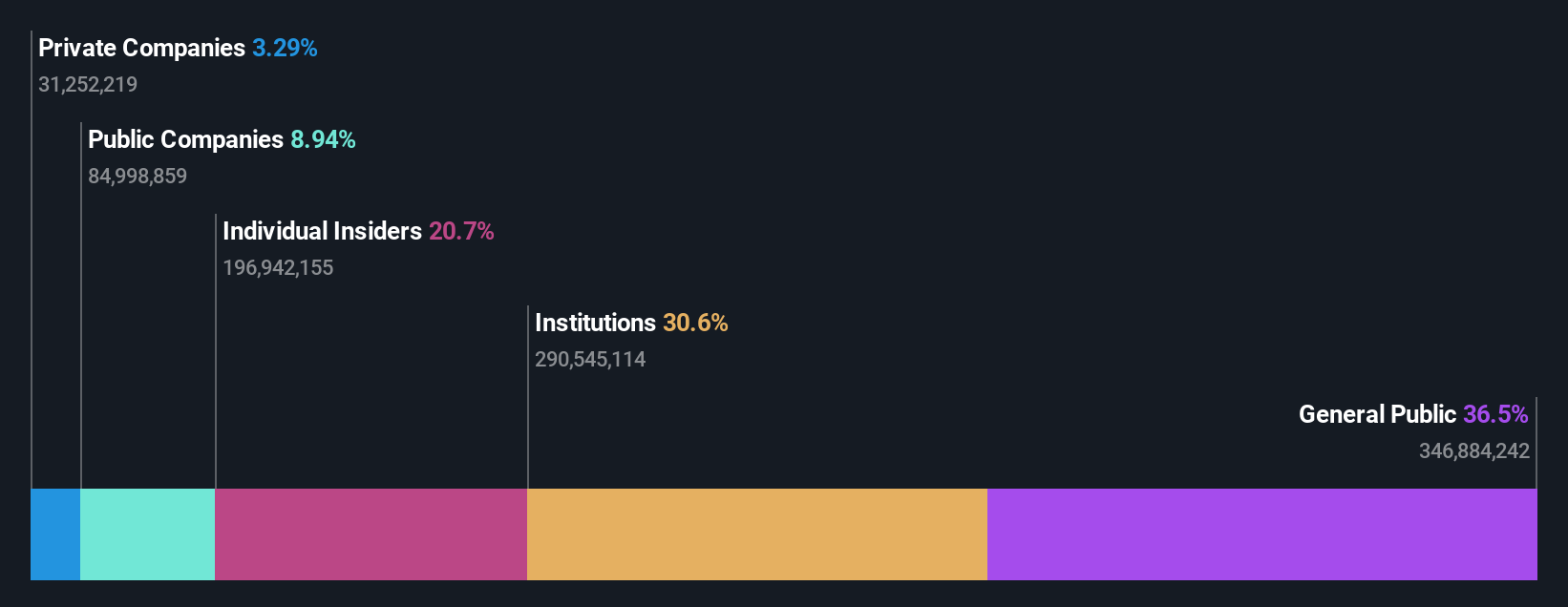

Insider Ownership: 20.7%

Revenue Growth Forecast: 23.9% p.a.

XPeng showcases robust growth potential with expected annual revenue growth of 23.9%, surpassing the US market average. The company is on track to become profitable in three years, driven by innovative product launches like the MONA M03 Max and AI advancements. Recent vehicle deliveries reached 162,578 units year-to-date, marking a significant increase from last year. XPeng's strategic expansion into global markets and its focus on cutting-edge technology bolster its competitive position in the EV industry.

- Click here and access our complete growth analysis report to understand the dynamics of XPeng.

- In light of our recent valuation report, it seems possible that XPeng is trading beyond its estimated value.

Where To Now?

- Gain an insight into the universe of 192 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English