The Palantir Effect: Momentum Stocks Are Making A Killing Like Never Before

Momentum traders are enjoying their best stretch in over a decade, with the strategy's flagship fund outpacing the broader U.S. market by the widest margin since records began — and it's a selective basket of stocks, led by Palantir Technologies Inc. (NASDAQ:PLTR), doing all the heavy lifting.

Momentum Strategy Crushes S&P 500

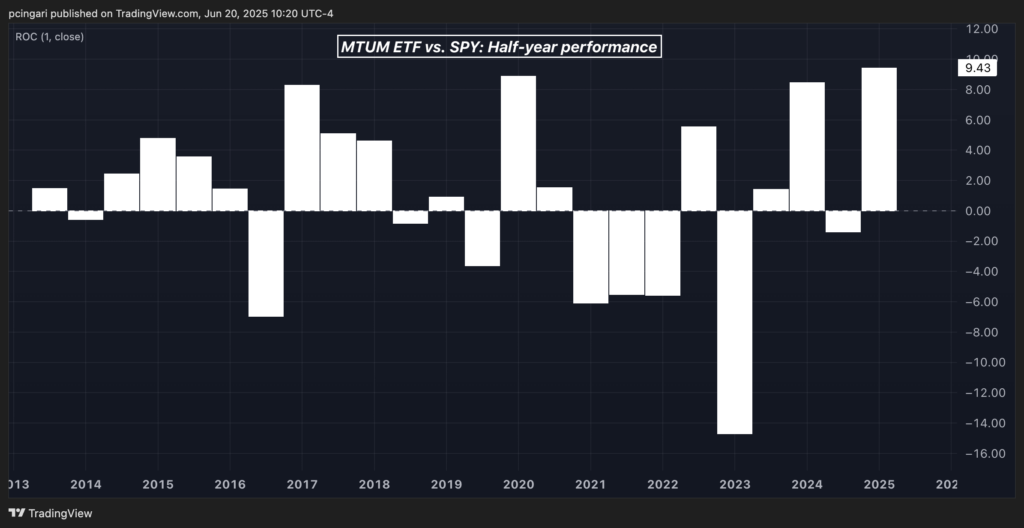

The iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) is up 11.4% year-to-date through June, versus a modest 2% gain for the S&P 500 ETF Trust (NYSE:SPY).

That nine percentage point lead marks the largest six-month outperformance since MTUM's launch in 2013.

While the absolute performance is below the first half of 2024 — when the AI-fueled rally sent momentum stocks soaring 25% — the relative gap is now wider, as the broader market cooled following U.S. trade tensions and rate uncertainty.

MTUM targets large- and mid-cap U.S. stocks showing strong recent price momentum, adjusting exposure semi-annually to overweight leaders and cut laggards.

The momentum style has clearly paid off in 2025.

Five Stocks Are Driving The Momentum Rally – And Weighting Is The Key

Five stocks are powering the momentum’s outperformance in 2025, thanks to both strong returns and significantly higher weightings than in the S&P 500.

- Palantir Technologies has surged 83.4% year-to-date and carries a 3.72% weight in MTUM ETF versus just 0.6% in the SPY.

- Netflix Inc. (NASDAQ:NFLX) is up 38.7% with a 4.88% weight, more than quadruple its 1.03% allocation in the SPY.

- Philip Morris International Inc. (NYSE:PM) has climbed 53.1%, with a 3.25% momentum weight compared to just 0.56% in the broader SPY.

- Meta Platforms Inc. (NASDAQ:META), up 18%, holds a 5.2% position in MTUM versus 3% in the SPY.

- GE Vernova Inc. (NYSE:GEV), up 47.5%, has a 2.13% weight in the momentum ETF, far above its 0.3% SPY weighting.

Together, these five names account for roughly 6.6 percentage points — or over half — of the MTUM's year-to-date return.

| Stock Name | YTD Return | MTUM Weight | SPY Weight | MTUM Contribution | SPY Contribution |

|---|---|---|---|---|---|

| Palantir Technologies Inc. | +83.4% | 3.72% | 0.6% | +197 bps | +26 bps |

| Netflix Inc. | +38.7% | 4.88% | 1.03% | +158 bps | +29 bps |

| Philip Morris International | +53.1% | 3.25% | 0.56% | +131 bps | +20 bps |

| Meta Platforms Inc. | +18.0% | 5.20% | 3.0% | +92 bps | +47 bps |

| GE Vernova Inc. | +47.5% | 2.13% | 0.3% | +80 bps | +9 bps |

| Cumulative Contribution | — | — | — | +658 bps | +131 bps |

Read Now:

- This Rare Market Dynamic Preceded The Dot-Com Crash — It’s Back In 2025

Photo: Shutterstock

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English