It Looks Like The CEO Of Central New Energy Holding Group Limited (HKG:1735) May Be Underpaid Compared To Peers

Key Insights

- Central New Energy Holding Group to hold its Annual General Meeting on 27th of June

- Total pay for CEO Zhuyun Yu includes HK$645.0k salary

- Total compensation is 83% below industry average

- Over the past three years, Central New Energy Holding Group's EPS grew by 20% and over the past three years, the total shareholder return was 101%

The solid performance at Central New Energy Holding Group Limited (HKG:1735) has been impressive and shareholders will probably be pleased to know that CEO Zhuyun Yu has delivered. At the upcoming AGM on 27th of June, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

Check out our latest analysis for Central New Energy Holding Group

How Does Total Compensation For Zhuyun Yu Compare With Other Companies In The Industry?

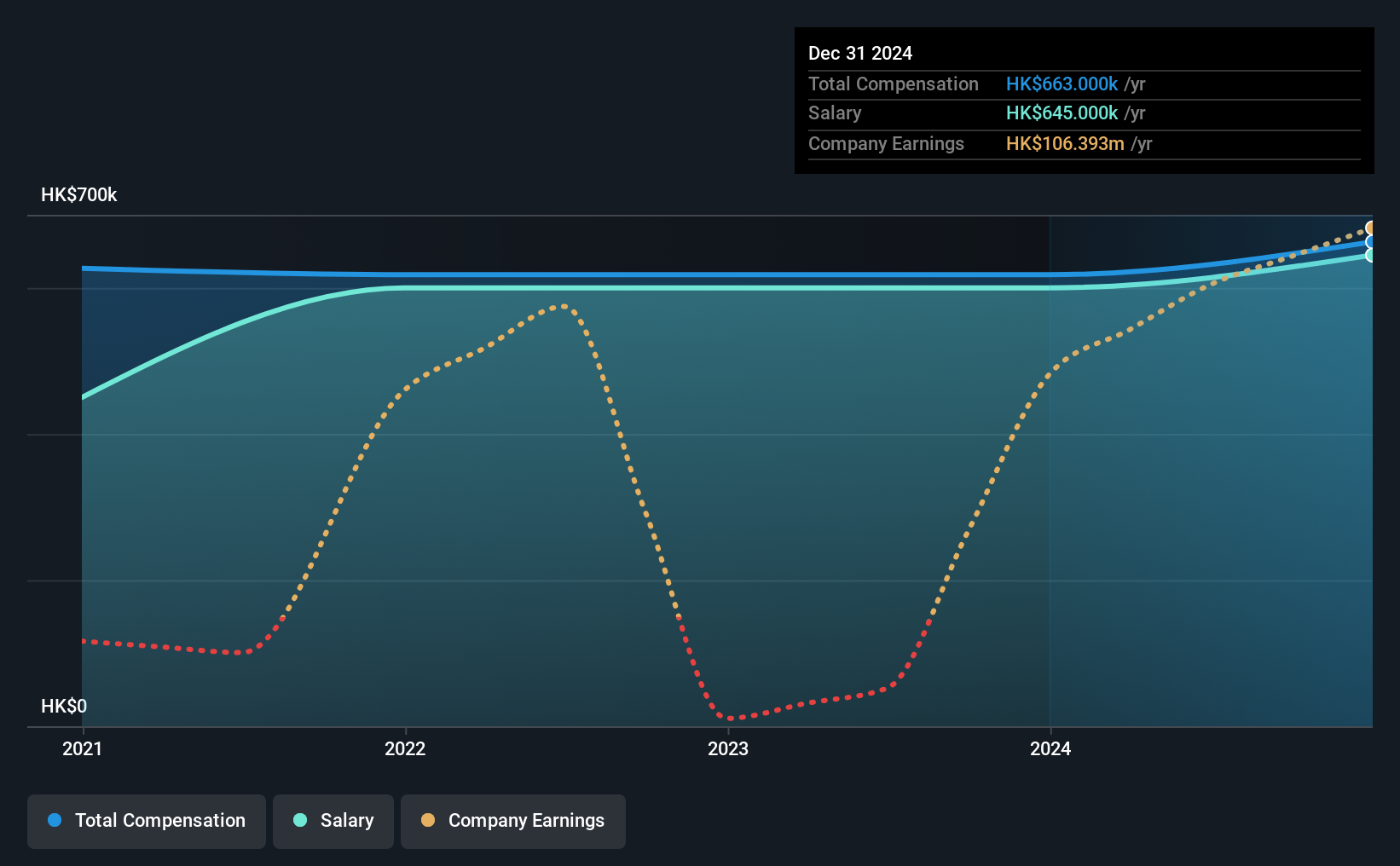

Our data indicates that Central New Energy Holding Group Limited has a market capitalization of HK$35b, and total annual CEO compensation was reported as HK$663k for the year to December 2024. That's just a smallish increase of 7.3% on last year. In particular, the salary of HK$645.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Hong Kong Construction industry with market capitalizations between HK$16b and HK$50b, we discovered that the median CEO total compensation of that group was HK$3.8m. This suggests that Zhuyun Yu is paid below the industry median. Furthermore, Zhuyun Yu directly owns HK$24b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$645k | HK$600k | 97% |

| Other | HK$18k | HK$18k | 3% |

| Total Compensation | HK$663k | HK$618k | 100% |

Speaking on an industry level, nearly 85% of total compensation represents salary, while the remainder of 15% is other remuneration. Central New Energy Holding Group is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Central New Energy Holding Group Limited's Growth Numbers

Over the past three years, Central New Energy Holding Group Limited has seen its earnings per share (EPS) grow by 20% per year. It achieved revenue growth of 50% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Central New Energy Holding Group Limited Been A Good Investment?

We think that the total shareholder return of 101%, over three years, would leave most Central New Energy Holding Group Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Zhuyun receives almost all of their compensation through a salary. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Central New Energy Holding Group that you should be aware of before investing.

Switching gears from Central New Energy Holding Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English