Strong week for ZhongAn Online P & C Insurance (HKG:6060) shareholders doesn't alleviate pain of five-year loss

This month, we saw the ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060) up an impressive 54%. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 50%, which falls well short of the return you could get by buying an index fund.

While the stock has risen 4.8% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, ZhongAn Online P & C Insurance moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

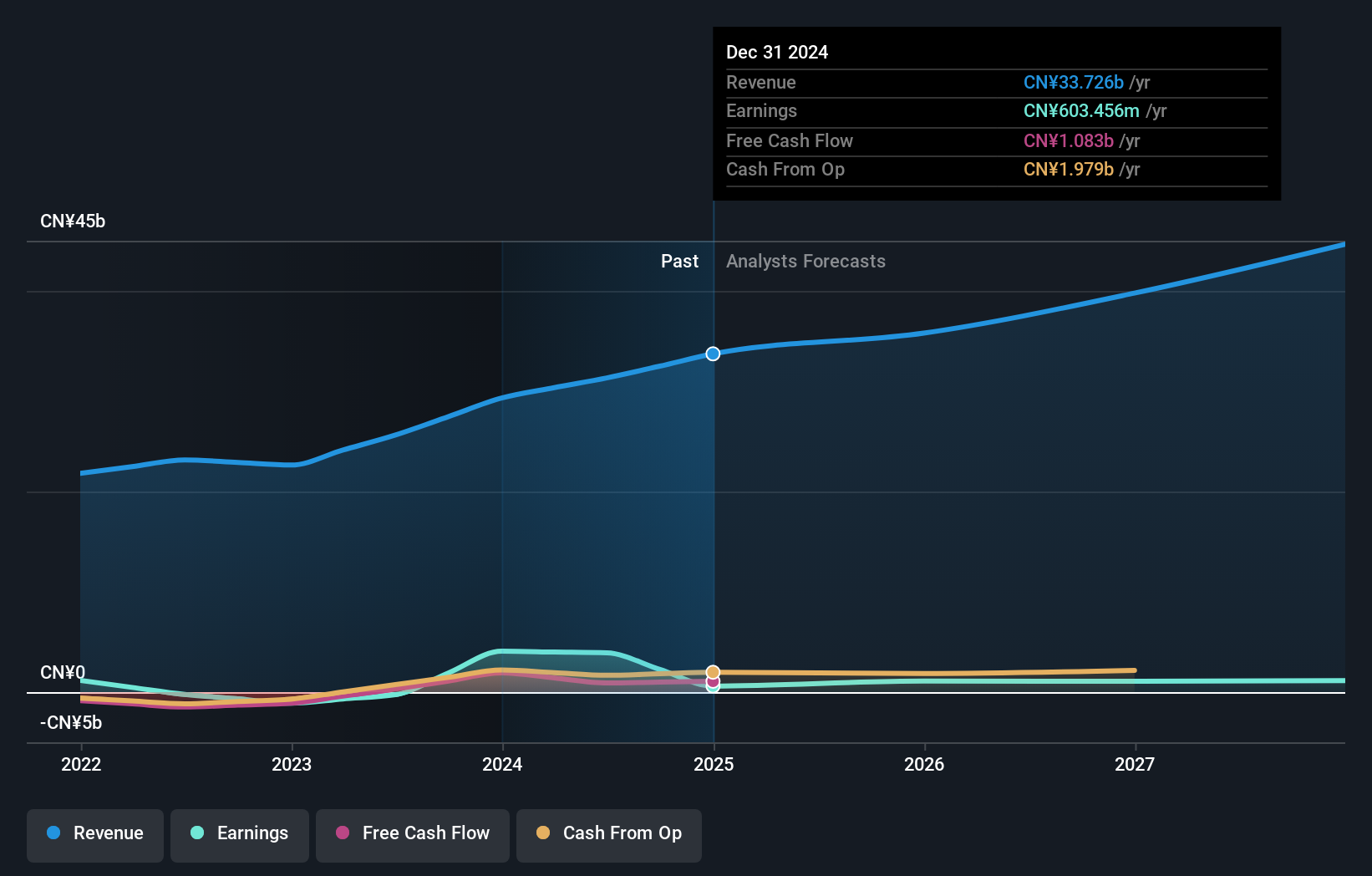

In contrast to the share price, revenue has actually increased by 15% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

ZhongAn Online P & C Insurance is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

ZhongAn Online P & C Insurance's TSR for the year was broadly in line with the market average, at 32%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 8% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for ZhongAn Online P & C Insurance that you should be aware of.

Of course ZhongAn Online P & C Insurance may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English