SIGN UP

LOG IN

This Hilton Worldwide Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Monday

Benzinga·06/23/2025 12:26:21

Listen to the news

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Chardan Capital analyst Keay Nakae initiated coverage on Monopar Therapeutics Inc. (NASDAQ:MNPR) with a Buy rating and announced a price target of $60. Monopar Therapeutics shares closed at $32.86 on Friday. See how other analysts view this stock.

- JP Morgan analyst Daniel Politzer initiated coverage on Choice Hotels International, Inc. (NYSE:CHH) with an Underweight rating and announced a price target of $124. Choice Hotels shares closed at $122.90 on Friday. See how other analysts view this stock.

- HC Wainwright & Co. analyst Raghuram Selvaraju initiated coverage on Septerna, Inc. (NASDAQ:SEPN) with a Buy rating and announced a price target of $26. Septerna shares closed at $10.47 on Friday. See how other analysts view this stock.

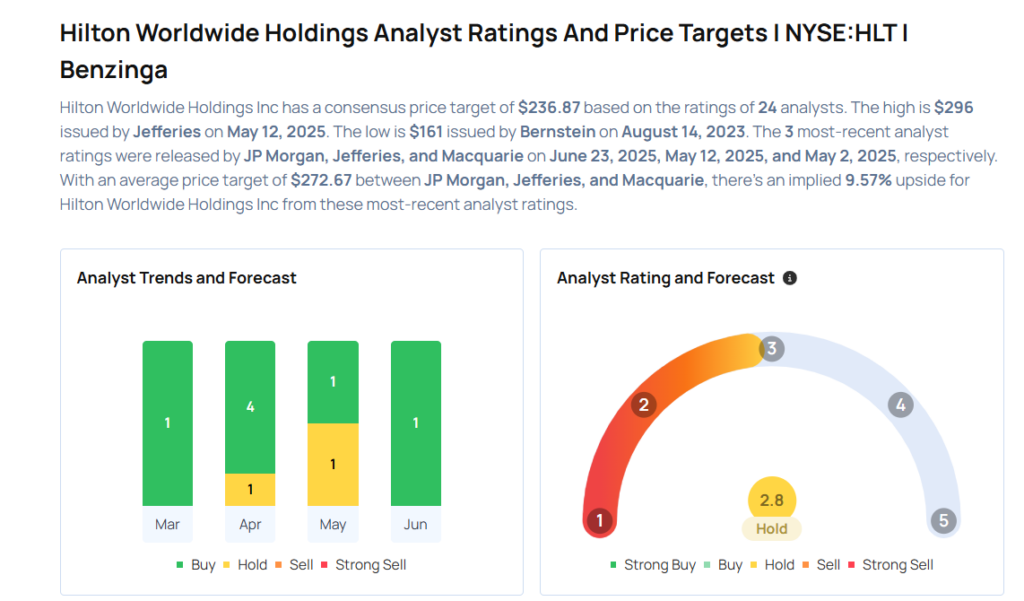

- JP Morgan analyst Daniel Politzer initiated coverage on Hilton Worldwide Holdings Inc. (NYSE:HLT) with an Overweight rating and announced a price target of $282. Hilton Worldwide shares closed at $248.86 on Friday. See how other analysts view this stock.

- JP Morgan analyst Daniel Politzer initiated coverage on Host Hotels & Resorts, Inc. (NASDAQ:HST) with a Neutral rating and announced a price target of $16. Host Hotels & Resorts shares closed at $15.67 on Friday. See how other analysts view this stock.

Considering buying HLT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Risk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.