US Market's Top 3 Undiscovered Gems with Strong Fundamentals

In the last week, the United States market has been flat, but it has risen by 10.0% over the past year with earnings forecasted to grow by 15% annually. In this environment, stocks with strong fundamentals that remain under the radar can offer unique opportunities for investors seeking potential growth and stability.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

PrimeEnergy Resources (PNRG)

Simply Wall St Value Rating: ★★★★☆☆

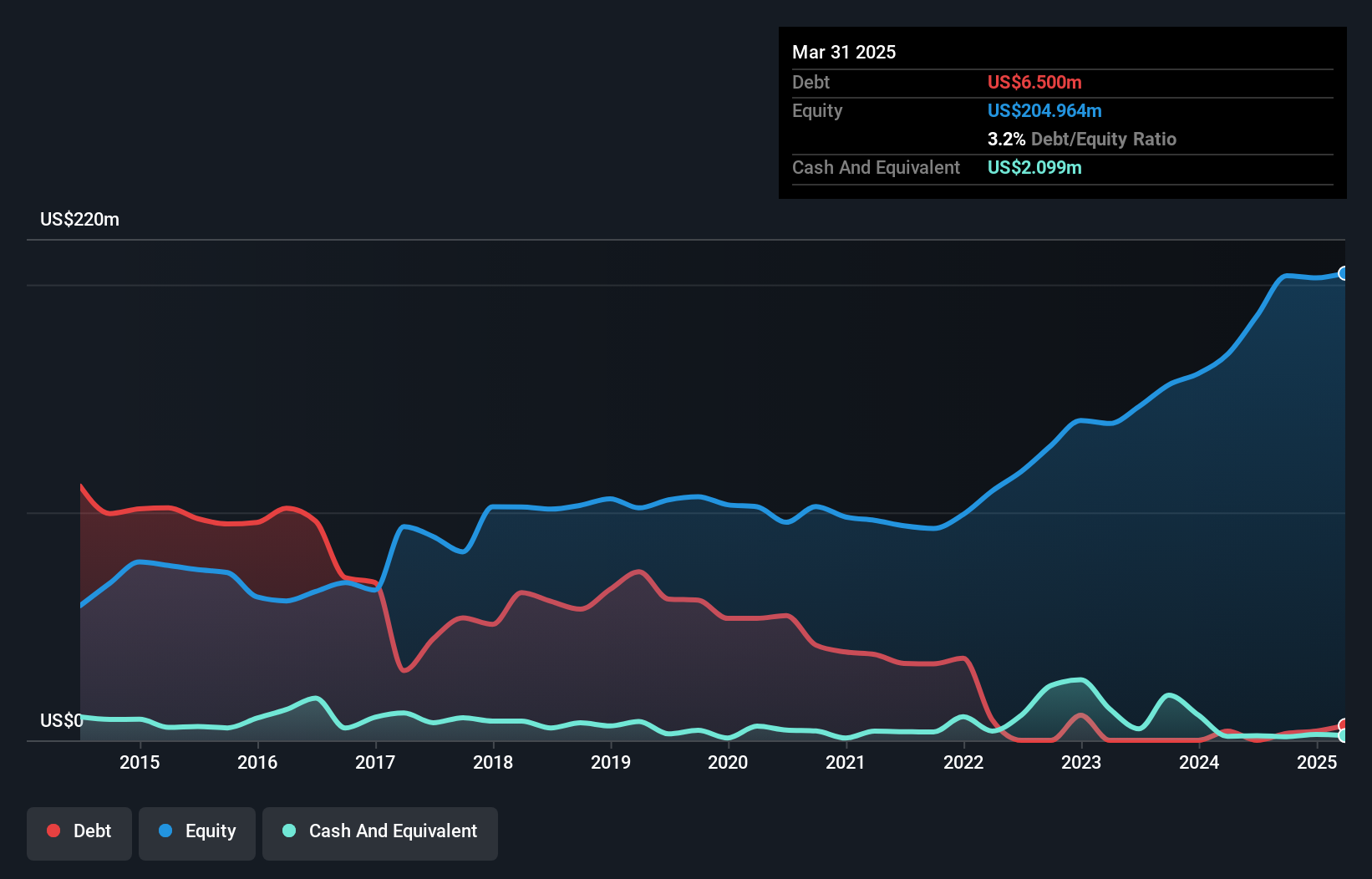

Overview: PrimeEnergy Resources Corporation focuses on the acquisition, development, and production of oil and natural gas properties in the United States, with a market capitalization of approximately $254.57 million.

Operations: PrimeEnergy Resources generates revenue primarily from oil and gas exploration, development, operation, and servicing, amounting to $240.96 million.

PrimeEnergy Resources, a nimble player in the energy sector, has shown impressive growth with earnings surging 40% over the past year, outpacing the industry average. Its net debt to equity ratio stands at a mere 2.1%, reflecting prudent financial management as it shrank from 52.2% over five years. The company boasts a price-to-earnings ratio of 4.8x, well below the US market average of 17.7x, suggesting potential undervaluation. Recent production results revealed significant increases in oil and gas output for Q1 2025 compared to last year, though net income dipped slightly to US$9.13 million from US$11.32 million previously.

- Get an in-depth perspective on PrimeEnergy Resources' performance by reading our health report here.

Third Coast Bancshares (TCBX)

Simply Wall St Value Rating: ★★★★★★

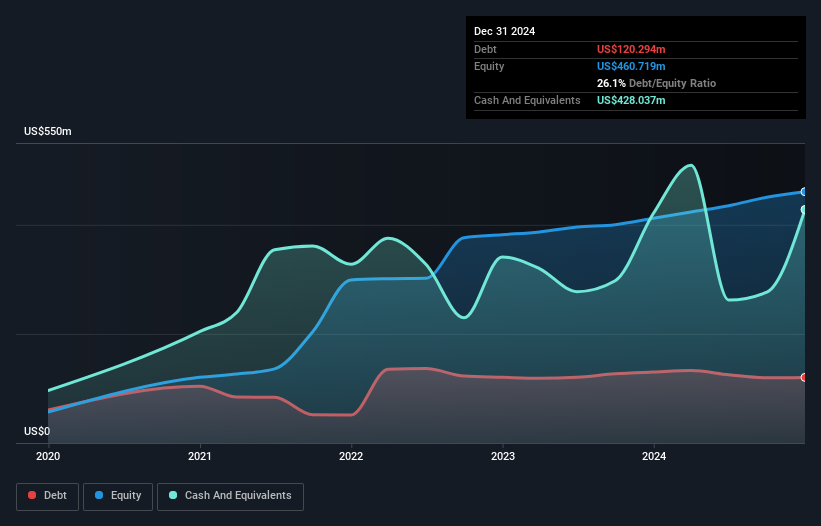

Overview: Third Coast Bancshares, Inc. is a bank holding company for Third Coast Bank, offering a range of commercial banking services to small and medium-sized businesses and professionals in the United States, with a market capitalization of $424.54 million.

Operations: Third Coast Bancshares generates revenue primarily through its community banking segment, totaling $172.27 million.

Third Coast Bancshares, with assets totaling US$4.9 billion and equity of US$479.8 million, stands out for its robust financial health. The bank's deposits amount to US$4.2 billion, while loans are at US$3.9 billion, supported by a solid net interest margin of 3.7%. Its allowance for bad loans is more than adequate at 218%, with non-performing loans kept low at 0.5%. Recent strategic moves include a share repurchase program up to $30 million and securitization efforts poised to boost balance sheet flexibility and earnings potential despite challenges like rising expenses and regional market reliance in Texas.

Sila Realty Trust (SILA)

Simply Wall St Value Rating: ★★★★★☆

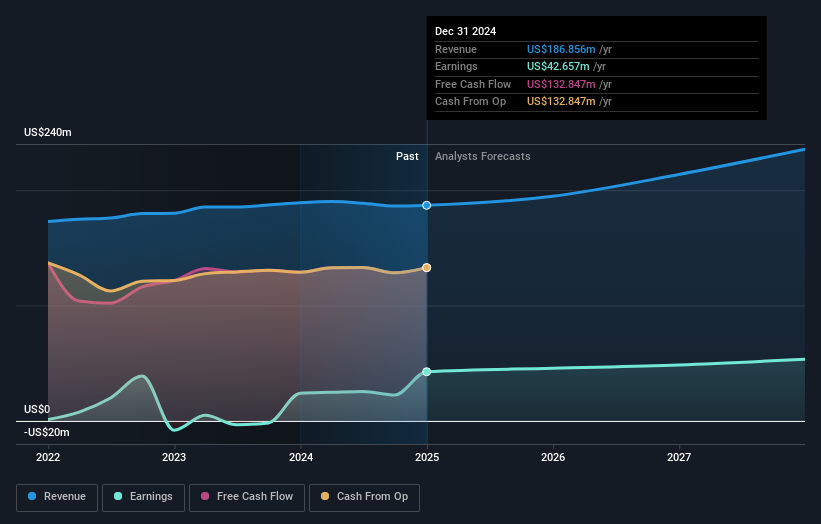

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, operates as a net lease real estate investment trust with a strategic emphasis on the healthcare sector and has a market cap of approximately $1.34 billion.

Operations: Sila Realty Trust generates revenue primarily from commercial real estate investments in the healthcare sector, amounting to $184.47 million.

Sila Realty Trust, a healthcare-focused net lease REIT based in Tampa, has strengthened its financial footing by extending long-term leases with key tenants. Over the past five years, its debt to equity ratio improved from 87.2% to 40.2%, reflecting prudent debt management, while earnings have grown at an impressive 47.6% annually. Despite trading at $25.64 per share—below the consensus target of $28—the company faces risks such as tenant bankruptcies and rising interest costs impacting profitability; however, it remains a solid player in its sector with high-quality earnings and satisfactory interest coverage of 3.1x EBIT on debts.

Turning Ideas Into Actions

- Dive into all 284 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English