Ginkgo Bioworks Holdings, Inc.'s (NYSE:DNA) 31% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) shares have been powering on, with a gain of 31% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

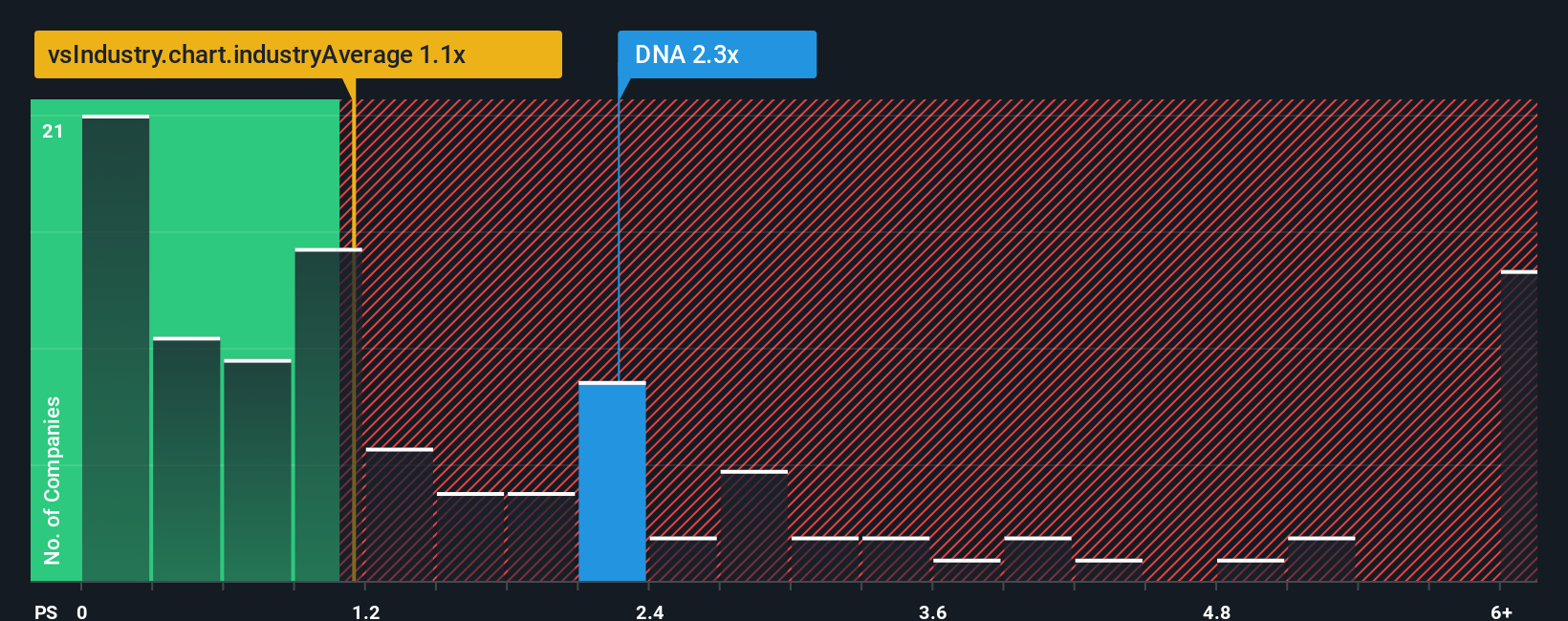

Following the firm bounce in price, given close to half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Ginkgo Bioworks Holdings as a stock to potentially avoid with its 2.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Ginkgo Bioworks Holdings

What Does Ginkgo Bioworks Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Ginkgo Bioworks Holdings has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Ginkgo Bioworks Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Ginkgo Bioworks Holdings?

Ginkgo Bioworks Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 46% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 22% as estimated by the five analysts watching the company. That's not great when the rest of the industry is expected to grow by 2.8%.

With this in mind, we find it intriguing that Ginkgo Bioworks Holdings' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in Ginkgo Bioworks Holdings' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ginkgo Bioworks Holdings currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 2 warning signs we've spotted with Ginkgo Bioworks Holdings.

If you're unsure about the strength of Ginkgo Bioworks Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English