LifeStance Health Group (NASDAQ:LFST) Is Carrying A Fair Bit Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, LifeStance Health Group, Inc. (NASDAQ:LFST) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does LifeStance Health Group Carry?

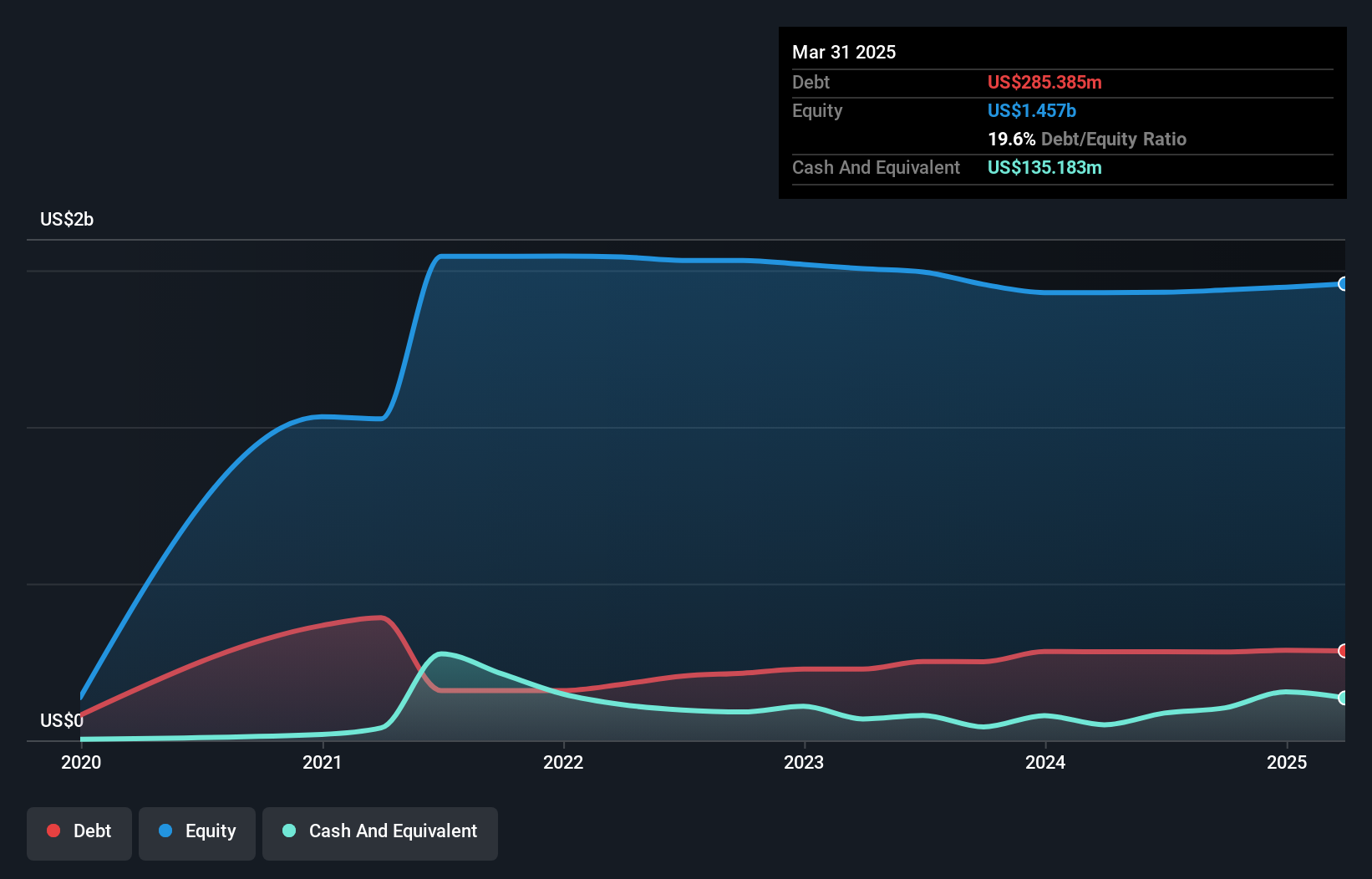

The chart below, which you can click on for greater detail, shows that LifeStance Health Group had US$285.4m in debt in March 2025; about the same as the year before. However, it does have US$135.2m in cash offsetting this, leading to net debt of about US$150.2m.

How Strong Is LifeStance Health Group's Balance Sheet?

The latest balance sheet data shows that LifeStance Health Group had liabilities of US$207.4m due within a year, and liabilities of US$440.2m falling due after that. Offsetting these obligations, it had cash of US$135.2m as well as receivables valued at US$140.4m due within 12 months. So its liabilities total US$372.0m more than the combination of its cash and short-term receivables.

Of course, LifeStance Health Group has a market capitalization of US$1.98b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if LifeStance Health Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Check out our latest analysis for LifeStance Health Group

In the last year LifeStance Health Group wasn't profitable at an EBIT level, but managed to grow its revenue by 16%, to US$1.3b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, LifeStance Health Group had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost US$11m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of US$36m into a profit. In the meantime, we consider the stock very risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting LifeStance Health Group insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English