Pfizer (NYSE:PFE) Announces Positive Results For Hemophilia Treatment And Declares $0.43 Dividend

Pfizer (NYSE:PFE) recently announced positive topline results from its Phase 3 BASIS study for HYMPAVZI™ and declared a third-quarter 2025 dividend of $0.43 per share. Alongside these developments, the company reported various clinical trial updates and strategic agreements. Over the last month, Pfizer's share price rose by 4%, slightly outperforming the broader market's 1.7% increase in the past week. These advances, along with sustained dividend distribution, likely reinforced investor confidence and offered added weight to the positive market trends, reflecting the company’s ongoing drive in innovation and shareholder value.

Every company has risks, and we've spotted 3 possible red flags for Pfizer you should know about.

The recent positive outcomes from Pfizer's Phase 3 BASIS study for HYMPAVZI™ and the declaration of a third-quarter 2025 dividend could strengthen the company's market position and bolster investor confidence. These developments have led to a short-term share price increase of 4%. This is a favorable outcome considering the company's broader challenges in maintaining revenue growth amidst increased competition and changing drug utilization patterns. Over the past five years, however, Pfizer's total shareholder return, including share price and dividends, was a 4.54% decline, contrasting with its recent gains.

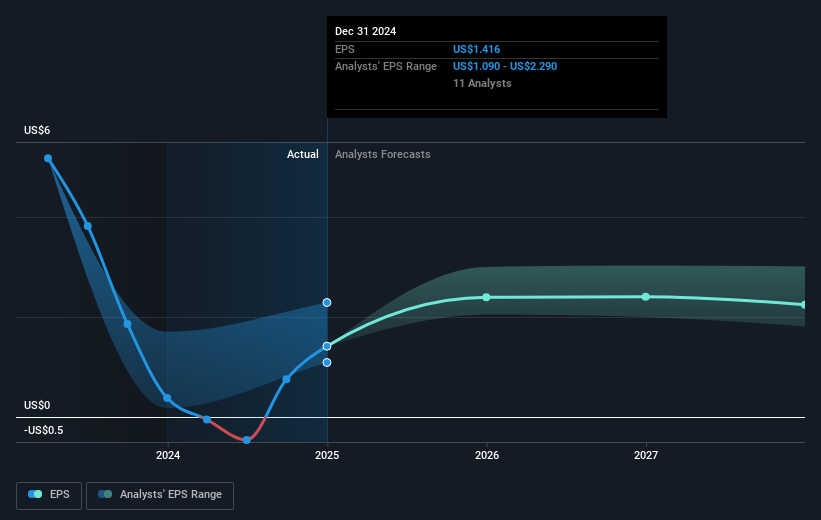

In the past year, Pfizer's share price performance has aligned with the US Pharmaceuticals industry's 10.7% decrease, indicating broader industry pressures. Despite the near-term boost, there remains uncertainty regarding the long-term revenue impact, especially with products like Vyndaqel and Paxlovid facing headwinds. The earnings forecasts similarly reflect cautious optimism, with analysts predicting growth but with slower annual profit growth of 7.2% compared to the broader US market's 14.7%.

The current share price of $24.41 remains close to the bearish analyst price target of $24.57, suggesting a consensus that the company is fairly valued relative to anticipated performance. With future catalysts and potential macroeconomic challenges, the company's ability to exceed these projections and impact its long-term valuation trajectory will depend heavily on its strategic execution and market dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English