TMC The Metals (NasdaqGS:TMC) Stock Surges 341% Over Last Quarter

TMC the metals (NasdaqGS:TMC) recently appointed Michael Hess and Alex Spiro to its Board of Directors, aiming to bolster the company's leadership. In parallel, TMC entered a significant Securities Purchase Agreement with Korea Zinc, issuing shares and accompanying warrants. These pivotal developments, alongside the approval of Ernst & Young as their independent auditor, may have supported TMC's impressive share price increase of 341% over the last quarter, far outperforming the market's 1.7% weekly rise and 12% annual increase. The company's proactive financial and governance strategies likely resonated positively with investors, contributing to its robust stock performance.

Over the past three years, TMC The Metals Company Inc. achieved an impressive total return of 649%, markedly surpassing broader market trends. In the past year alone, the company's shares exceeded both the US market's 12% and the Metals and Mining industry's 8.5% returns. This strong performance highlights investor confidence amidst a challenging industry landscape.

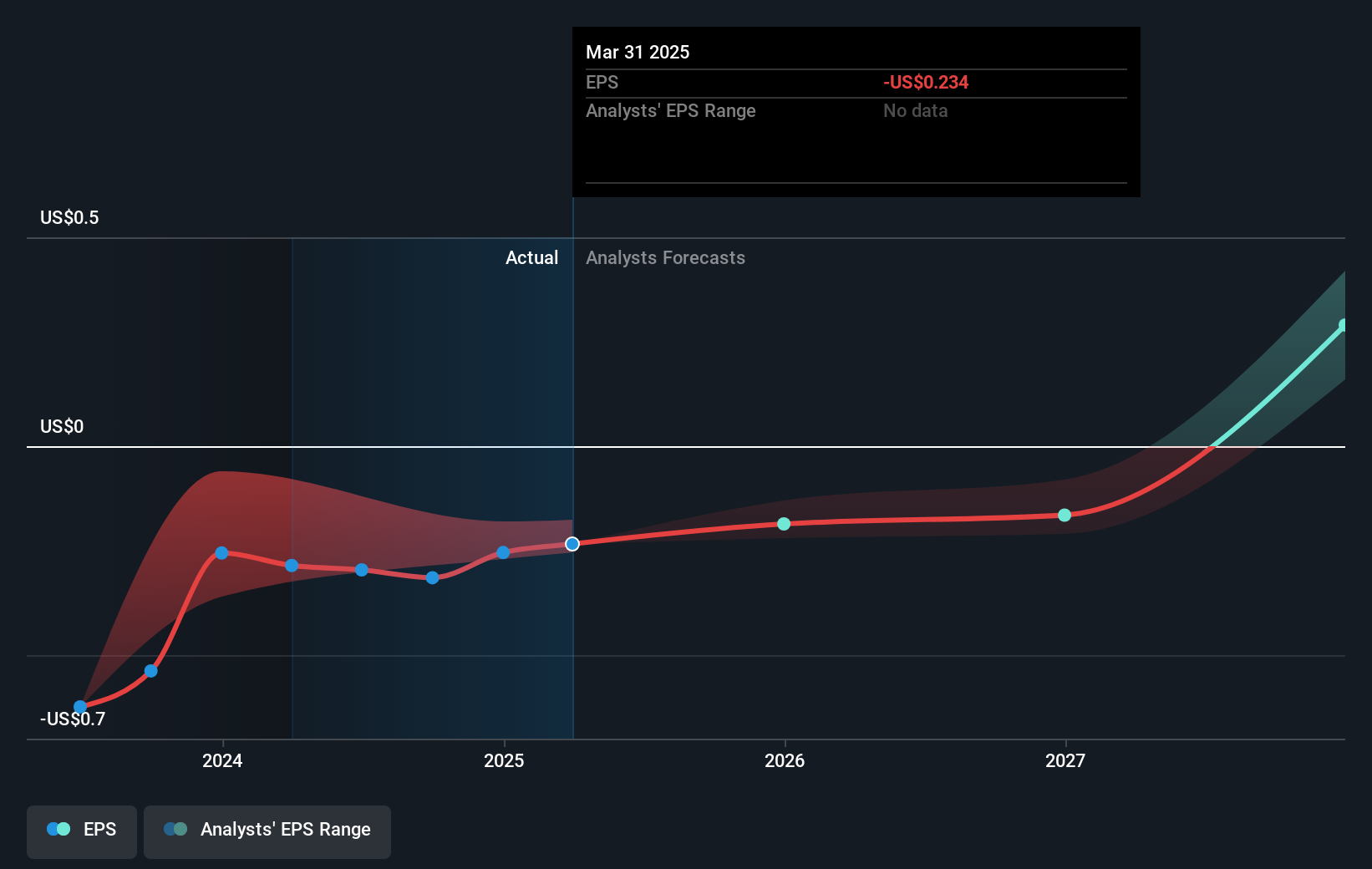

The strategic moves mentioned earlier, including key board appointments and partnerships, suggest potential positive effects on TMC's future earnings forecasts, despite its current revenue standing at zero. The issuance of new shares, combined with strategic partnerships, could bolster TMC's future revenue opportunities. However, the recent stock price increase places TMC's trading value at approximately 14.2% below its consensus analyst price target of US$8.85, indicating potential further upside. Investors should weigh these developments as TMC works toward achieving profitability within the projected period.

Evaluate TMC the metals' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English