Deep Dive Into FactSet Research Systems Stock: Analyst Perspectives (6 Ratings)

Throughout the last three months, 6 analysts have evaluated FactSet Research Systems (NYSE:FDS), offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 2 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 4 | 2 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

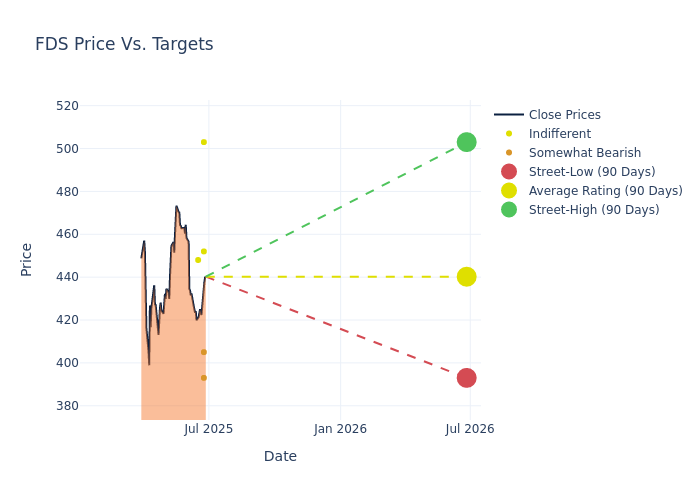

Insights from analysts' 12-month price targets are revealed, presenting an average target of $450.67, a high estimate of $503.00, and a low estimate of $393.00. Highlighting a 0.44% decrease, the current average has fallen from the previous average price target of $452.67.

Interpreting Analyst Ratings: A Closer Look

The perception of FactSet Research Systems by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Silber | BMO Capital | Raises | Market Perform | $452.00 | $448.00 |

| Ashish Sabadra | RBC Capital | Maintains | Sector Perform | $503.00 | $503.00 |

| Jason Haas | Wells Fargo | Raises | Underweight | $405.00 | $402.00 |

| Toni Kaplan | Morgan Stanley | Raises | Underweight | $393.00 | $390.00 |

| David Motemeden | Evercore ISI Group | Lowers | In-Line | $448.00 | $470.00 |

| Ashish Sabadra | RBC Capital | Maintains | Sector Perform | $503.00 | $503.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to FactSet Research Systems. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of FactSet Research Systems compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of FactSet Research Systems's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on FactSet Research Systems analyst ratings.

Unveiling the Story Behind FactSet Research Systems

FactSet provides financial data and portfolio analytics to the global investment community. The company aggregates data from third-party data suppliers, news sources, exchanges, brokerages, and contributors into its workstations. In addition, it provides essential portfolio analytics that companies use to monitor portfolios and address reporting requirements. Buy-side clients (including wealth and corporate clients) account for roughly 82% of FactSet's annual subscription value. In 2015, the company acquired Portware, a provider of trade execution software. In 2017, it acquired BISAM, a risk management and performance measurement provider. In 2022, it completed its purchase of CUSIP Global Services.

A Deep Dive into FactSet Research Systems's Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: FactSet Research Systems's revenue growth over a period of 3M has been noteworthy. As of 31 May, 2025, the company achieved a revenue growth rate of approximately 2.6%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: FactSet Research Systems's net margin excels beyond industry benchmarks, reaching 25.37%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.05%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): FactSet Research Systems's ROA excels beyond industry benchmarks, reaching 3.46%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.75.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English