11 Analysts Have This To Say About Murphy Oil

11 analysts have shared their evaluations of Murphy Oil (NYSE:MUR) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 6 | 3 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 3 | 2 | 0 |

| 3M Ago | 0 | 1 | 2 | 1 | 0 |

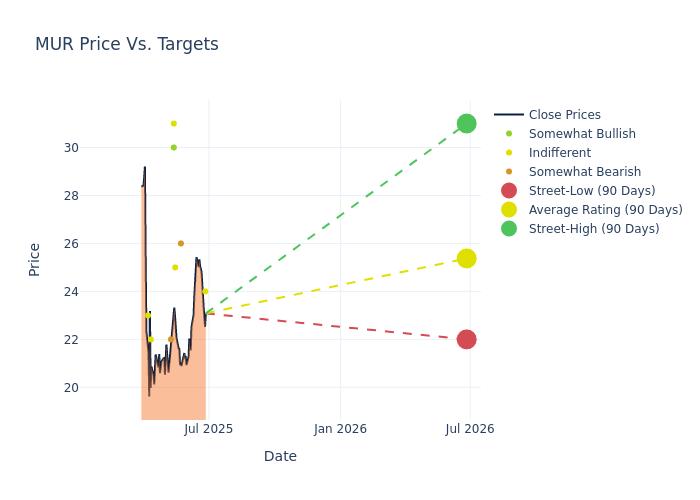

The 12-month price targets, analyzed by analysts, offer insights with an average target of $26.18, a high estimate of $35.00, and a low estimate of $22.00. A decline of 13.25% from the prior average price target is evident in the current average.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Murphy Oil among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Roger Read | Wells Fargo | Lowers | Equal-Weight | $24.00 | $26.00 |

| Devin McDermott | Morgan Stanley | Lowers | Underweight | $26.00 | $27.00 |

| Leo Mariani | Roth Capital | Lowers | Neutral | $25.00 | $27.00 |

| Roger Read | Wells Fargo | Lowers | Equal-Weight | $26.00 | $31.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $30.00 | $35.00 |

| William Janela | Mizuho | Lowers | Neutral | $31.00 | $32.00 |

| Betty Jiang | Barclays | Lowers | Underweight | $22.00 | $24.00 |

| Betty Jiang | Barclays | Lowers | Underweight | $24.00 | $32.00 |

| Mark Lear | Piper Sandler | Raises | Overweight | $35.00 | $34.00 |

| Paul Cheng | Scotiabank | Lowers | Sector Perform | $22.00 | $36.00 |

| Josh Silverstein | UBS | Lowers | Neutral | $23.00 | $28.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Murphy Oil. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Murphy Oil compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Murphy Oil's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Murphy Oil's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Murphy Oil analyst ratings.

About Murphy Oil

Murphy Oil Corp is an oil and gas exploration and production company, with both onshore and offshore operations and properties. It operates in two geographic reportable segments the United States and Canada. It generates the majority of its revenue form the United States.

Murphy Oil: A Financial Overview

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Negative Revenue Trend: Examining Murphy Oil's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -15.36% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Murphy Oil's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.86% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Murphy Oil's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.42%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Murphy Oil's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.75%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.43, Murphy Oil adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English