Asian Growth Stocks With Insider Ownership And 48% Earnings Growth

Amidst a backdrop of mixed global economic signals and regional market fluctuations, Asian markets have shown resilience, with Japan's indices registering gains and China's economy displaying solid growth indicators despite some sectoral challenges. In this environment, identifying growth companies with high insider ownership can be appealing as they often signal confidence from those closest to the business, particularly when these companies are achieving impressive earnings growth rates.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

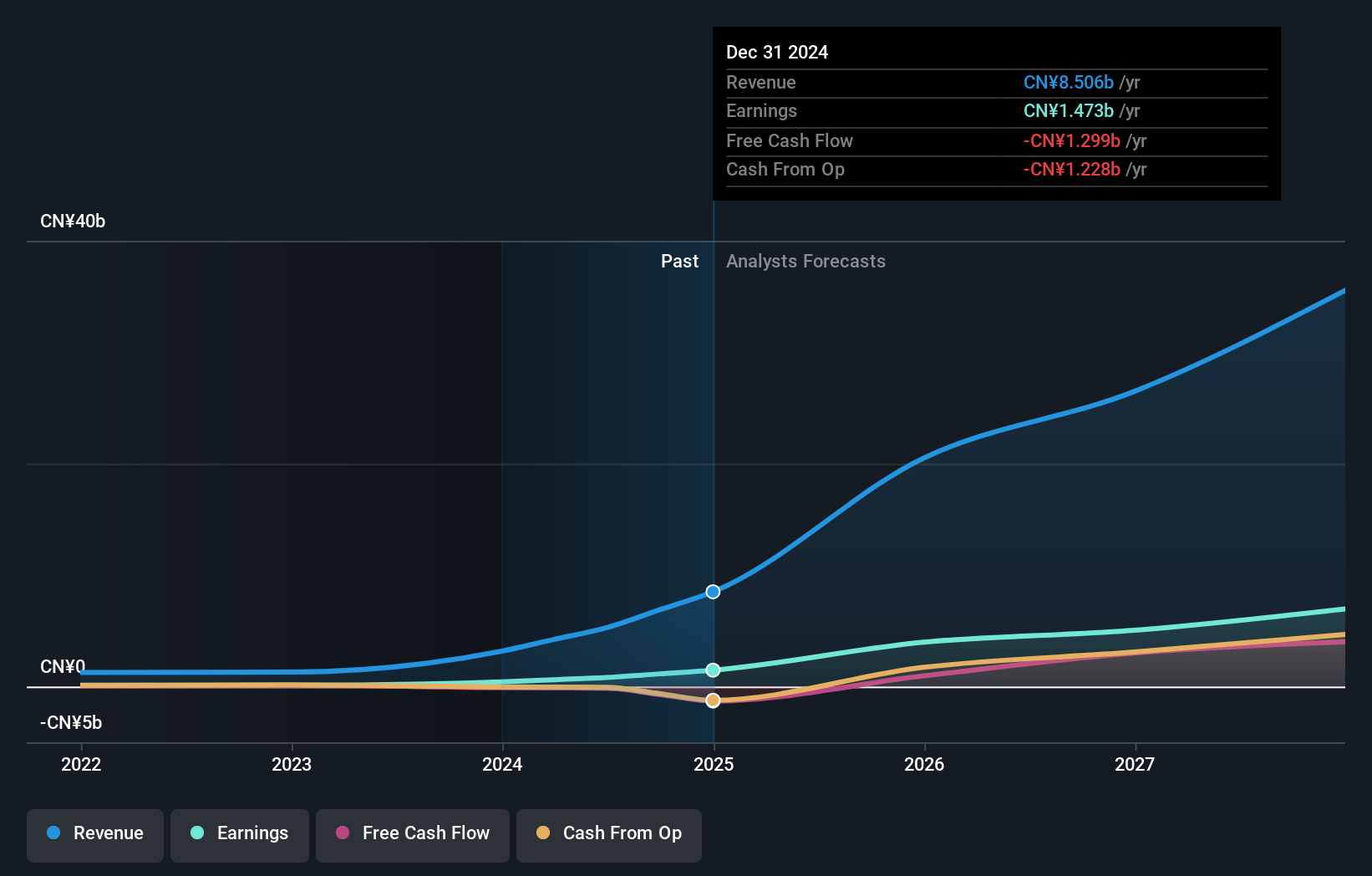

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$149.97 billion.

Operations: The company generates revenue from its Jewelry & Watches segment, amounting to CN¥8.51 billion.

Insider Ownership: 35.5%

Earnings Growth Forecast: 40.5% p.a.

Laopu Gold demonstrates strong growth potential, with earnings expected to grow significantly at over 40% annually, outpacing the Hong Kong market. Revenue is also forecast to rise rapidly at 38.6% per year. Despite high volatility in its share price recently, Laopu Gold's substantial insider ownership aligns interests with shareholders. The company completed a follow-on equity offering of HK$2.72 billion and announced a final dividend of RMB 6.35 per share for FY2024, reflecting robust financial health and commitment to shareholder returns.

- Click here to discover the nuances of Laopu Gold with our detailed analytical future growth report.

- Our valuation report here indicates Laopu Gold may be overvalued.

OSL Group (SEHK:863)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OSL Group Limited is an investment holding company that operates in the digital assets and blockchain platform sector across Hong Kong, Australia, Japan, Singapore, and Mainland China with a market cap of HK$8.79 billion.

Operations: The company generates revenue of HK$374.75 million from its digital assets and blockchain platform business across multiple regions including Hong Kong, Australia, Japan, Singapore, and Mainland China.

Insider Ownership: 33.8%

Earnings Growth Forecast: 48.2% p.a.

OSL Group is positioned for robust growth, with earnings projected to rise significantly at 48.22% annually, surpassing the Hong Kong market average. Revenue is expected to increase by 38.2% per year, driven by strategic initiatives like the launch of OSL Wealth and a collaboration with MoneyHero Limited to expand digital asset offerings in Hong Kong. While insider ownership aligns management and shareholder interests, recent auditor changes may warrant attention from investors monitoring governance stability.

- Get an in-depth perspective on OSL Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that OSL Group's current price could be inflated.

Siam Cement (SET:SCC)

Simply Wall St Growth Rating: ★★★★☆☆

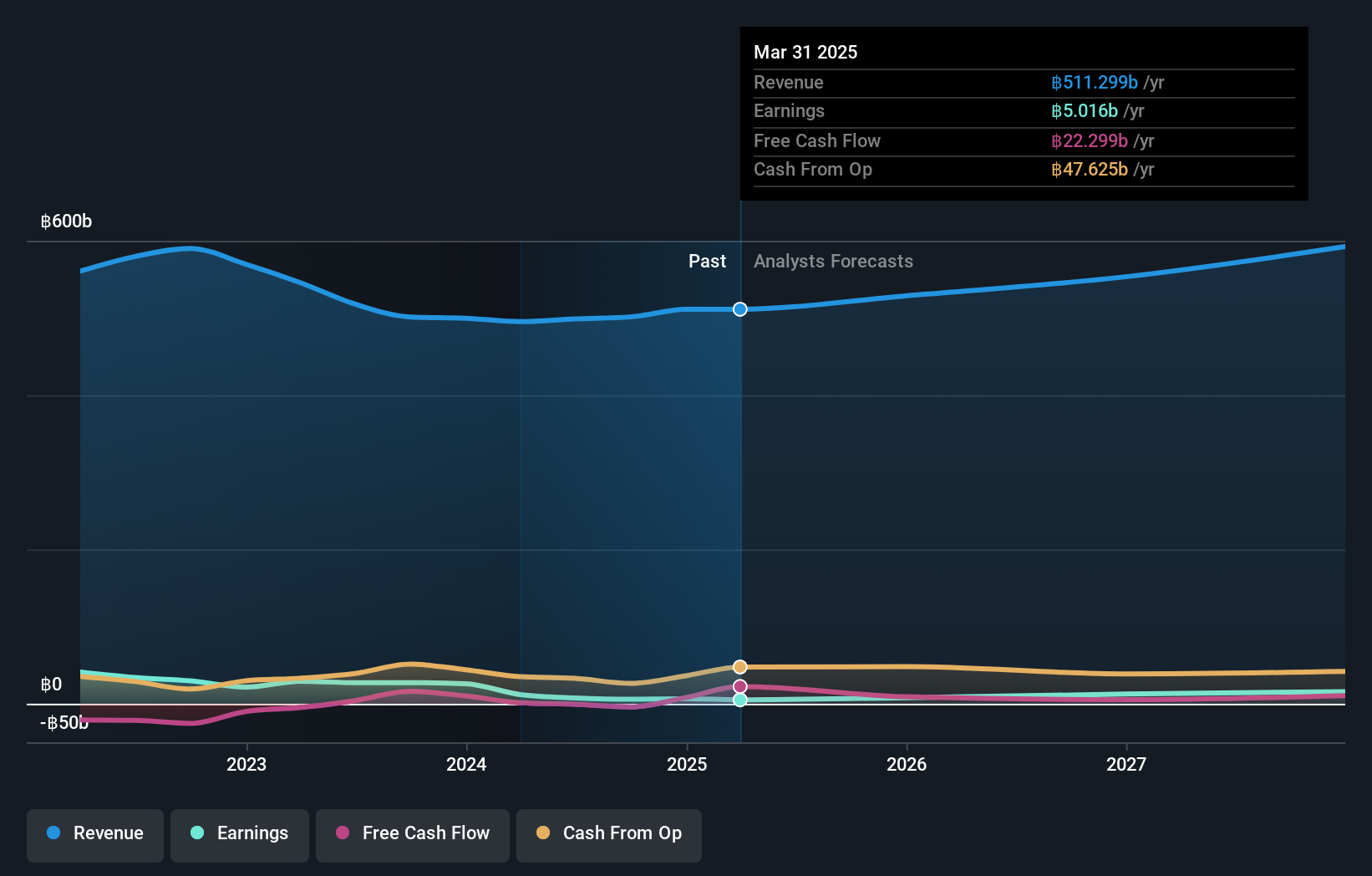

Overview: The Siam Cement Public Company Limited, along with its subsidiaries, engages in the cement and building materials, chemicals, and packaging sectors both in Thailand and globally, with a market cap of THB202.20 billion.

Operations: The company's revenue is primarily derived from SCG Chemicals (SCGC) at THB215.10 billion, SCG Smart Living Business and SCG Distribution and Retail Business at THB136.41 billion, SCGP at THB131.05 billion, SCG Cement and Green Solutions Business at THB81.39 billion, and SCG Decor (SCGD) at THB24.74 billion.

Insider Ownership: 33.6%

Earnings Growth Forecast: 39.1% p.a.

Siam Cement's earnings are projected to grow significantly at 39.1% annually, outpacing the Thai market average. Despite a slight dip in profit margins from 2.4% to 1%, the company remains financially strong with revenue growth expected at 5.3% per year, above the market rate of 4.9%. Recent first-quarter results showed stable sales but decreased net income, while governance changes included audit committee appointments and a dividend adjustment of THB 2.50 per share approved in March 2025.

- Dive into the specifics of Siam Cement here with our thorough growth forecast report.

- Our valuation report unveils the possibility Siam Cement's shares may be trading at a premium.

Key Takeaways

- Click through to start exploring the rest of the 608 Fast Growing Asian Companies With High Insider Ownership now.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English