Lumen Technologies (NYSE:LUMN) shareholder returns have been fantastic, earning 306% in 1 year

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Lumen Technologies, Inc. (NYSE:LUMN) share price is up a whopping 306% in the last 1 year, a handsome return in a single year. On top of that, the share price is up 17% in about a quarter. But this could be related to the strong market, which is up 11% in the last three months. On the other hand, longer term shareholders have had a tougher run, with the stock falling 60% in three years.

Since it's been a strong week for Lumen Technologies shareholders, let's have a look at trend of the longer term fundamentals.

Because Lumen Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Lumen Technologies actually shrunk its revenue over the last year, with a reduction of 7.9%. So it's very confusing to see that the share price gained a whopping 306%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

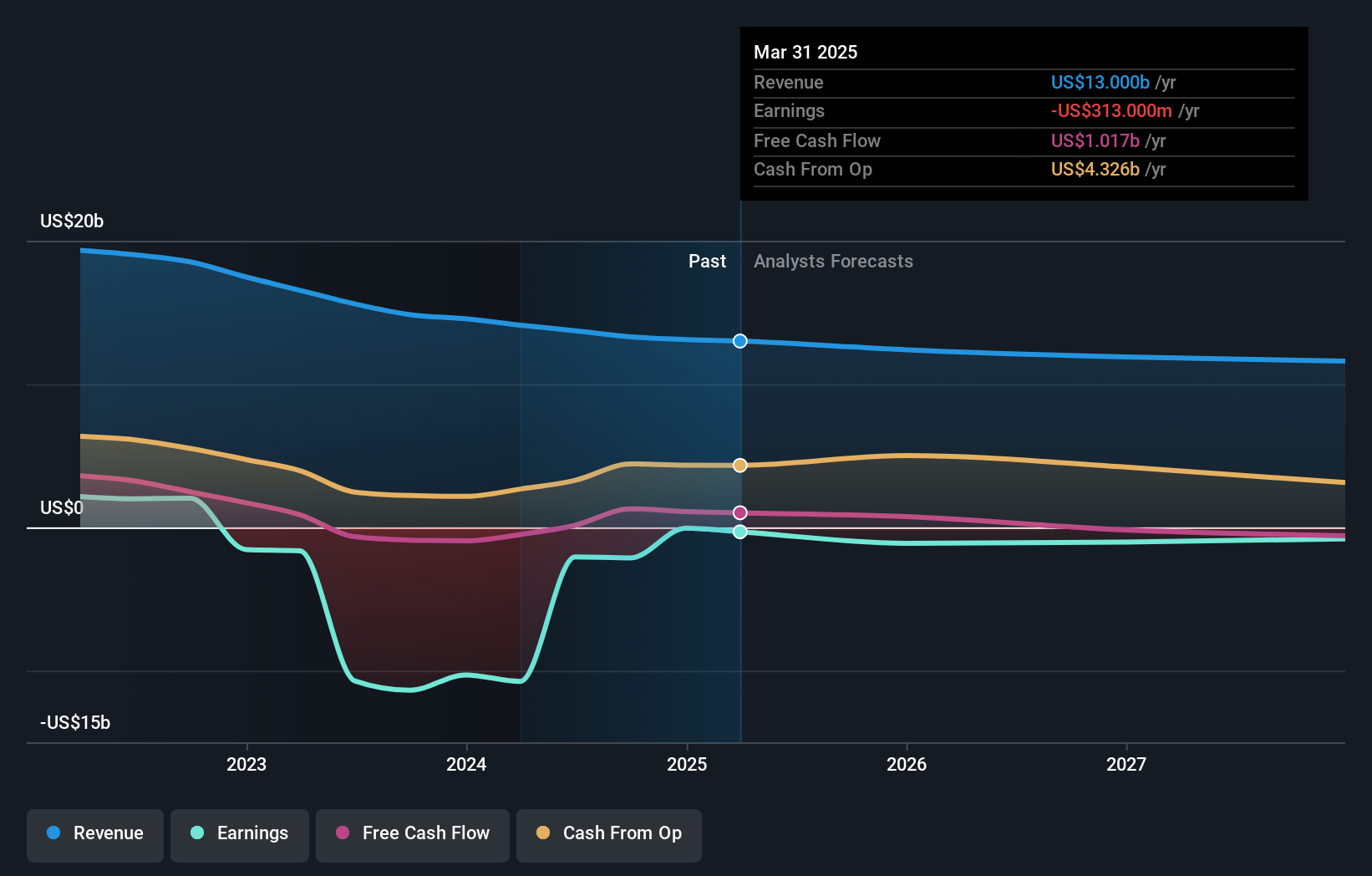

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Lumen Technologies is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Lumen Technologies in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Lumen Technologies shareholders have received a total shareholder return of 306% over the last year. That certainly beats the loss of about 8% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Lumen Technologies (including 1 which is concerning) .

Of course Lumen Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English