Is Procter & Gamble Set to Shield Earnings From Global Volatility?

The Procter & Gamble Company PG is not fully immune to global headwinds like currency swings, inflation, tariffs and potential trade tensions. Given its significant global foothold, the company is also exposed to risks including market volatility, political and social instabilities, debt and credit issues, and evolving foreign government or enforcement policies.

However, the company is proactively taking strategic measures to offset such risks and protect its margins and earnings. PG's focus on productivity initiatives, coupled with pricing strength, cost efficiencies, restructuring strategy and a diversified, resilient brand portfolio, is the key enabler in addressing these challenges.

PG’s pricing strategy, which goes beyond simple price hikes and controls, is bolstered by product innovations that add value and validate premium positioning. Productivity remains a strong pillar of PG’s strategic priorities. The company accelerates productivity across all operational areas to unlock efficiencies, reinvest strategically and drive enterprise-wide growth. Productivity gains have been driving margins and free cash flow productivity is projected to be 90% for fiscal 2025.

In recent periods, the company has effectively mitigated higher commodity costs, supply disruptions, inflation and currency volatility through disciplined pricing and productivity measures. However, unforeseen macro shocks in currency, commodities and geopolitics, coupled with execution risks related to restructuring and soft consumer demand in discretionary, could pose a threat to earnings. In third-quarter fiscal 2025 earnings call, management cut core EPS growth to 2-4% year over year from the 5-7% rise expected earlier, due to volatile market dynamics.

PG’s Peers: How CL & CHD Aid Earnings Amid Global Headwinds

Amid global economic headwinds, Colgate-Palmolive Company CL and Church & Dwight Co., Inc. CHD are leveraging pricing power, cost controls and brand resilience to protect earnings and maintain growth momentum.

Colgate leverages the power of pricing and productivity to offset global challenges. The company is benefiting from pricing actions and its funding-the-growth program, aimed at driving efficiency and expanding margins. Colgate has revamped its innovation model, leveraged its global scale across price tiers and reinforced operational excellence. The company is developing plans to tackle tariffs in the short, medium and long term, comprising the alternative sourcing, formula simplification, shifting production and revenue-growth initiatives. For 2025, CL expects adjusted EPS to grow low-single-digits.

Church & Dwight continues to bolster its position through a robust brand portfolio, strategic pricing and innovation. However, the company witnessed soft U.S. category growth, especially in discretionary segments, and margin pressure from inflationary costs, lower sales and tariff impacts in first-quarter 2025. Nevertheless, CHD’s strategic portfolio management and supply-chain actions are likely to lower its tariff exposure by 80%. Cost optimization, brand-focused innovation and the divestiture of underperforming assets might aid. CHD envisions adjusted EPS growth of 0-2%.

PG’s Price Performance, Valuation and Estimates

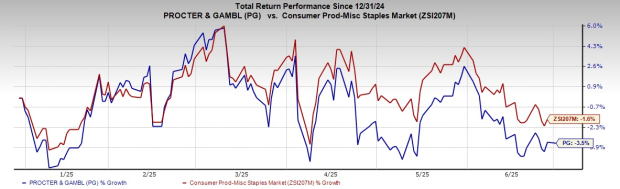

Procter & Gamble’s shares have lost around 3.5% year to date compared with the industry’s 1.6% dip.

Image Source: Zacks Investment Research

From a valuation standpoint, PG trades at a forward price-to-earnings ratio of 22.77X compared with the industry’s average of 20.18X.

Image Source: Zacks Investment Research

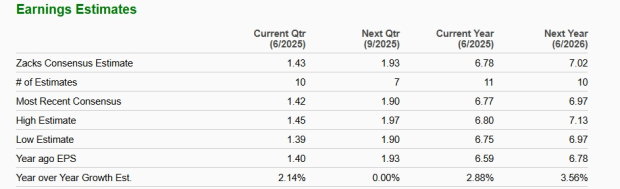

The Zacks Consensus Estimate for PG’s fiscal 2025 and 2026 EPS indicates year-over-year growth of 2.9% and 3.6%, respectively. The company’s EPS estimate for fiscal 2025 has been stable, and that for fiscal 2026 has moved northward in the past 30 days.

Image Source: Zacks Investment Research

Procter & Gamble carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English