Argan (NYSE:AGX) Removed From Russell 3000E And Microcap Indexes

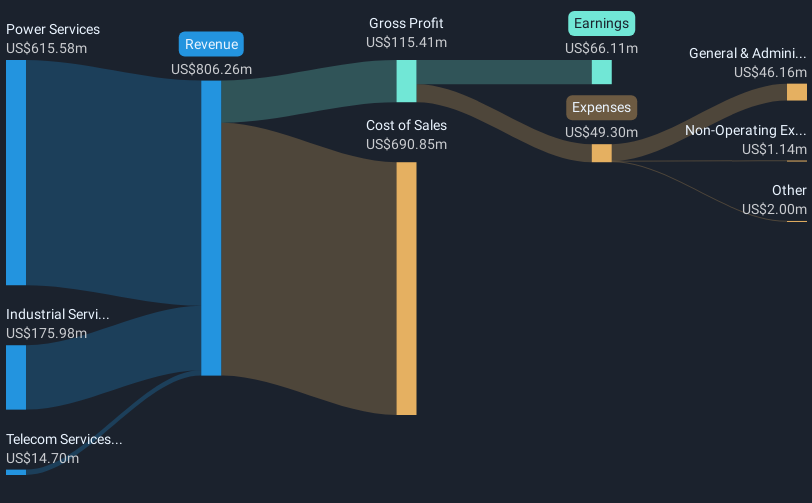

Argan (NYSE:AGX) experienced significant changes last quarter, with its removal from key indices like the Russell 3000E and Russell Microcap, likely impacting market visibility. Despite this, the company reported a strong earnings performance for Q1 2026, with sales rising to $194 million and net income increasing to $23 million. This positive financial performance contrasts with the index exclusion and may have reinforced investor confidence, contributing to a notable 68% price rise. The company's continuous dividend affirmations and buyback activities further supported its stock performance amid broader market gains, as the S&P 500 and Nasdaq reached new highs.

Argan has 1 warning sign we think you should know about.

The recent exclusion of Argan from key indices like the Russell 3000E and Microcap could affect its market visibility, yet the company's robust first-quarter earnings demonstrate resilience. With US$525 million in cash and no debt, Argan's financial stability allows for ongoing investments and operational improvements. On-market total returns over a three-year period reached a very large value, highlighting investor confidence and consistent performance. Over the past year, Argan outperformed both the US Market, which returned 13.7%, and the US Construction industry, which posted a 44.7% return, supporting investor optimism in its growth prospects.

The updated earnings and revenue forecasts could be positively impacted by the strong project backlog, including significant projects like the 405 megawatt solar project in Illinois. Analysts expect revenues to grow to US$1.2 billion and earnings to US$130.2 million by 2028. However, the execution risks associated with large-scale projects, regulatory shifts, and possible cost overruns remain critical concerns. Currently, Argan's share price is close to the analyst price target of US$150.0, suggesting that the stock is fairly priced based on these earnings projections. Investors may want to assess whether the forecasted potential of Argan justifies the company's current valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English