NuScale Power (NYSE:SMR) Appoints Shahram Ghasemian as Chief Legal Officer

NuScale Power (NYSE:SMR) made a significant move by appointing Shahram Ghasemian as its new Chief Legal Officer and Corporate Secretary, effective June 30, 2025. This executive change, along with NuScale's partnership with Paragon Energy Solutions and the launch of new educational initiatives, paints a picture of a company actively expanding and innovating. Meanwhile, the market displayed strong positive trends, with major indexes reaching new highs, fueled by global economic optimism and trade agreements. While NuScale's 161% price surge over the quarter outpaced general market trends, these developments may have bolstered investor confidence in the company’s long-term value creation.

Be aware that NuScale Power is showing 4 warning signs in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent strategic shifts at NuScale Power, including appointing a new Chief Legal Officer and entering partnerships, are poised to support its narrative of innovation and strategic growth in small modular reactor technology. This backdrop of corporate progression comes alongside a substantial share price increase of 161% over the last quarter. Long-term performance has been increasingly impressive, with a total shareholder return of 258.69% over three years.

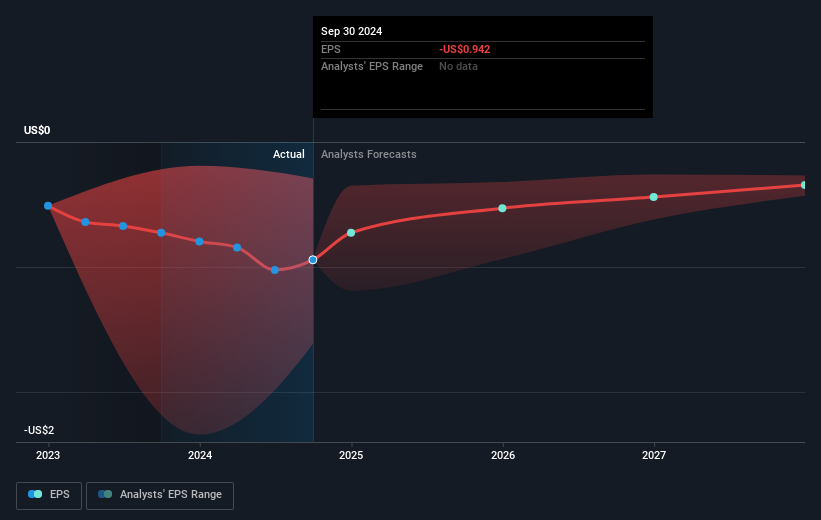

In comparison to the US Electrical industry, which saw a 34% return over the past year, NuScale's recent annual return significantly surpassed industry averages and the broader US market's 13.7% return. While analysts predict a challenging path to profitability, the company's advancements suggest potential for future earnings and revenue growth, supported by its aggressive commercial deployment plans.

Despite facing obstacles like funding uncertainties and supply chain risks, NuScale's efforts in SMR technology could play a vital role in driving revenue and earnings improvements. The recent news could positively influence analyst revenue forecasts, as NuScale is well-positioned to benefit from increasing global energy demands. However, with the current share price at US$13.91 in comparison to the analyst consensus target of US$34.66, investors should remain cautious and consider market expectations alongside their own assessments.

Learn about NuScale Power's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English