Pitney Bowes Inc.'s (NYSE:PBI) Shareholders Might Be Looking For Exit

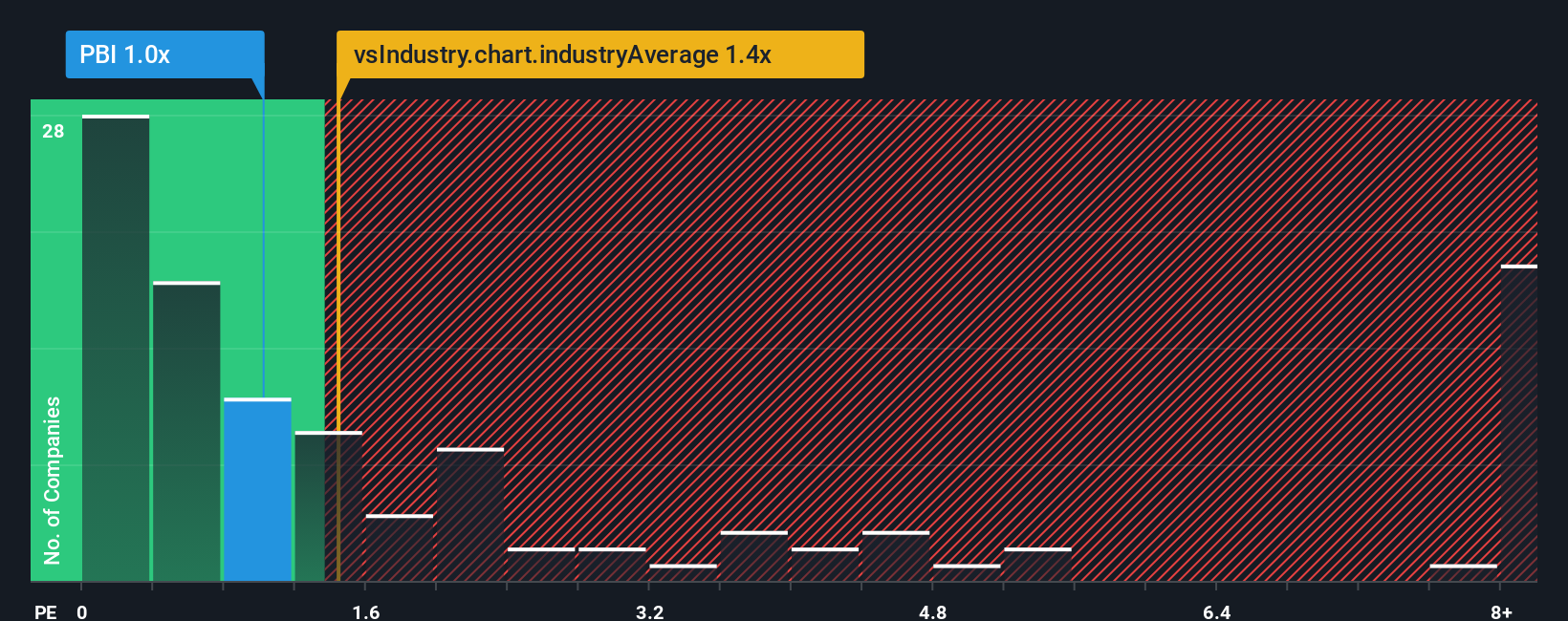

There wouldn't be many who think Pitney Bowes Inc.'s (NYSE:PBI) price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S for the Commercial Services industry in the United States is similar at about 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Pitney Bowes

What Does Pitney Bowes' P/S Mean For Shareholders?

Pitney Bowes certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Pitney Bowes' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Pitney Bowes?

In order to justify its P/S ratio, Pitney Bowes would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. However, this wasn't enough as the latest three year period has seen an unpleasant 46% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.2% as estimated by the lone analyst watching the company. Meanwhile, the broader industry is forecast to expand by 7.6%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Pitney Bowes' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Pitney Bowes' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Pitney Bowes' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You should always think about risks. Case in point, we've spotted 3 warning signs for Pitney Bowes you should be aware of, and 1 of them shouldn't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English