Intuitive Surgical (NasdaqGS:ISRG) Expands Da Vinci Surgical System Presence In European Market

Intuitive Surgical (NasdaqGS:ISRG) recently secured CE Mark approval for its da Vinci 5 Surgical System, enabling advanced robotic-assisted surgical procedures in Europe. This positive development aligns with the company's strategic push to enhance surgical technology. Over the last quarter, Intuitive's stock price increased by 9%, a movement that broadly aligns with market trends, where the S&P 500 and Nasdaq Composite experienced upward momentum, with notable gains in the tech sector. The company's innovation-driven announcements likely supported its share price performance, adding weight to the overall positive market movement. However, broader market trends, rather than singular events, seem instrumental in driving this increase.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent CE Mark approval for Intuitive Surgical's da Vinci 5 Surgical System is a significant advancement for increasing product adoption and sales, aligning with the company's growth narrative. By expanding access to robotic-assisted surgeries in Europe, this development could enhance long-term revenue potential and elevate surgical outcomes globally. The global launch and technological enhancements such as Force Feedback could drive stronger adoption rates and bolster future earnings, aligning with analyst projections of steady growth over the coming years.

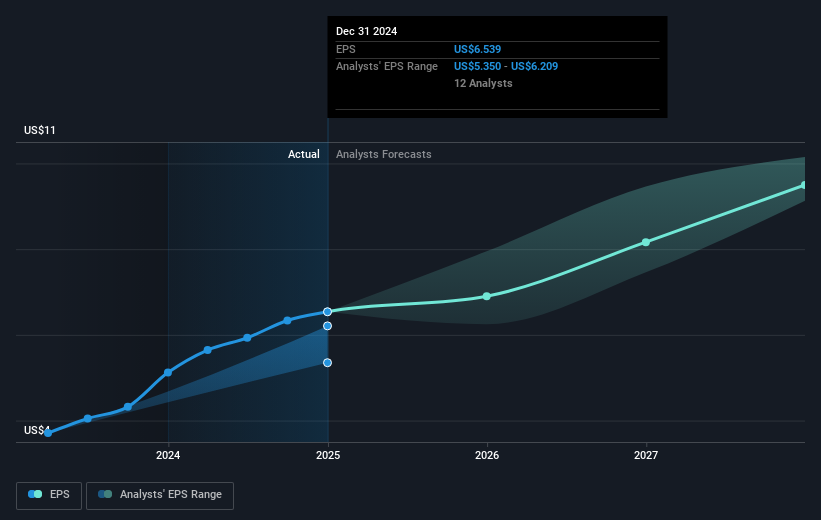

Over the past five years, Intuitive Surgical's total shareholder return, including stock price and dividends, has been a substantial 177.81%, reflecting strong performance in the medical equipment sector. In contrast, for the last year, the company exceeded both the broader US market and the US Medical Equipment industry. With recently reported earnings of US$2.48 billion and revenue reaching US$8.71 billion, the introduction of advanced technologies such as da Vinci 5 could continue to fuel such growth. Analysts project its revenue to grow at an approximate rate of 12.3% annually, potentially elevating its market position further.

Despite its strong historical performance, the company's stock is presently trading at a higher price-to-earnings ratio compared to the industry average, indicating potential market optimism regarding its future prospects. With the current share price of US$523.08, there remains a 9.1% potential upside relative to the consensus analyst price target of US$575.49. Investors should evaluate the long-term strategic initiatives like the da Vinci 5 launch against market dynamics when considering the company's future growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English