Asian Penny Stocks Spotlight: Shengjing Bank And Two Others

As global markets continue to react positively to easing trade tensions and economic developments, investors are exploring diverse opportunities across regions. Penny stocks, though an older term, still capture the essence of investing in smaller or newer companies that may offer significant value at lower price points. By focusing on those with strong financials and growth potential, investors can uncover hidden gems within the Asian market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.24 | HK$782.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.08 | HK$3.6B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.13 | HK$1.89B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.24 | SGD8.82B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD41.45M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.10 | SGD850.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.54 | HK$52.01B | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.54 | HK$13.96B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 997 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Shengjing Bank (SEHK:2066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shengjing Bank Co., Ltd. and its subsidiaries provide banking products and financial services in Mainland China, with a market cap of HK$11.17 billion.

Operations: The company generates revenue through three main segments: Retail Banking with CN¥1.87 billion, Corporate Banking at CN¥4.67 billion, and Treasury Business contributing CN¥176.56 million.

Market Cap: HK$11.17B

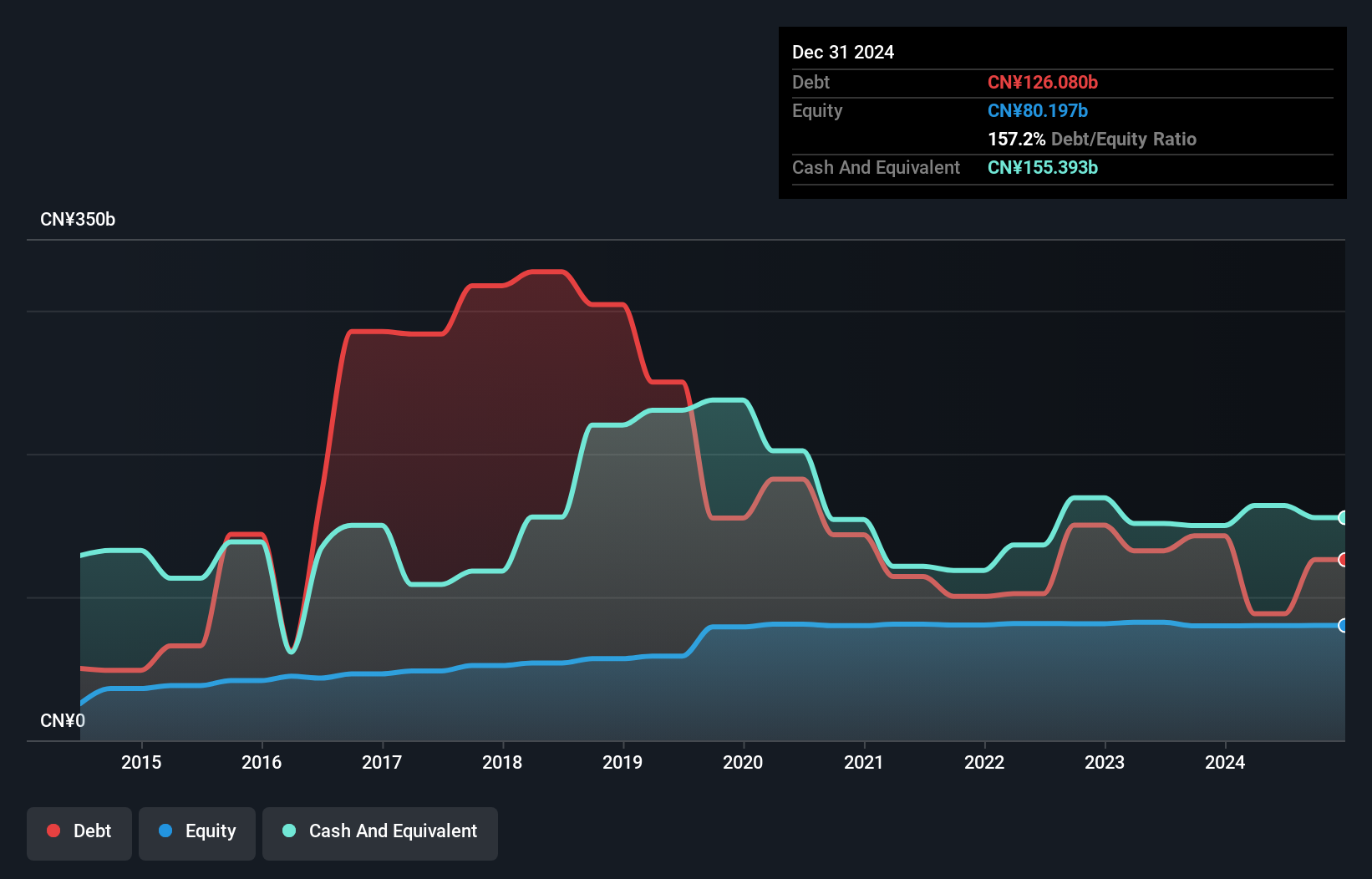

Shengjing Bank, with a market cap of HK$11.17 billion, operates through Retail Banking (CN¥1.87 billion), Corporate Banking (CN¥4.67 billion), and Treasury Business (CN¥176.56 million). Despite its high-quality earnings and appropriate loan levels, the bank faces challenges with declining profits—down 50% annually over five years—and low return on equity at 0.8%. The management team is experienced but the board lacks tenure depth, reflecting recent changes including Mr. Wang Jun's resignation due to retirement age and upcoming elections for new directors amid restructuring plans for village banks into branches.

- Click to explore a detailed breakdown of our findings in Shengjing Bank's financial health report.

- Gain insights into Shengjing Bank's past trends and performance with our report on the company's historical track record.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. operates as a home meal products company in Mainland China with a market cap of HK$8.81 billion.

Operations: The company generates revenue primarily from its Retail - Grocery Stores segment, amounting to CN¥6.47 billion.

Market Cap: HK$8.81B

Guoquan Food (Shanghai), with a market cap of HK$8.81 billion, is expanding its footprint by investing approximately RMB 490 million in a new production base in Hainan Province. Despite negative earnings growth last year and a low return on equity of 7.4%, the company maintains strong financial health with short-term assets exceeding liabilities and more cash than total debt. Recent strategic moves include increasing dividends and appointing Ms. Yang Tongyu as an executive director, reflecting efforts to enhance shareholder value and governance amidst stable weekly volatility at 11%. Earnings are projected to grow by 21.92% annually.

- Unlock comprehensive insights into our analysis of Guoquan Food (Shanghai) stock in this financial health report.

- Assess Guoquan Food (Shanghai)'s future earnings estimates with our detailed growth reports.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Energy Group Limited is an investment holding company involved in upstream oil, natural gas, clean energy, and energy trading operations across Pakistan, South Asia, the Middle East, and North Africa with a market cap of approximately HK$13.96 billion.

Operations: The company generates revenue through two primary segments: Trading, which contributes HK$7.66 billion, and Exploration and Production, accounting for HK$9.86 billion.

Market Cap: HK$13.96B

United Energy Group, with a market cap of HK$13.96 billion, has shown resilience by becoming profitable this year despite a large one-off loss of HK$442.4 million impacting its recent financial results. The company generates substantial revenue from its Trading and Exploration and Production segments, totaling over HK$17 billion combined. While the company's debt is well-covered by operating cash flow, recent leadership changes highlight an evolving governance structure with new appointments in key roles. Despite high share price volatility and significant insider selling recently, United Energy Group trades at a good value compared to industry peers.

- Click here to discover the nuances of United Energy Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into United Energy Group's future.

Where To Now?

- Jump into our full catalog of 997 Asian Penny Stocks here.

- Contemplating Other Strategies? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English