Cerus Leads The Pack Of 3 Promising Penny Stocks

Over the last 7 days, the United States market has risen 2.2%, and over the past 12 months, it is up by 13% with earnings forecasted to grow by 15% annually. For investors willing to explore beyond well-known companies, penny stocks — often smaller or newer enterprises — can offer unexpected opportunities. Despite their vintage name, these stocks can still provide value and potential growth when backed by solid financials; here we highlight three such promising options.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $488.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8963 | $150.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.40 | $244.44M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.63 | $451.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.44 | $37M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84368 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.40 | $448.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.19 | $26.81M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cerus (CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $282.92 million.

Operations: The company generates revenue from its Blood Safety segment, totaling $185.14 million.

Market Cap: $282.92M

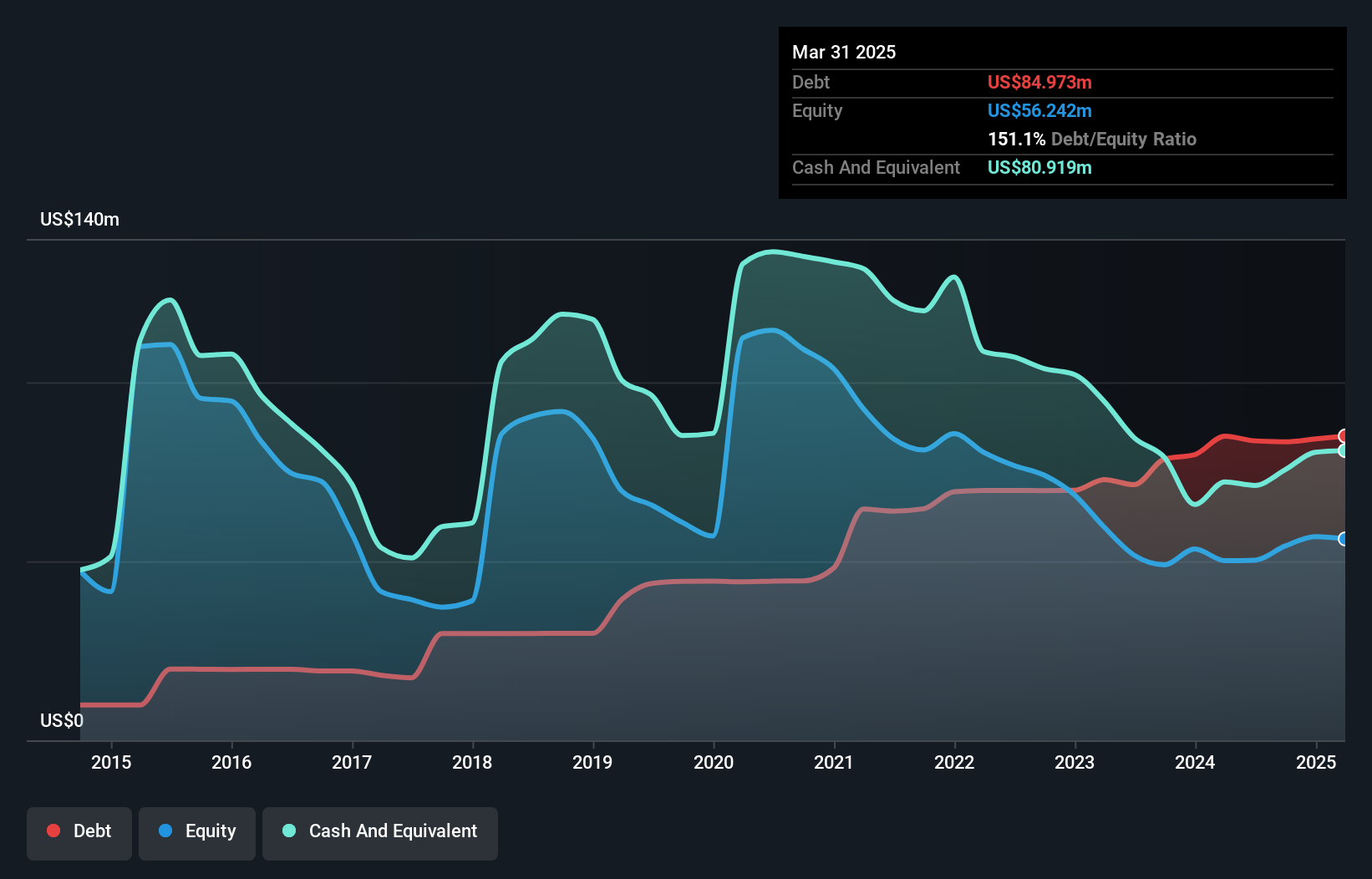

Cerus Corporation, with a market cap of US$282.92 million, remains unprofitable but shows potential in its Blood Safety segment, generating US$185.14 million in revenue. Despite a negative return on equity and increased debt over five years, the company maintains a satisfactory net debt to equity ratio of 7.2%. Recent European regulatory updates for the INTERCEPT RBC program may enhance growth prospects. Analysts predict significant stock price appreciation and revenue growth at 11.85% annually, supported by product expansion like INT200's regulatory approvals in France and Switzerland and anticipated U.S. market penetration increases for their platelet business.

- Click here and access our complete financial health analysis report to understand the dynamics of Cerus.

- Understand Cerus' earnings outlook by examining our growth report.

Opendoor Technologies (OPEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Opendoor Technologies Inc. operates a digital platform for residential real estate transactions in the United States and has a market cap of approximately $411.96 million.

Operations: The company's revenue is primarily derived from its real estate brokers segment, totaling $5.13 billion.

Market Cap: $411.96M

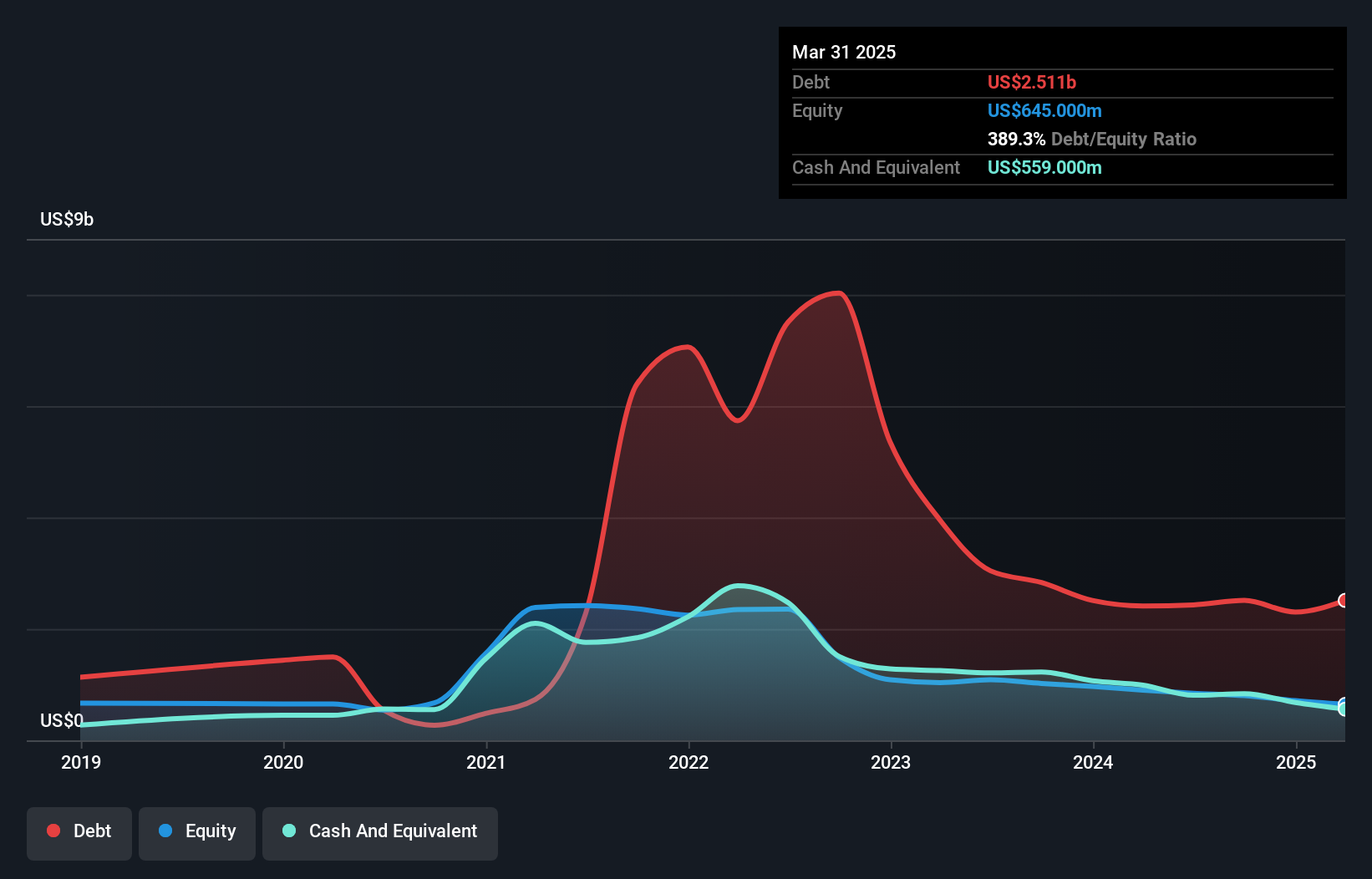

Opendoor Technologies, with a market cap of US$411.96 million, faces challenges as its stock price has fallen below the Nasdaq minimum bid requirement. The company is exploring options like a reverse stock split to regain compliance by November 2025. Despite being unprofitable and having a high net debt to equity ratio of 302.6%, Opendoor's short-term assets cover both short and long-term liabilities, providing some financial stability. Recent initiatives such as the Key Connections program aim to diversify revenue streams by enhancing agent partnerships and expanding market reach, potentially increasing conversion rates among sellers.

- Take a closer look at Opendoor Technologies' potential here in our financial health report.

- Examine Opendoor Technologies' earnings growth report to understand how analysts expect it to perform.

Xunlei (XNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xunlei Limited, with a market cap of $269.45 million, operates an internet platform for digital media content in the People's Republic of China through its subsidiaries.

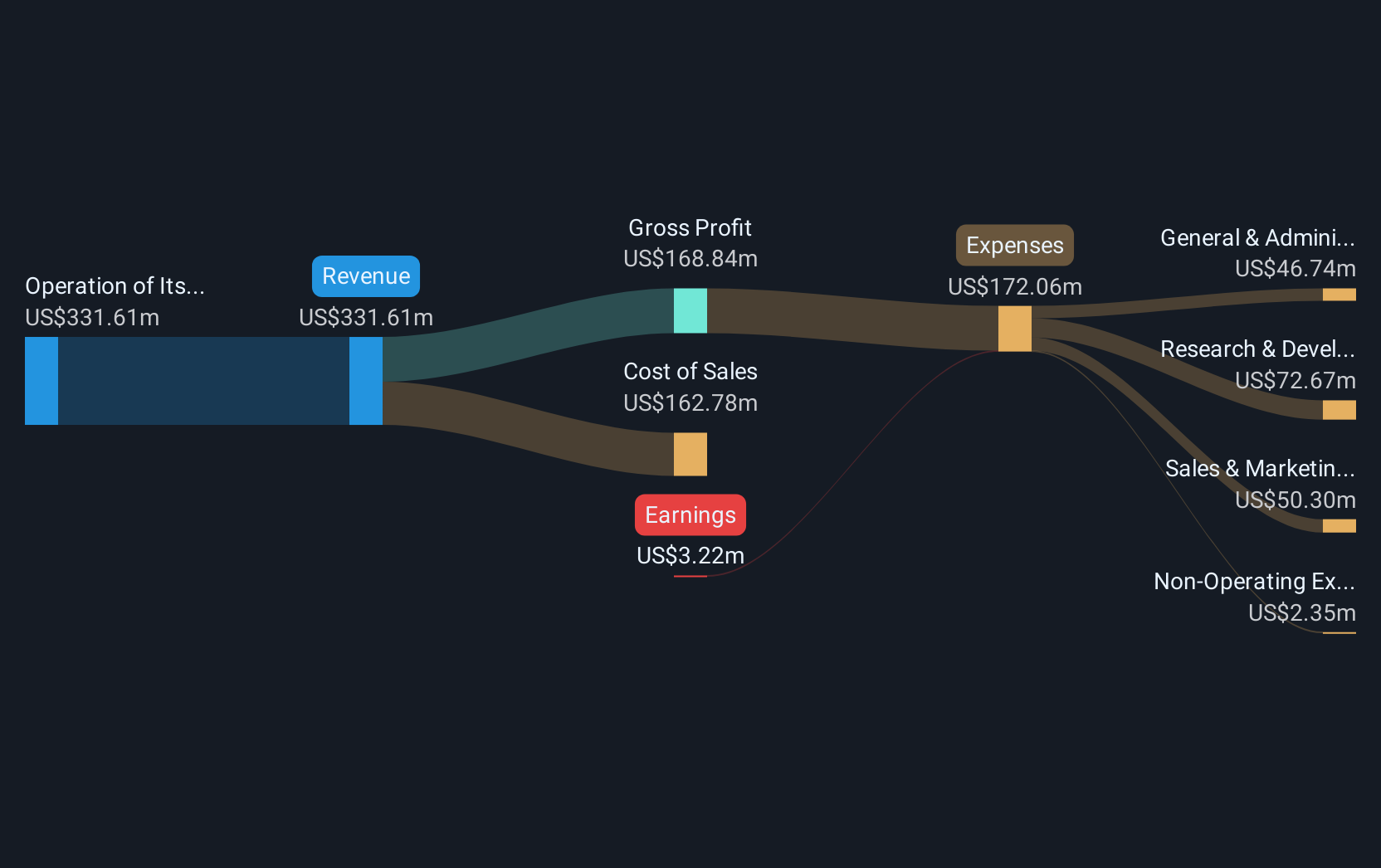

Operations: The company generates revenue primarily from the operation of its online media platform, which amounts to $331.61 million.

Market Cap: $269.45M

Xunlei Limited, with a market cap of US$269.45 million, is navigating the penny stock landscape with a focus on its digital media platform in China. Despite being unprofitable, it has reduced losses over the past five years and maintains financial stability with short-term assets of US$361.6 million exceeding liabilities. The company recently reported first-quarter revenue of US$88.45 million and provided guidance for Q2 2025 revenues between US$91 million and US$96 million. Xunlei's management team is experienced, and the company has completed significant share buybacks while maintaining a positive cash flow runway for over three years.

- Click here to discover the nuances of Xunlei with our detailed analytical financial health report.

- Learn about Xunlei's historical performance here.

Next Steps

- Get an in-depth perspective on all 421 US Penny Stocks by using our screener here.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English