UP Fintech Holding's (NASDAQ:TIGR) earnings growth rate lags the 111% return delivered to shareholders

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. Take, for example UP Fintech Holding Limited (NASDAQ:TIGR). Its share price is already up an impressive 111% in the last twelve months. It's also good to see the share price up 35% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 26% in 90 days). Looking back further, the stock price is 108% higher than it was three years ago.

Since the long term performance has been good but there's been a recent pullback of 5.5%, let's check if the fundamentals match the share price.

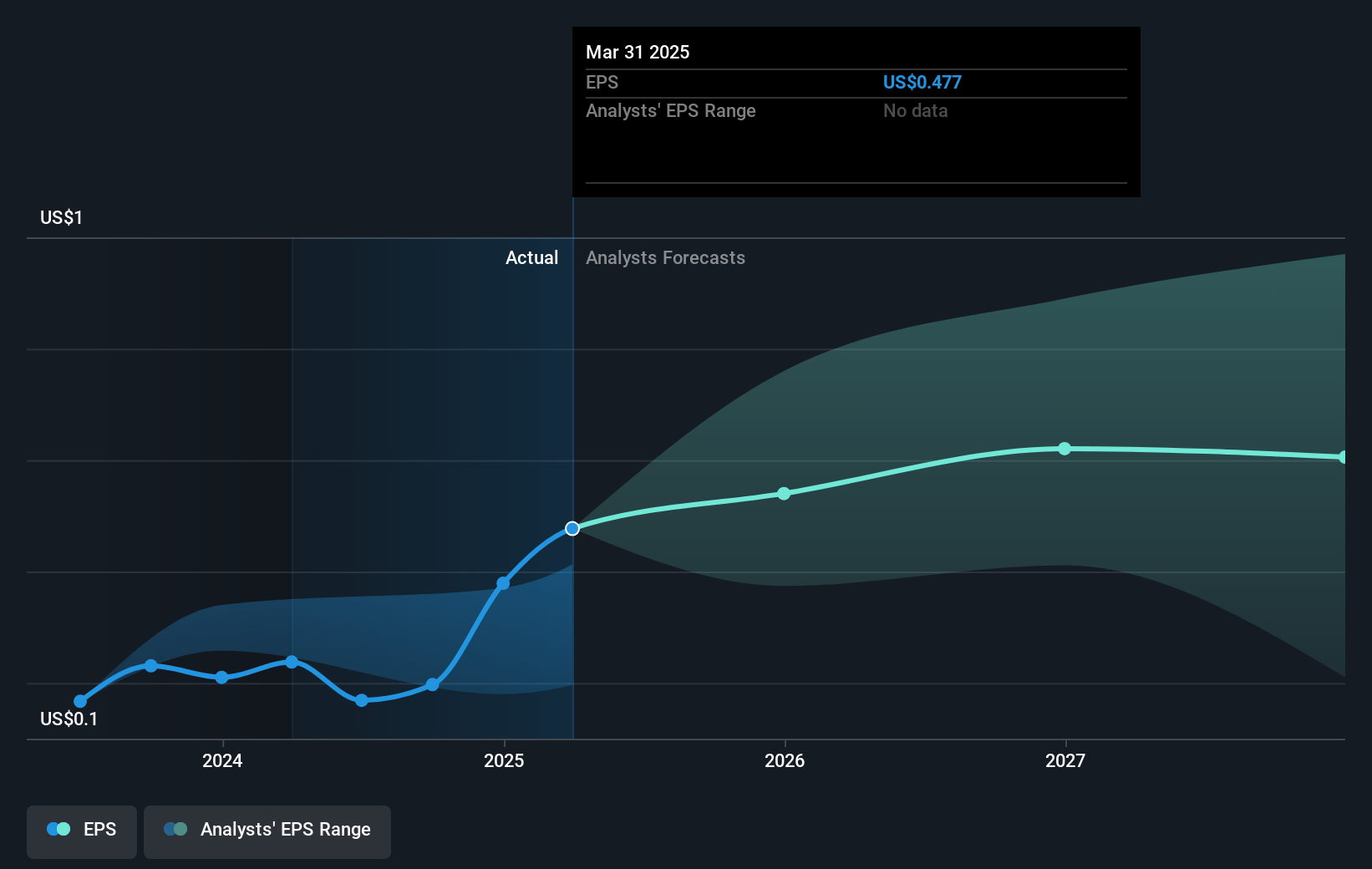

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

UP Fintech Holding was able to grow EPS by 101% in the last twelve months. We note that the earnings per share growth isn't far from the share price growth (of 111%). So this implies that investor expectations of the company have remained pretty steady. It makes intuitive sense that the share price and EPS would grow at similar rates.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how UP Fintech Holding has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that UP Fintech Holding shareholders have received a total shareholder return of 111% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Is UP Fintech Holding cheap compared to other companies? These 3 valuation measures might help you decide.

We will like UP Fintech Holding better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English