Tetra Tech Wins $248M Architect Engineering Contract From USACE

Tetra Tech, Inc. TTEK recently secured a $248 million contract from the U.S. Army Corps of Engineers (USACE), Europe District, to offer architect-engineer (A-E) services for U.S. military bases in the EUCOM region.

Per the five-year, multiple-award deal, TTEK’s engineers and technical specialists will deliver multidisciplinary A-E design services. This includes conceptual and detailed design, planning and studying, 3D modeling and a range of engineering services. These services will support important military infrastructure and facilities such as utility systems, air bases, barracks, hospitals, family housing and other operational sites across eight countries in Europe.

Lately, Tetra Tech has received a series of deals that are likely to drive its growth. In April, the company secured a contract from USACE, Los Angeles District, to offer A-E services.

In March 2025, TTEK secured a contract from United Utilities for the management of flooding and control of stormwater overflows in the United Kingdom. In the same month, the company and its joint venture partner secured three $416 million contracts from USACE, Honolulu District, to offer technical services for facilities and sites across the Indo-Pacific region.

In October 2024, it secured a $249 million contract from the USACE Omaha District to offer environmental evaluation and design services for facilities and sites across the United States.

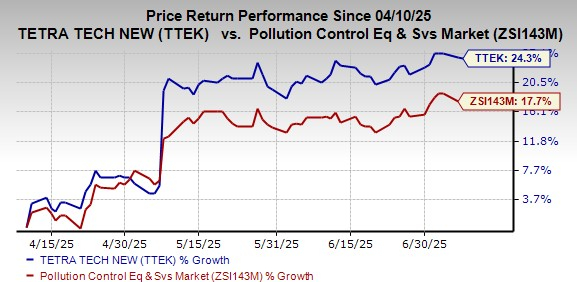

TTEK’s Zacks Rank and Price Performance

Tetra Tech is benefiting from its focus on providing high-end consulting, design and engineering services. Its Government Services Group unit is benefiting from higher international development and advanced water treatment work.

Tetra Tech currently carries a Zacks Rank #3 (Hold). Shares of the company have risen 24.3% in the past three months compared with the industry‘s 17.7% growth.

Image Source: Zacks Investment Research

Escalating selling, general and administrative expenses, due to rising marketing costs, are likely to affect TTEK’s margins in the quarters ahead. Also, given the company’s international presence, foreign currency headwinds are concerning.

Stocks to Consider

Some better-ranked companies are discussed below:

Life360, Inc. LIF currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

LIF delivered a trailing four-quarter average earnings surprise of 425%. In the past 60 days, the Zacks Consensus Estimate for Life360’s 2025 earnings has increased 20%.

Alarm.com Holdings, Inc. ALRM presently sports a Zacks Rank of 1. It has a trailing four-quarter average earnings surprise of 15.7%.

The Zacks Consensus Estimate for ALRM’s 2025 earnings has increased 0.4% in the past 60 days.

Broadwind, Inc. BWEN presently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter average earnings surprise of 61.1%.

In the past 60 days, the consensus estimate for BWEN’s 2025 earnings has increased 14.3%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK): Free Stock Analysis Report

Broadwind Energy, Inc. (BWEN): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Free Stock Analysis Report

Life360, Inc. (LIF): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English