Can Colgate's Pricing Strength Keep Earnings Buoyant in 2025?

Colgate-Palmolive Company CL is effectively leveraging its pricing power to support growth and mitigate external cost pressures. The company has a multifaceted pricing approach, including competitive pricing, value-based strategy and price segmentation, to address diverse consumer needs while optimizing value.

Colgate sets prices comparable to its competitors, emphasizing the value and benefits of its products, thereby offering a range of prices to suit different consumer budgets. The company is benefiting from key pricing actions, coupled with its funding-the-growth program and other productivity moves, aimed at driving efficiency and expanding margins.

The company has been implementing aggressive pricing measures in the recent past, which continue to boost its margins and earnings. In first-quarter 2025, the adjusted gross margin expanded 80 basis points (bps) while the operating margin expanded 120 bps year over year. This led to adjusted earnings per share (EPS) growth of 6% from the prior-year period. Pricing improved 1.5% year over year in the reported quarter, backed by positive pricing across its most segmental divisions. Our model expects pricing gains of 2.5% for 2025.

On an adjusted basis, Colgate expects the gross margin to be nearly flat year over year and EPS to grow low single-digits for 2025. CL’s pricing strategy goes beyond hikes and controls, bolstered by ongoing product innovations and launches that drive value and validate premium positioning. It has revamped its innovation model, leveraged its global scale across price tiers, invested in marketing and reinforced operational capabilities, all to drive brand health and higher household penetration. Such efforts are likely to continue driving sustained growth and profitability.

CL’s Competition in Pricing Dominance

The Procter & Gamble Company PG, The Clorox Company CLX and Church & Dwight Co., Inc. CHD are the major companies competing with Colgate in pricing power.

Procter & Gamble’s pricing strength serves as a vital pillar of its overall business strategy, which looks to enrich consumer value, boost profits and retain a competitive edge. PG’s value-based pricing approach across categories like laundry detergents enables it to reduce dependence on promotional discounts, alongside maintaining competitive pricing and sustaining market share. PG’s pricing strategy is complemented by ongoing product innovations and launches that drive value.

Clorox’s strategic pricing and cost-saving measures have been boosting gross margin in recent periods. Despite the sales decline in third-quarter fiscal 2025, the gross margin expanded 240 basis points (bps) year over year, marking the company's 10th consecutive quarter of margin expansion. Clorox’s holistic margin-management efforts, constant product innovations and IGNITE strategy progress well. Clorox’s multi-faceted pricing policy includes premium pricing for its core brands, with a focus on premiumization and value for consumers. Our model anticipates price/mix/other to grow 0.2% in fiscal 2025.

Church & Dwight has been strengthening its market position through a robust brand portfolio, strategic pricing and innovation. Leveraging its strong brand equity, CHD exercises pricing power to bolster profitability and overall growth. As a result, the company demonstrated solid brand performance, gaining market share in nine of its 14 major brands and achieving volume share growth in more than 80% of its business in first-quarter 2025.

CL’s Price Performance, Valuation and Estimates

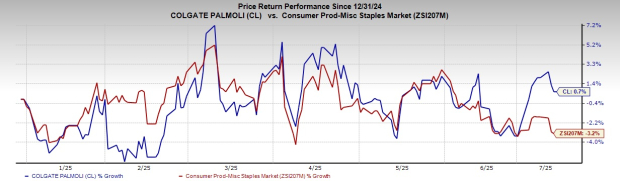

Colgate’s shares have gained 0.7% year to date against the industry’s 3.2% dip.

Image Source: Zacks Investment Research

From a valuation standpoint, CL trades at a forward price-to-earnings ratio of 24.17X compared with the industry’s average of 20.19X.

Image Source: Zacks Investment Research

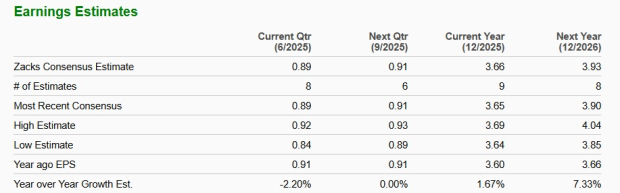

The Zacks Consensus Estimate for CL’s 2025 and 2026 EPS indicates year-over-year growth of 1.7% and 7.3%, respectively. The company’s EPS estimate for 2025 and 2026 has been stable in the past 30 days.

Image Source: Zacks Investment Research

Colgate currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

The Clorox Company (CLX): Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English