Can MP and DoD Rebuild America's Rare Earth Magnet Supply Chain?

MP Materials MP has entered into a public-private partnership with the United States Department of Defense (DoD) to fast-track the development of a domestic rare earth magnet supply chain. Backed by a multibillion-dollar investment package and long-term commitments from DoD, MP Materials will substantially expand its production capacity and play a pivotal role in reducing the United States’ reliance on foreign sources, particularly China.

MP Materials is the United States’ only fully integrated rare earth producer with capabilities spanning the entire supply chain, from mining and processing to advanced metallization and magnet manufacturing.

It currently operates the Mountain Pass Rare Earth Mine (the world’s second-largest rare earth mine) and a processing facility at the site. The company is commissioning a magnetics facility in Texas, known as Independence, which anchors its downstream capabilities.

MP will construct the second domestic magnet manufacturing facility (dubbed the 10X Facility), slated to begin commissioning in 2028. It will take MP Materials’ total U.S. rare earth magnet manufacturing capacity to an estimated 10,000 metric tons and will cater to both the defense and commercial sectors. The company, meanwhile, plans to expand its heavy rare earth separation capabilities at the Mountain Pass facility.

Under the 10-year agreement, DoD has established a price floor commitment of $110 per kilogram for MP Materials’ products stockpiled or sold, providing protection from market volatility. Also, DoD has committed that 100% of the magnets produced at the 10X Facility will be purchased by defense and commercial customers for 10 years.

Rare earth magnets are critical components in a wide range of advanced technologies, including defense systems, electric vehicles, wind turbines and other commercial applications. Various players are now diversifying into rare earths to capitalize on this demand.

Energy Fuels UUUU acquired Base Resources Limited in October, which gave it access to the promising Toliara Mineral Sand Project, boosting its potential as a key producer of titanium and zirconium minerals, alongside rare earth elements. Energy Fuels aims to transform White Mesa Mill in Utah into a critical minerals hub, producing uranium, vanadium, rare earth elements and potentially medical radioisotopes. Energy Fuels recently received the final major regulatory approval from the Government of Victoria, Australia, to advance the Donald Rare Earth and Mineral Sand Project, its joint venture with Astron Corporation. The approval is a critical milestone in unlocking one of the world’s best near-term sources of 'light', 'mid' and 'heavy' rare earth oxides needed for numerous commercial and defense applications.

Idaho Strategic Resources IDR is a gold producer that also owns the largest rare earth elements land package in the United States. Idaho Strategic has three REE exploration properties in Idaho — Lemhi Pass, Diamond Creek and Mineral Hill. Idaho Strategic has conducted numerous exploration programs on its REE properties, which include drilling, trenching, sampling and mapping certain areas within its 19,090-acre landholdings. The company plans for its busiest exploration season to date in 2025, targeting REE and thorium at its properties.

MP’s Price Performance, Valuation & Estimates

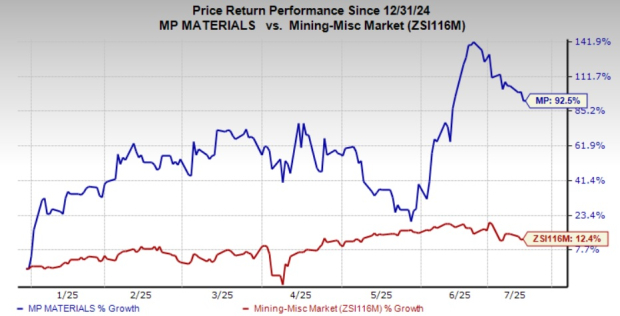

MP Materials shares have gained 92.5% so far this year compared with the industry’s 12.4% growth.

Image Source: Zacks Investment Research

MP is trading at a forward 12-month price/sales multiple of 14.63X, a significant premium to the industry’s 1.24X. It has a Value Score of F.

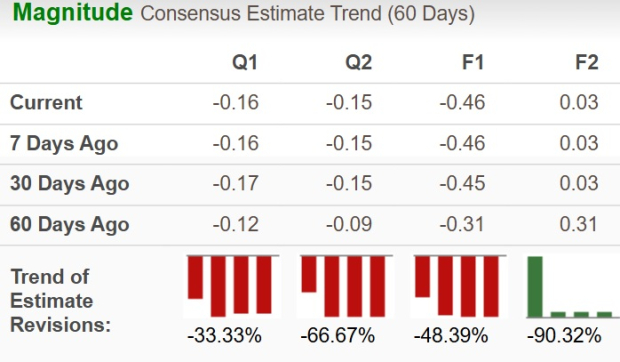

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MP Materials’ 2025 earnings is pegged at a loss of 46 cents per share. However, the bottom-line estimate for 2026 is pegged at earnings of three cents per share. The estimates for 2025 and 2026 have moved down over the past 60 days, as shown below.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You'll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MP Materials Corp. (MP): Free Stock Analysis Report

Energy Fuels Inc (UUUU): Free Stock Analysis Report

Idaho Strategic Resources, Inc. (IDR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English