Is it Wise to Retain American Tower Stock in Your Portfolio Now?

American Tower Corporation AMT boasts a portfolio of nearly 149,000 communication sites worldwide and a highly interconnected footprint of U.S. data center facilities.

The company is strategically positioned to capture incremental demand from global 5G deployment efforts, growing wireless penetration and spectrum auctions. Its data center segment is poised to gain due to industry-wide strong demand. Moreover, a decent financial position supports its growth endeavors. However, customer concentration and consolidation are a concern in the wireless industry and are likely to weigh on top-line growth.

What’s Aiding AMT?

American Tower has a solid track record of delivering healthy performance due to the robust demand for its global macro tower-oriented asset base. It has witnessed strong growth in key financial metrics while continuing to expand its platform. In the first quarter of 2025, the company recorded healthy year-over-year organic tenant billings growth of 4.7% and total tenant billings growth of 5.2%. Amid secular growth trends in the wireless industry, the healthy performance is expected to continue in 2025 and beyond.

With the growth in cloud computing, Internet of Things and Big Data, and an increasing number of companies opting for third-party IT infrastructure, data-center companies are experiencing a boom in the market. Also, the estimated growth rates for the Artificial Intelligence (AI), autonomous vehicle and virtual/augmented reality markets are expected to remain robust over the coming years. In the first quarter of 2025, the company attained data center revenue growth of 8.4%. In April 2025, AMT completed the acquisition of a multi-tenant data center facility in Denver, CO, in which it previously leased space (“DE1”).

Apart from having a robust operating platform, American Tower has ample liquidity to support its debt servicing. Its consistent adjusted EBITDA margins, revenue growth and favorable return on invested capital indicate strength in its core business and support its ability to manage its near-term obligations. As of March 31, 2025, AMT had $11.7 billion in total liquidity. With a weighted average remaining term of debt of 5.7 years, it has decent financial flexibility.

American Tower has a disciplined capital distribution strategy and remains committed to increasing shareholder value through regular dividend hikes. In the last five years, American Tower has increased its dividend 14 times, and the annualized dividend growth rate for this period is 8.26%. Such disbursements highlight its operational strength and commitment to rewarding shareholders handsomely. Check American Tower’s dividend history here.

What’s Hurting AMT?

Customer concentration is high for American Tower, with the company’s top three customers in terms of consolidated operating revenues for the first quarter of 2025 being T-Mobile TMUS (16%), AT&T T (15%) and Verizon Wireless (13%). The loss of TMUS, T or Verizon Wireless as customers, consolidation among them or a reduction in network spending may lead to a material impact on the company’s top line.

The merger between T-Mobile and Sprint resulted in tower site overlap for American Tower. This merger has negatively impacted the company’s leasing revenues. In the first quarter of 2025, the churn was roughly 2% of its tenant billings, mainly driven by the churn in its U.S. & Canada property segment. Given the contractual lease cancellations and non-renewals by T-Mobile, including legacy Sprint Corporation leases, management expects the churn rate in its U.S. & Canada property segment will continue to be elevated through 2025.

Despite the Federal Reserve announcing rate cuts in the second half of 2025, the interest rate is still high and is a concern for American Tower. Elevated rates imply a higher borrowing cost for the company, which would affect its ability to purchase or develop real estate. The company has a substantial debt burden, and its total debt, as of March 31, 2025, was approximately $36.86 billion.

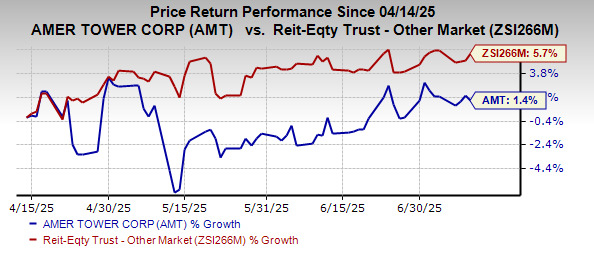

In the past three months, shares of this Zacks Rank #3 (Hold) company have gained 1.4% compared with the industry's growth of 5.7%.

Image Source: Zacks Investment Research

Stock to Consider

A better-ranked stock from the broader REIT sector is SBA Communications SBAC, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for SBAC’s 2025 FFO per share has moved 3 cents northward to $12.74 over the past two months.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

SBA Communications Corporation (SBAC): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English