Demystifying Nucor: Insights From 5 Analyst Reviews

During the last three months, 5 analysts shared their evaluations of Nucor (NYSE:NUE), revealing diverse outlooks from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

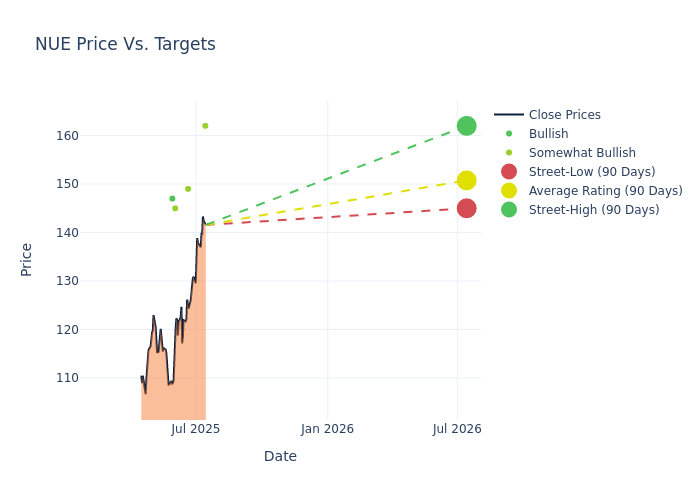

Analysts have recently evaluated Nucor and provided 12-month price targets. The average target is $148.6, accompanied by a high estimate of $162.00 and a low estimate of $140.00. This current average has increased by 2.34% from the previous average price target of $145.20.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Nucor's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Bill Peterson | JP Morgan | Raises | Overweight | $162.00 | $143.00 |

| Carlos De Alba | Morgan Stanley | Raises | Overweight | $149.00 | $134.00 |

| Katja Jancic | BMO Capital | Raises | Outperform | $145.00 | $140.00 |

| Curt Woodworth | UBS | Lowers | Buy | $147.00 | $153.00 |

| Bill Peterson | JP Morgan | Lowers | Overweight | $140.00 | $156.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Nucor. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Nucor compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Nucor's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Nucor's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Nucor analyst ratings.

About Nucor

Nucor Corp manufactures steel and steel products. The company's reportable segments are steel mills, steel products, and raw materials. A majority of its revenue is derived from the steel mills segment, which is engaged in producing sheet steel (hot-rolled, cold-rolled, and galvanized), plate steel, structural steel (wide-flange beams, beam blanks, H-piling, and sheet piling), and bar steel products. Nucor manufactures steel principally from scrap steel and scrap steel substitutes using electric arc furnaces (EAFs) along with continuous casting and automated rolling mills. The steel mills segment sells its products mainly to steel service centers, fabricators, and manufacturers located in the United States, Canada, and Mexico.

Breaking Down Nucor's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Negative Revenue Trend: Examining Nucor's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -3.77% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Materials sector.

Net Margin: Nucor's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.99% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Nucor's ROE excels beyond industry benchmarks, reaching 0.77%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.45%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Nucor's debt-to-equity ratio is below the industry average. With a ratio of 0.39, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English